US yields spike as 20-year auction flops, budget vote looms

- 20-year bond auction sees poor demand, yield jumps to 5.047%, highest since November 2023.

- Moody’s downgrade and looming tax bill stoke fears over US fiscal credibility.

- Broad yield curve climbs as investors brace for inflationary, deficit-boosting policies.

US Treasury yields soared on Wednesday as a weaker-than-expected 20-year US bond auction ahead of the vote on the US budget in the US Congress. At the time of writing, the US 10-year T-note benchmark note surges 11 basis points at 4.601%.

Treasury yields jump after weak bond demand and deficit fears tied to Trump’s debt-heavy tax plan

Reuters reported that a $16 billion sale of 20-year bonds saw soft demand, with a yield of 5.047%, which exceeded the previous auction's yield of 4.810%.

The yields of US government debt across the entire curve rose at the beginning of the week, following news that Moody’s downgraded the US creditworthiness from AAA to Aa1, citing more than a decade of inaction by successive US administrations and Congress to address the country’s deteriorating fiscal position.

Sources cited by Reuters revealed that “the interest rate environment is reflecting concerns regarding U.S. budget deficits, with some estimates around the new tax bill showing it would add trillions to the deficit.”

The yield on the US 20-year note rose to 5.125% following the auction, its highest level since November 2023.

Unpredictable economic policies by US President Donald Trump triggered a jump in Treasury yields across the curve. Tariffs are seen as inflation-prone, and the increase in the US fiscal deficit continues to pressure the bond market.

The US House of Representatives will vote on Trump’s budget on Wednesday.

In the meantime, the Federal Reserve’s posture to keep interest rates steady. Consequently, the US 2-year Treasury note yield, the most sensitive to changes in monetary policy, rises five bps up at 4.022% at the time of writing,

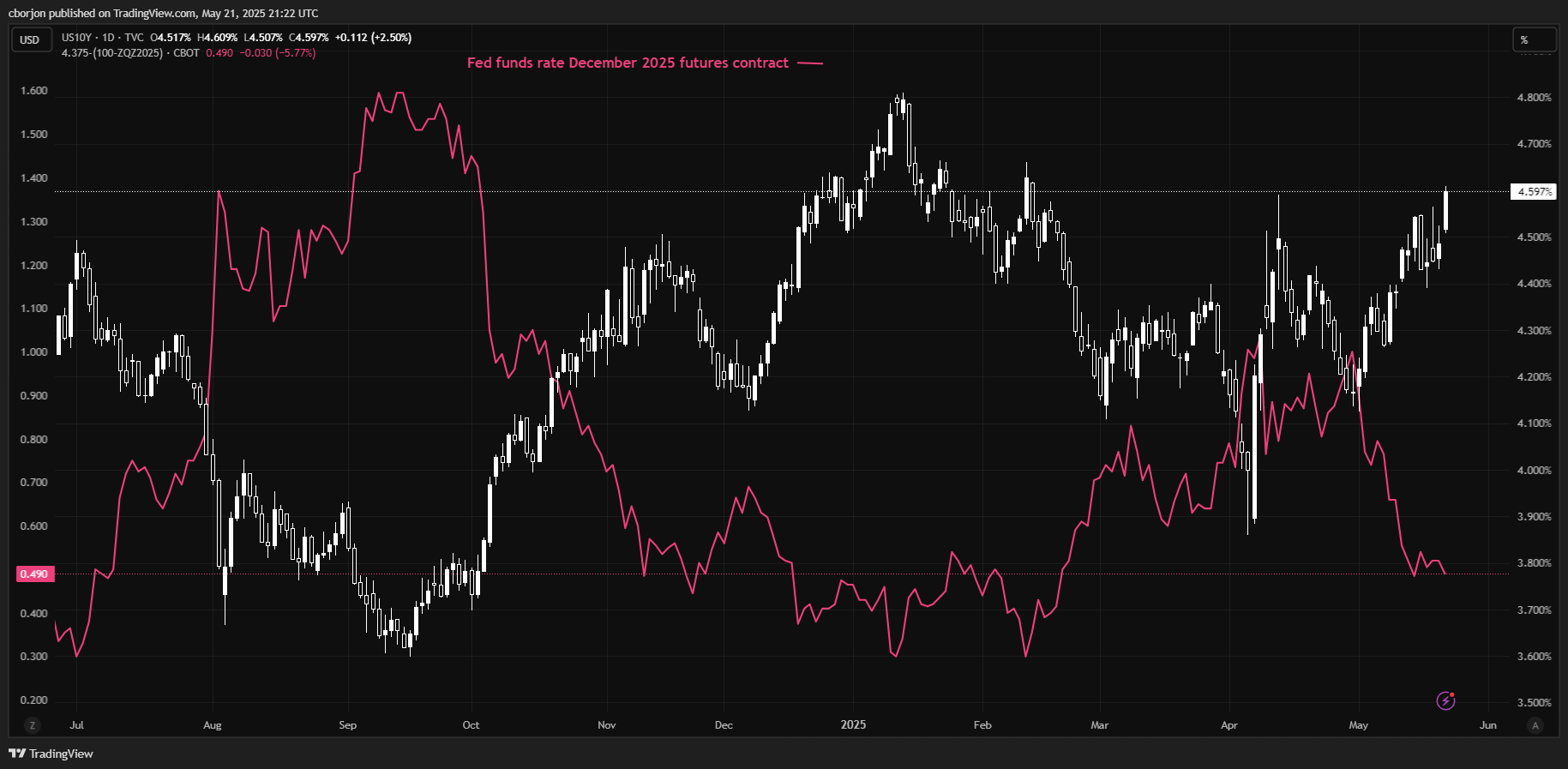

US 10-year yield vs. Fed funds rate December 2025 easing expectations

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.