Bitcoin Price Forecast: BTC rebounds to $109,000 as US-EU tariff delay helps sentiment recover

- Bitcoin trades above $109,000 on Monday, recovering from Friday’s correction.

- Market sentiment improves as Trump’s EU tariff delay offers temporary relief, supporting risky assets.

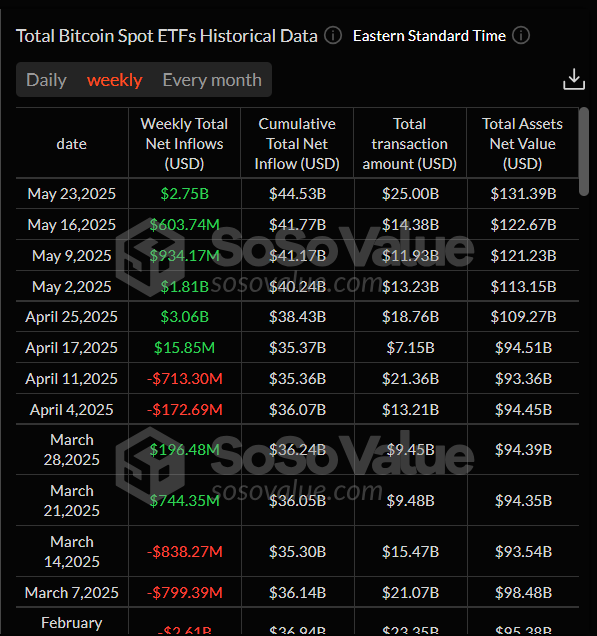

- US spot Bitcoin ETFs saw $2.75 billion in weekly inflows, the highest since late April, boosting investor confidence.

Bitcoin (BTC) trades above $109,000 at the time of writing on Monday, recovering from Friday’s correction. The price recovery was fueled by US President Donald Trump’s announcement of a delay in the planned 50% tariff on European Union goods. Institutional demand continues to strengthen as it recorded the highest weekly inflows since late April, boosting investor confidence.

Trump tariff delay supports Bitcoin recovery

Donald Trump announced on Monday on his Truth social account that he has agreed to extend the implementation date for the 50% tariff on EU goods from June 1 to July 9. This news followed Friday’s announcement to impose 50% tariffs on imports from the European Union, as Trump said that negotiations in Brussels were going nowhere. Friday’s announcement triggered a risk-off sentiment in the market as Bitcoin fell 3.9% that day.

This delay in the EU tariff slightly boosted investor sentiment and triggered a mild rise in risk-on sentiment. During the Asian and European trading sessions, the equity and crypto markets reacted positively, with Bitcoin recovering slightly on Monday.

Bitcoin’s institutional demand remains strong

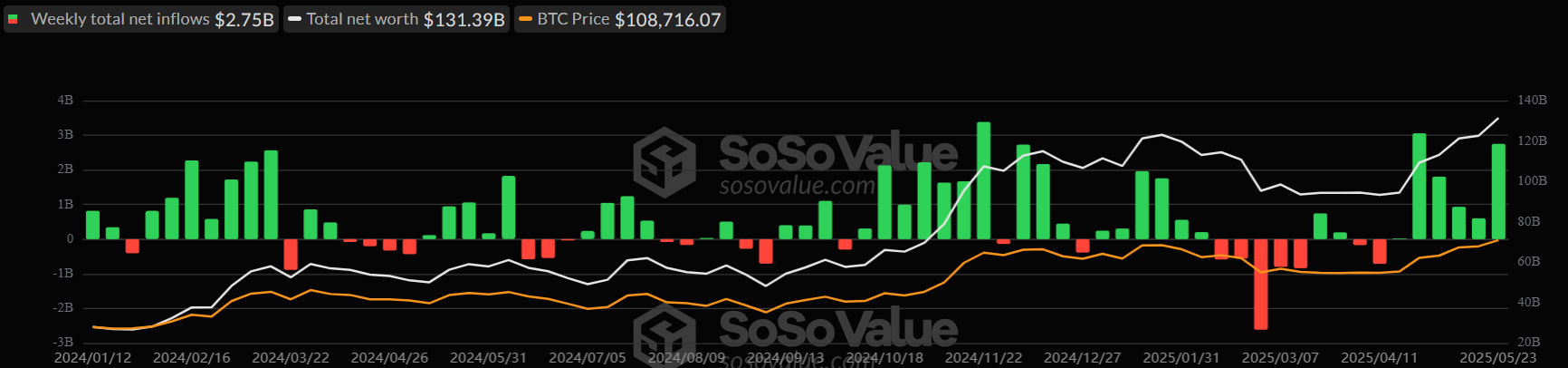

SoSoValue data shows that US spot Bitcoin Exchange Traded Funds (ETFs) recorded a total inflow of $2.75 billion last week, the highest since late April. The six-week winning streak of inflows that began in mid-April boosted investor confidence. If the level of inflow intensifies, Bitcoin’s price rally could continue.

Total Bitcoin Spot ETFs weekly chart. Source: SoSoValue

Some signs of concern

The ongoing escalation of the Russia-Ukraine conflict is a sign of concern for Bitcoin. On Sunday, Russia fired 355 drones and nine missiles at Ukraine. The Ukrainian Air Force says it was a record number of drones launched, according to BBC’s report.

The report continues that Russia says it intercepted 96 Ukrainian drones across 12 regions overnight, including six over Moscow.

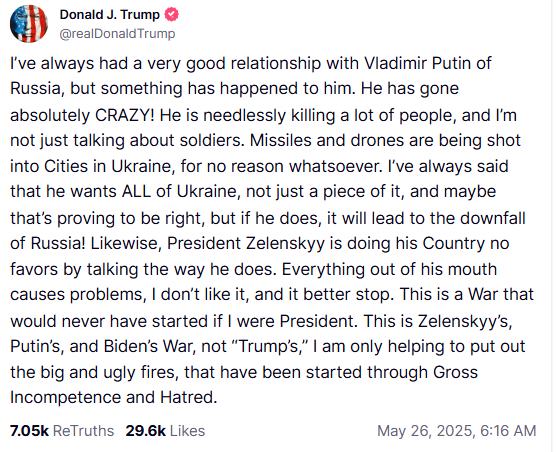

Donald Trump writes on his Truth Social media account, “I’ve always had a very good relationship with Vladimir Putin of Russia, but something has happened to him…. He has gone absolutely CRAZY!”

If the ongoing conflict takes a major escalation and continues, it could decrease investors’ confidence in risky assets like Bitcoin, which could hurt its ongoing rally as investors could move their capital to safer assets like Gold (XAU) and Silver (XAG).

Bitcoin Price Forecast: BTC recovers as it finds support around its key level

Bitcoin price reached a new all-time high (ATH) of $111,900 on Thursday and declined 3.92% on Friday. However, it found support around the $106,406 daily level on Saturday and recovered slightly on Sunday. At the time of writing on Monday, it continues to recover, trading at around $109,760.

If BTC continues to recover and closes above its ATH, it could extend the rally toward a key psychological level of $120,000.

The Relative Strength Index (RSI) on the daily chart reads 67, pointing upward toward its overbought level of 70, indicating bulls are still in control of the momentum. However, the Moving Average Convergence Divergence (MACD) indicator on the daily chart converges, indicating indecisiveness among the traders.

BTC/USDT daily chart

If BTC faces a pullback and closes below $106,406 daily support, it could extend the correction to retest its next key support at $100,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.