Bitcoin’s ‘Key’ Stakeholders Moving In Right Direction, Analytics Firm Says

The analytics firm Santiment has explained how the key Bitcoin holders are showing behavior that could prove to be a bullish sign for the asset.

Bitcoin Sharks & Whales Have Loaded Up During The Last 6 Weeks

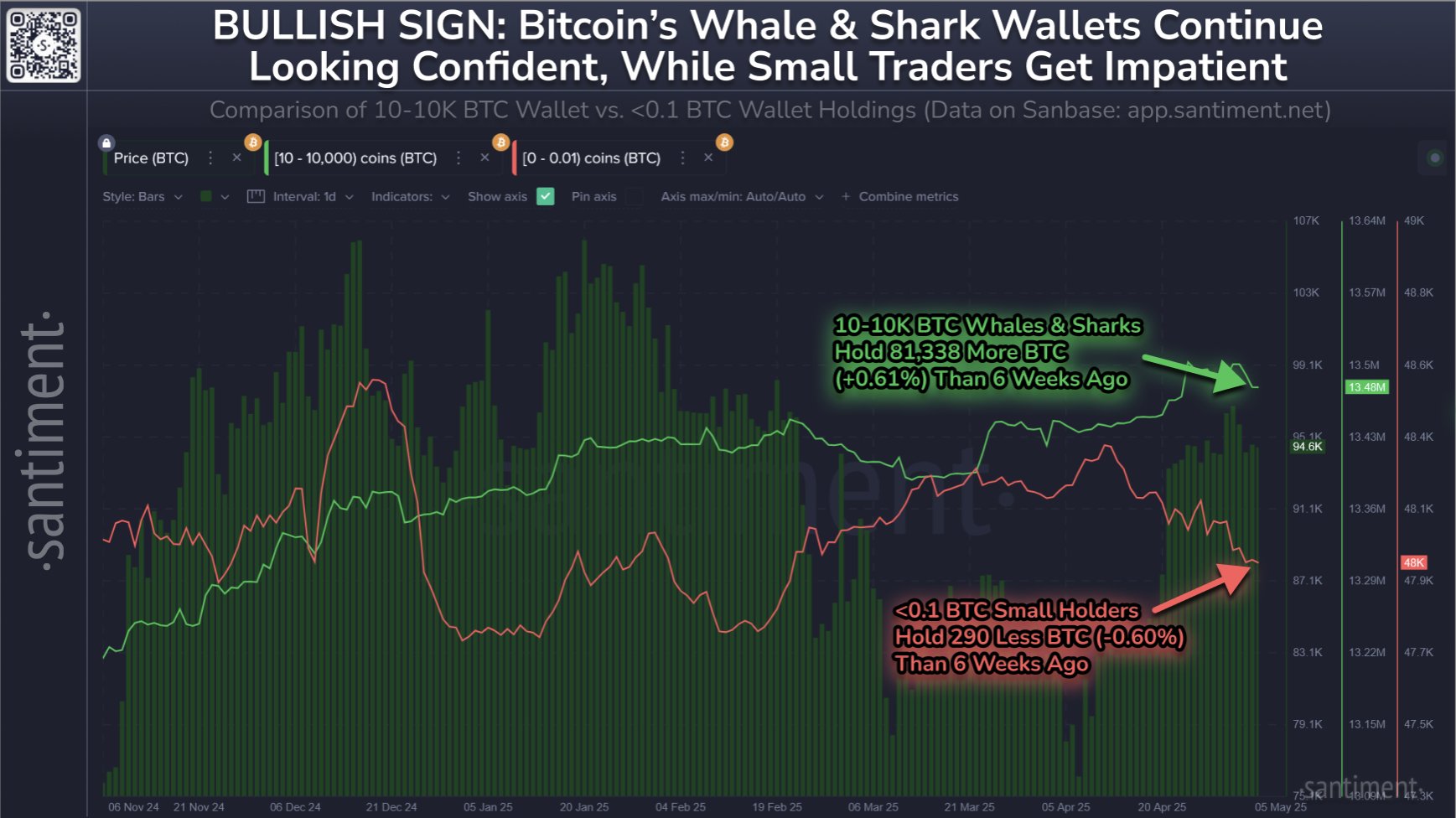

In a new post on X, Santiment has talked about the latest trend in the supply of some of BTC’s key investors. The indicator of relevance here is the “Supply Distribution,” which tells us about the amount of Bitcoin that a given wallet group as a whole is holding. The addresses or investors are divided into these cohorts based on the number of coins that they hold in their balance. The 1 to 10 coins group, for example, includes all holders who own between 1 and 10 tokens of the asset.

In the context of the current topic, the range of interest is the 10 to 10,000 BTC one. At the current exchange rate, its lower bound converts to around $969,000 and the upper one to $969 million.

This broad wallet group includes different parts of the market, including the sharks and whales, who are considered important in the ecosystem due to their sizeable holdings.

Now, here is the chart for the Supply Distribution of this holder range shared by the analytics firms that shows the trend in its value over the past several months:

As displayed in the above graph, the 10 to 10,000 BTC holders have seen their supply go up recently. More specifically, these large investors have added a total of 81,338 BTC to their wallets over the last six weeks.

