BNB Price Forecast: BNB bulls aim above $700 as stablecoin and DEX activity surge

- BNB price stabilizes around $674 on Tuesday after a three-day recovery rally.

- On-chain data support the bullish outlook, withBNB’s DEX volume and stablecoin activity rising sharply.

- The technical outlook shows a bullish breakout, aiming for a higher leg.

BNB (BNB) stabilizes around $674 on Tuesday after a three-day recovery rally. On-chain data and technical outlook suggest a rally ahead as BNB breaks above the symmetrical triangle pattern, with DEX (Decentralized exchange) volume and stablecoin activity surging.

BNB on-chain data show bullish bias

BNB’s stablecoin value has been actively rising and reached $24.2 billion, the highest year-to-date (YTD) level on May 21, according to Atermis terminal data. While the volume has retreated somewhat in recent days, the current level ofstablecoin activity and value increase on BNB is positive as they increase network usage and can attract more users to the ecosystem.

-1748327761750.jpeg)

BNB chain stablecoin activity chart. Source: Artemis

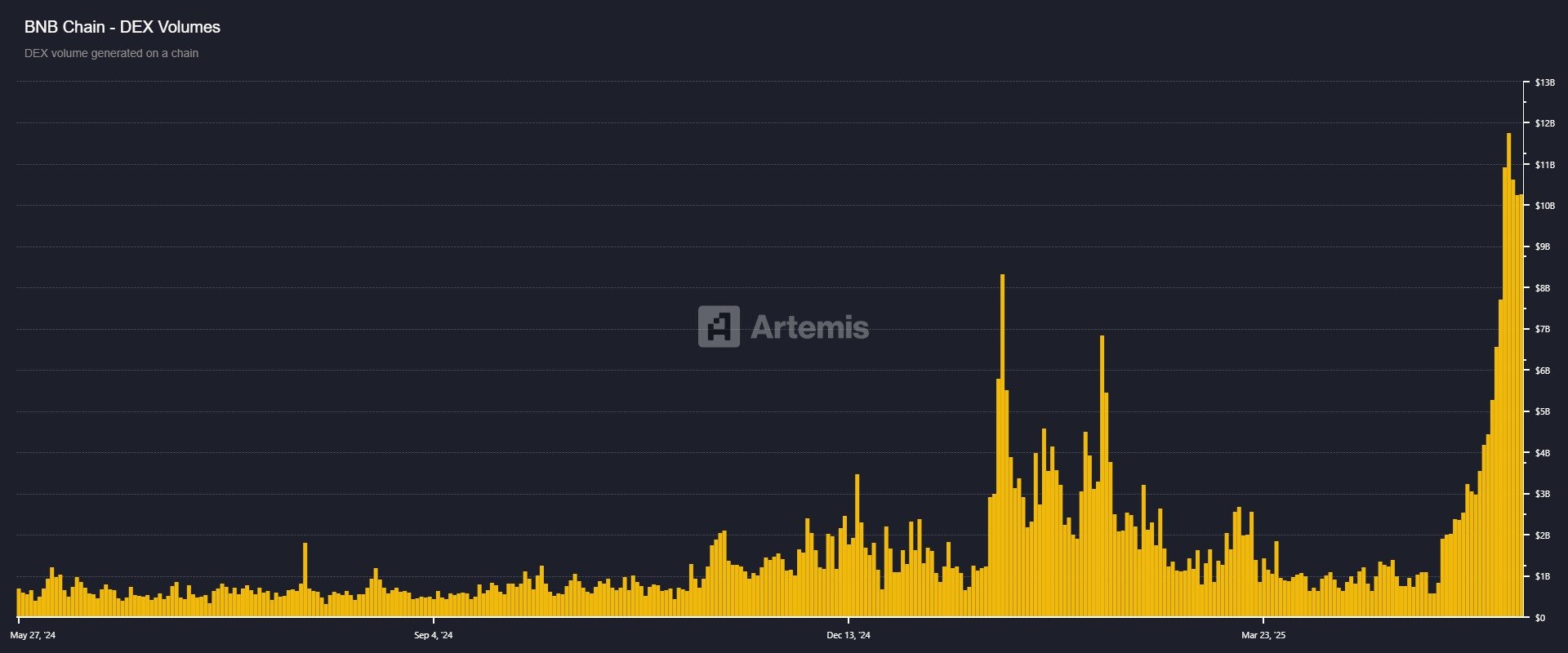

Another aspect bolstering the platform’s bullish outlook is the recent surge in traders’ interest and liquidity in the BNB chain. The chart below shows that BNB’s DEX daily trading volume soared to $11.8 billion on May 21, the highest YTD and constantly rising since mid-May.

BNB chain Dex volume chart. Source: Artemis

BNB Price Forecast: Bullish symmetrical triangle breakout emerges

BNB’s price broke above a symmetrical triangle on May 8, a technical pattern formed by connecting multiple highs and lows with two converging trendlines (from January to early May), and rallied more than 10%. However, BNB corrected 4.31% last Friday but recovered slightly in the following three days. At the time of writing on Tuesday, it hovers around $673.50.

BNB price could extend the rally to reach the technical target of the symmetrical triangle at $839.14 (obtained by measuring the distance between the first daily high and the first daily low and adding it to the breakout point). This is a theoretical target, and traders could realize some profits around the weekly level of $709.29 and at the Feburary 13 high of $732.

The Relative Strength Index (RSI) on the daily chart reads 61 points upward, indicating strong bullish momentum while still below overbought levels. However, the Moving Average Convergence Divergence (MACD) indicator on the daily chart converges, indicating indecisiveness among the traders.

BNB/USDT daily chart

If BNB faces a pullback, it could extend the decline to retest its next daily support at $638.68. A close above this level would invalidate the bullish thesis, with next support located at the May 5 low of $583.55.