How Kalshi’s Solana Integration Could Unlock New Liquidity for SOL

Kalshi opened Solana deposits today, letting users fund their accounts directly from SOL wallets. The altcoin joins Bitcoin, USDC, and Worldcoin in Kalshi’s crypto lineup. Solana integration can potentially deepen liquidity on both sides.

Traders who hold SOL can now channel tokens into prediction markets without first converting to stablecoins. Consequently, Solana balances will circulate more actively between wallets and Kalshi, boosting on‑chain demand.

Can the US Predictions Market Bring Solana Out of Stagnation?

In the past year, Solana’s on‑chain activity largely revolved around high‑speed DEX trading and viral meme coins.

For example, meme coins accounted for nearly 65% of Solana’s May trading volume. At its peak, daily DEX turnover climbed above $45 billion. However, deposit rails into prediction platforms add a novel utility.

Now, users can stake SOL against weather forecasts, election outcomes or even pop‑culture milestones like a GTA 6 launch date. This variety drives token movement across a broader spectrum of markets.

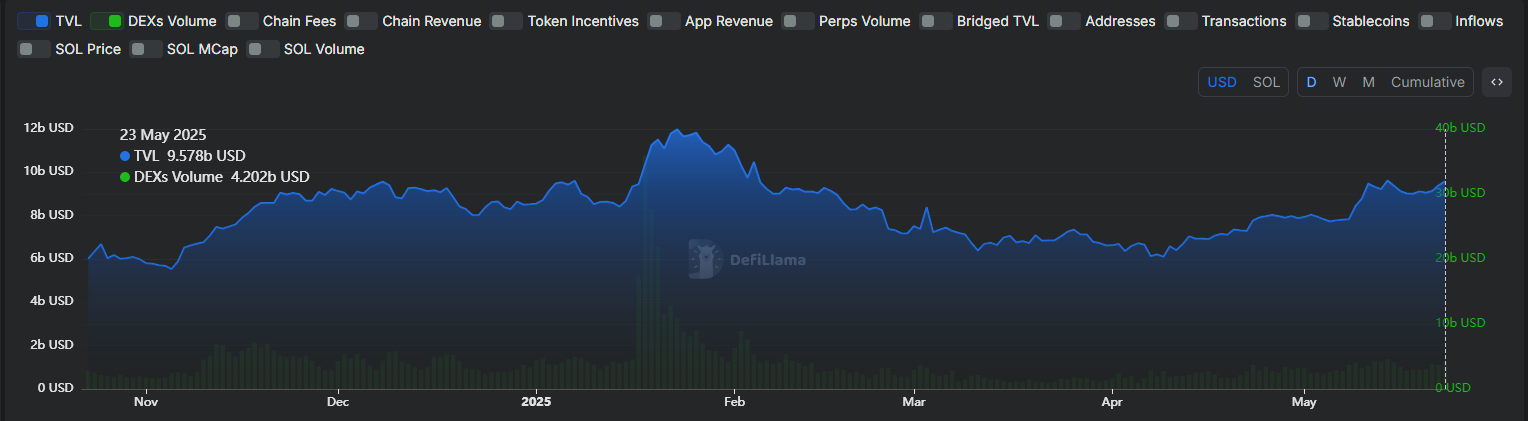

Solana TVL and DEX Volume in 2025. Source: DeFilLama

Solana TVL and DEX Volume in 2025. Source: DeFilLama

As a result, Solana’s market depth may improve, since funds locked in niche event contracts cycle back into the wider ecosystem.

Furthermore, integration with Zero Hash ensures that SOL deposits convert seamlessly into US dollars for Kalshi trades.

This flow reduces friction compared to traditional on‑ramps and may attract crypto‑native traders who value quick settlement and low fees.

Solana Could Boost Kalshi’s Market Share in the US

This move could help improve Solana’s liquidity by tapping into Kalshi’s growing user base.

In 2024, Kalshi saw $1.97 billion in trading volume, up from $183 million the year prior. It now serves users in over 40 US states and recently added a mini-app for Worldcoin users.

Importantly, Polymarket—Kalshi’s decentralized counterpart—already uses Solana for trading outcomes on-chain.

Kalshi vs Polymarket Stats 2025. Source: Polymarket Analytics

Kalshi vs Polymarket Stats 2025. Source: Polymarket Analytics

In the predictions market, users often access multiple platforms for better odds or niche predictions. So, Solana’s support across Polymarket and Kalshi could create a shared bridge between DeFi-native and regulated markets.