XRP Holders Mature as Bitcoin Correlation Dims – Where is the Price Going?

XRP has seen a slowdown in bullish momentum recently, following a period of sustained price growth. The altcoin, which benefited from strong investor interest, has started to lose some of that upward momentum.

While the price has been in decline, some market experts believe that the strength of investor support may prevent XRP from experiencing significant losses in the near term.

XRP Loses Its Bitcoin Backing

The correlation between XRP and Bitcoin has significantly decreased, dropping to 0.4. This marks the lowest level since February this year.

Historically, when this correlation weakened, XRP’s price saw a substantial decline, falling by 22%. However, after that drop, the asset recovered.

With Bitcoin recently reaching a new all-time high (ATH), the declining correlation could be seen as a sign of weakening support for XRP.

Bitcoin’s strong performance could normally lift altcoins, including XRP. However, this disconnect raises concerns that XRP may not be able to capitalize on Bitcoin’s success. As the correlation continues to diminish, XRP could face more challenges in the coming weeks.

XRP Correlation to Bitcoin. Source: TradingView

XRP Correlation to Bitcoin. Source: TradingView

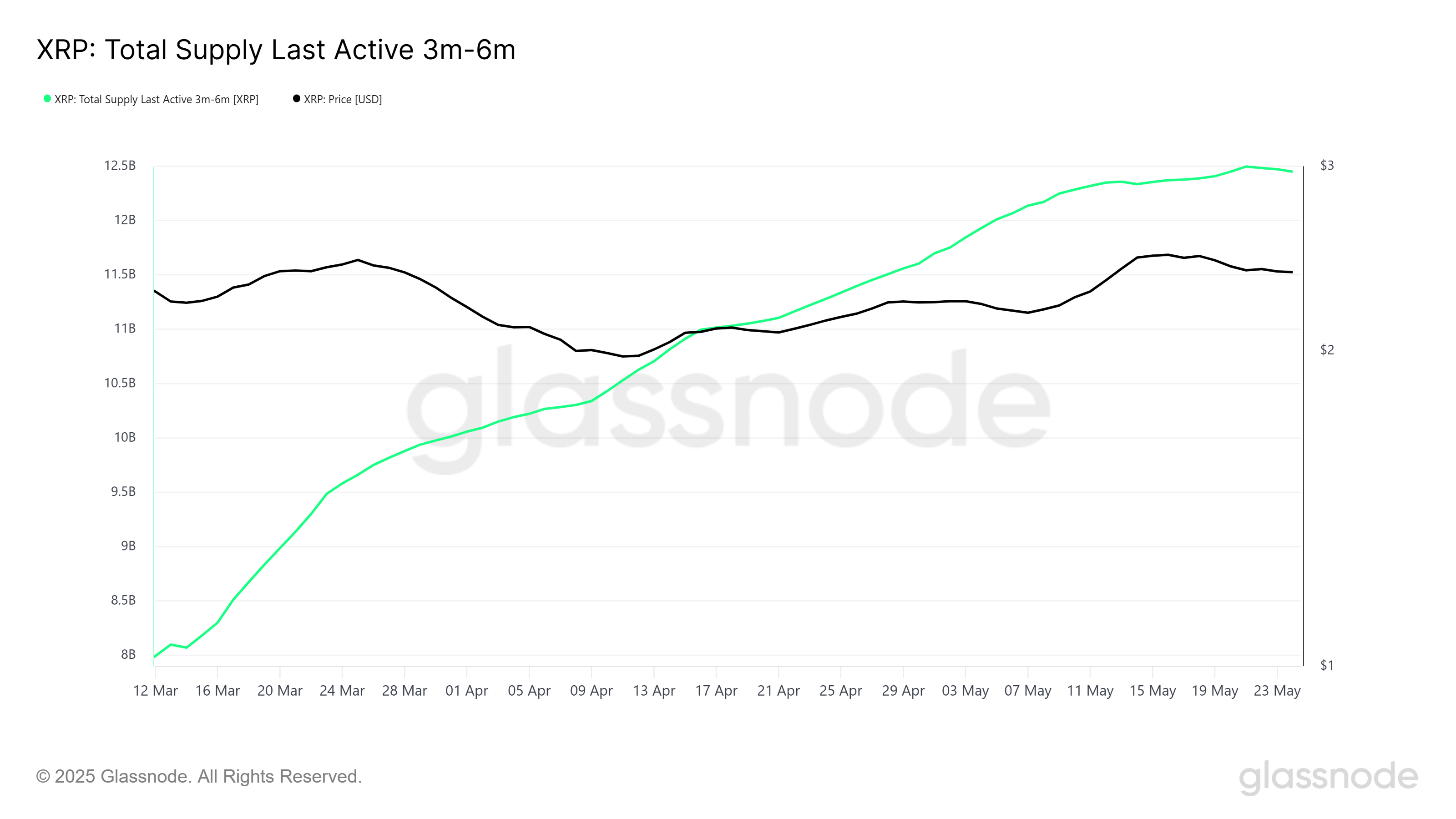

In contrast to the weakening correlation with Bitcoin, XRP’s investor behavior shows a more stable trend. The total supply of XRP that has remained untouched for 3-6 months has been steadily increasing this month.

This suggests that short-term holders (STH) are maturing and becoming mid-term holders. This shift is a positive sign, as it signals growing stability and confidence among XRP investors.

The increasing supply of dormant XRP indicates that more investors are holding onto their tokens rather than selling them. This long-term holding behavior could provide a buffer against short-term price fluctuations and help sustain the asset’s value in times of uncertainty.

XRP MTH Supply. Source; Glassnode

XRP MTH Supply. Source; Glassnode

XRP Price Could Bounce Back

XRP is currently trading at $2.26, having slipped below the support level of $2.27 over the past 24 hours. The price has been in a steady decline for the last two weeks, largely due to the inability to break the $2.58 resistance.

This suggests that upward momentum is stalling, and the price could continue to face downward pressure.

If this decline continues, XRP may test the next support level at $2.12, which would mark a significant loss for investors. Further declines could increase bearish sentiment and result in more selling pressure.

XRP Price Analysis. Source: TradingView

XRP Price Analysis. Source: TradingView

However, if investor support strengthens and stabilizes the price, XRP could hold the $2.27 support level. This would allow for a potential rebound to $2.38 or even higher, invalidating the current bearish outlook.

This support could pave the way for a new attempt to break past the $2.58 resistance and potentially push the price higher.