3 US Crypto Stocks to Watch Today

Crypto US stocks are in focus today as Galaxy Digital (GLXY), MARA Holdings (MARA), and Riot Platforms (RIOT) each present key developments and price movements.

GLXY continues to face volatility after its Nasdaq debut, while MARA shows strength with a 27.88% gain over the past 30 days. RIOT, meanwhile, expanded its credit line with Coinbase to $200 million, reinforcing its growth strategy. Analysts remain bullish on all three names, with strong upside targets and favorable ratings across the board.

Galaxy Digital (GLXY)

Galaxy Digital (GLXY) closed yesterday with a sharp 7.36% drop but is showing modest recovery in pre-market trading, up 1.5%. The company made its long-anticipated Nasdaq debut on May 16, opening at $23.50 per share.

CEO Mike Novogratz described the listing process as “unfair and infuriating,” marking the end of a years-long effort to enter U.S. markets.

Notably, Galaxy is already working with the SEC on tokenizing its shares, aiming to integrate them into DeFi applications. Despite the milestone, the timing coincided with the disclosure of a $295 million Q1 loss, adding pressure to investor sentiment.

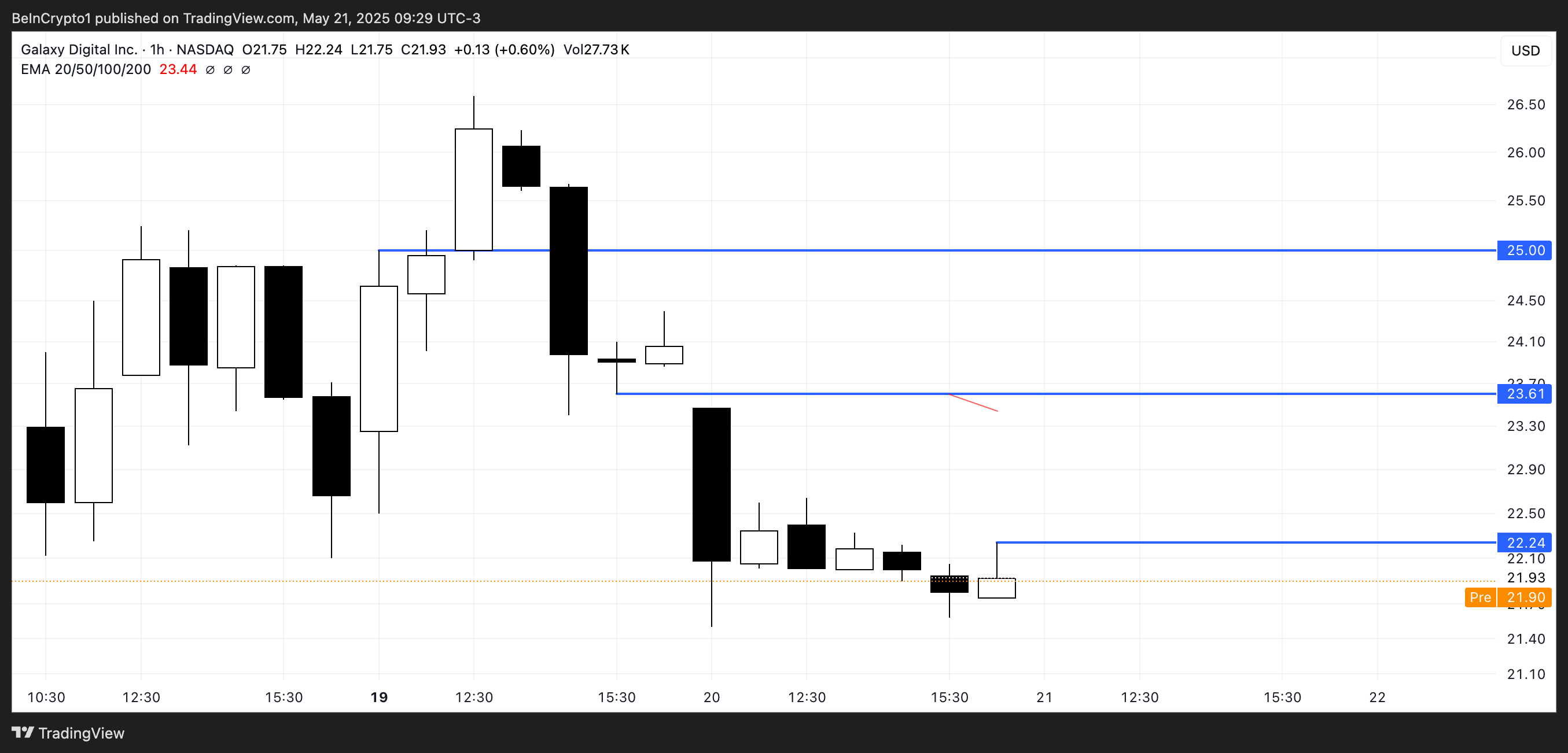

GLXY Price Analysis. Source: TradingView.

GLXY Price Analysis. Source: TradingView.

Technically, GLXY is down 6.77% since its Nasdaq debut and is hovering near key support levels. If bearish momentum persists, the stock could slide below $22, marking new all-time lows.

However, if the early pre-market strength continues and a broader rebound takes shape, GLXY may attempt to retest resistance at $22.24.

A decisive move above this level could pave the way toward $23.61 and even $25, but the company will likely need a strong fundamental catalyst—such as progress on tokenization or regulatory clarity—to sustain an upward trajectory.

MARA Holdings (MARA)

MARA is up 27.88% over the past 30 days and has held above the $15 level since May 9, showing resilience despite short-term pullbacks. It closed yesterday down 0.80% and is down another 0.68% in pre-market trading.

