Monero rally in spotlight amid broader resurgence of interest in privacy-focused cryptocurrencies

- Privacy-focused Monero is back in the spotlight, surging near 30% in May to $362.

- Monero's price increase reflects rising interest in privacy-focused crypto, driven by growing surveillance and regulatory scrutiny concerns.

- Monero's bullish structure could accelerate the uptrend above $400, supported by key technical indicators.

Monero's (XMR) price surges to trade at around $362 on Wednesday, as consolidation takes centre stage in the broader cryptocurrency market. Interest in privacy-oriented coins like XMR has been gaining traction amid growing concerns about surveillance and scrutiny by regulatory authorities.

Monero surges as demand for privacy coins returns

Monero's persistent rally in May continues unbothered by broader consolidation in the crypto market, seemingly buoyed by a resurgence of interest in privacy-focused cryptocurrencies, according to a recent Bitfinex report. Interest in XMR and other privacy coins like ZCash (ZEC) and Decred (DCR) is driven by mounting concerns over surveillance and tightening regulatory scrutiny.

Bitfinex states in the report released on May 16 that there is growing unease as central banks push for frameworks, including Central Bank Digital Currencies (CBDCs), know your customer (KYC), and anti-money laundering (AML) polices.

Users who value privacy have been gravitating toward digital assets like Monero, which offer anonymity through ring signatures, stealth addresses and confidential transactions.

Such features ensure that transaction details relating to the sender, the receiver and the amount remain hidden, with Monero standing out as the go-to platform.

"Monero's robust community and steady development pace have fuelled a quiet resurgence, drawing comparisons to Bitcoin's early days," Bitfinex notes in the report.

Nevertheless, Monero's bullish comeback has not been without headwinds, including facing delistings from major cryptocurrency exchanges like Kraken, which cite regulatory compliance challenges.

The Monero community is pivoting toward peer-to-peer (P2P) markets and decentralized exchanges (DEXs) to establish a resilient ecosystem that emulates the cypherpunk ethos of financial autonomy.

Monero's technical indicators flash bullish signals

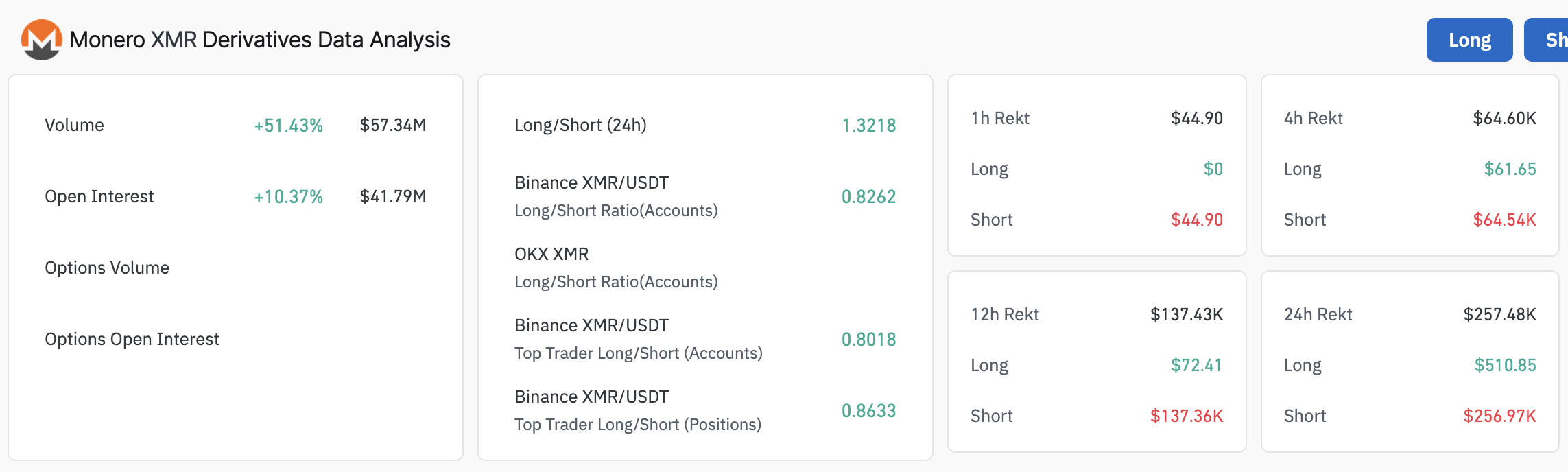

Monero's price uptrend in May has remained steady, rising nearly 30% to trade at $362 at the time of writing. CoinGlass highlights the steady growth in trader interest, with the derivatives Open Interest (OI) increasing by more than 10% in the last 24 hours to nearly $42 million. OI shows the total number of active derivatives contracts, such as futures or options, that are yet to be settled.

The concurrent increase in the volume by over 51% to approximately $57 million highlights the growing trader interest in XMR.

Rising OI alongside increasing trading volume and price often signals strong bullish sentiment and robust market participation supported by sufficient liquidity and fresh money flowing into the market.

Monero derivatives data | Source: Coinglass

Technically, Monero is still strongly bullish despite the extremely overbought conditions, as hinted at by the Relative Strength Index (RSI) momentum indicator's position at 86 in the three-day chart.

The path with the least resistance remains firmly upward, supported by a buy signal from the Moving Average Convergence Divergence (MACD) indicator. This signal, validated on April 22, occurs when the MACD line (blue) crosses above the signal line (red).

Moreover, the up-trending moving averages, which include the 50-day Exponential Moving Average (EMA) at around $237, the 100-day EMA at approximately $210 and the 200-day EMA at $190 suggest that the uptrend has a higher probability of extending to the next key hurdle at $400, tested last in May 2021.

XMR/USDT 3-day chart

On the other hand, the extremely overbought conditions spell caution for Monero traders, as the RSI at 86 signals potential short-term exhaustion. These elevated conditions suggest the 30% rally in May could face a pullback. Key monitoring levels on the downside include the area at $338, previously tested as resistance in August 2021, and the demand zone at $288, tested last in April 2022.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.