Analyst sentiment remains cautiously bullish: Seven out of 17 analysts rate it a “Strong Buy,” nine suggest holding, and only one recommends a “Strong Sell.”

The average 12-month price target is $20.27, indicating a potential upside of 25.2% from current levels.

MARA Price Analysis. Source: TradingView.

MARA Price Analysis. Source: TradingView.

Financially, MARA reported Q1 2025 revenue of $213.9 million—an increase from $165.2 million the year prior—driven by a 77% jump in the average Bitcoin price. However, Bitcoin production declined due to the halving, and the company posted a net loss of $533.4 million, primarily due to end-of-quarter price volatility.

Despite this, MARA expanded its BTC holdings to 47,531, a 174% year-over-year increase. Technically, MARA maintains a bullish EMA structure, but the narrowing gap suggests caution. If momentum fades, the stock could test support at $15.25, with further downside risk to $14.47 or even $12.63.

A renewed uptrend could see it pushing toward resistance levels at $16.69, $17.30, and potentially $17.86.

Riot Platforms (RIOT)

Riot Platforms (RIOT) closed yesterday with a mild decline of 0.45% and is down another 1.23% in pre-market trading. The company recently announced a major financial move, doubling its credit line with Coinbase to $200 million.

According to CEO Jason Les, the expanded facility aims to enhance Riot’s financial flexibility, support strategic initiatives, and reduce capital costs.

Operating mining facilities in Texas and Kentucky, along with engineering hubs in Colorado, Riot is positioning itself as a vertically integrated Bitcoin infrastructure platform.

RIOT Price Analysis. Source: TradingView.

RIOT Price Analysis. Source: TradingView.

Market sentiment around RIOT remains strongly bullish. Of 17 analysts covering the stock, 15 rate it a “Strong Buy,” with a one-year price target averaging $15.54—representing a potential upside of 74%.

From a technical perspective, RIOT faces resistance at $9.09; a breakout above this level could lead to gains toward $9.47.

Conversely, if the $8.82 support level breaks, the stock may fall to $8.40 or even $8.05, especially if selling pressure intensifies.