In the same chart, Santiment has also attached the data related to the Supply Distribution of the smallest of BTC investors. It would appear that these retail holders have scaled back on their holdings at the same time as the shark and whale accumulation spree.

“When large wallets gradually accumulate in tandem with retail panic selling/selling out of boredom, it is generally a strong long-term sign of prices biding their time before another breakout,” notes the analytics firm.

While the long-term trend has been accumulation for Bitcoin’s key investors, a different trend has emerged in a more recent view. As is apparent from the chart, the balance of this group has registered a decline in the last few days, a sign that some of these holders have taken profits from the recovery rally.

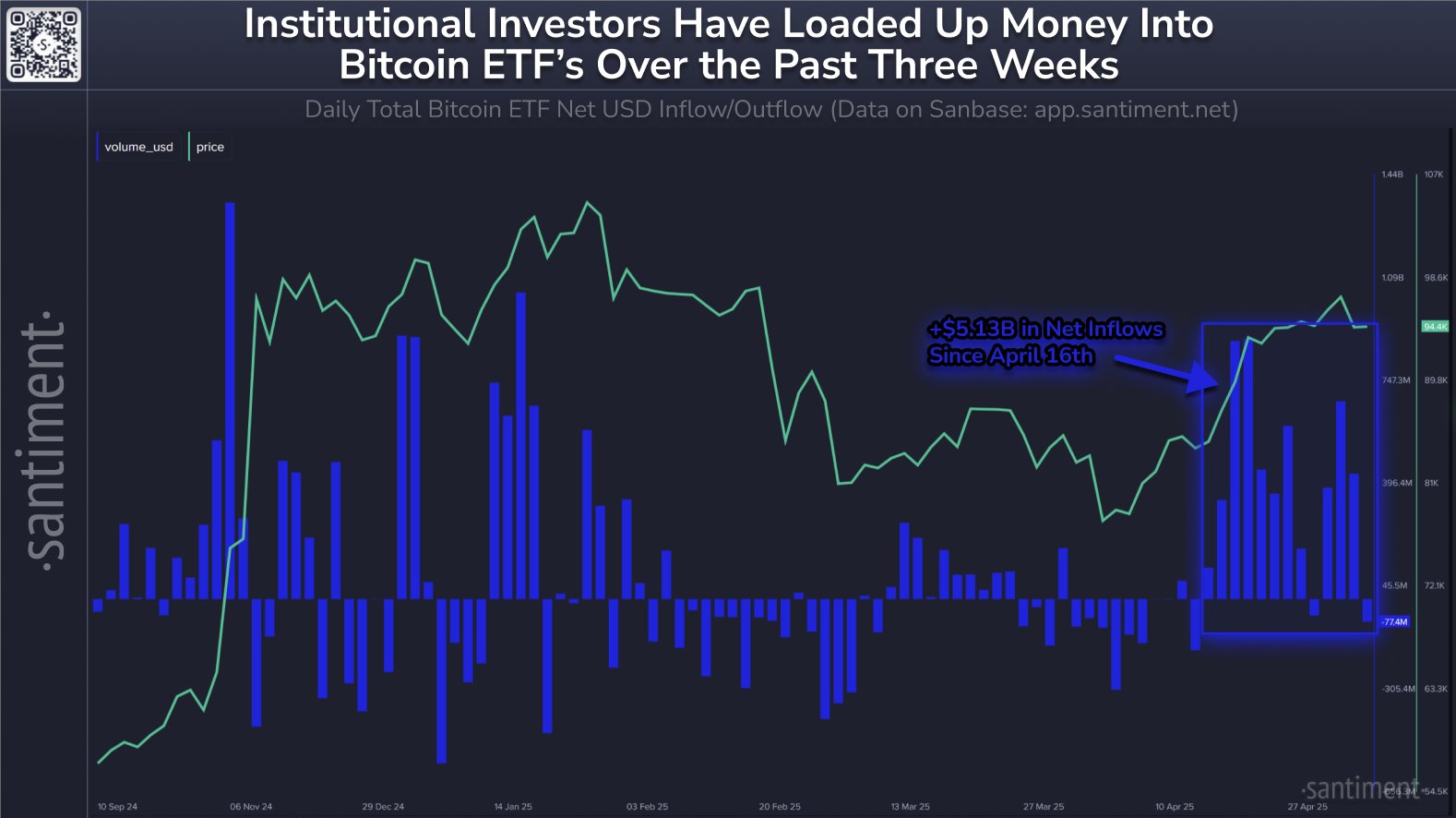

Speaking of accumulation, Bitcoin spot exchange-traded funds (ETFs) have enjoyed a high amount of inflows over the last few weeks, as Santiment has pointed out in another X post.

“Since April 16th, there has been $5.13B moved into collective BTC ETF’s, pumping markets,” says the analytics firm.

BTC Price

Bitcoin has seen a renewal of bullish momentum during the last 24 hours as its price has broken back above the $97,000 level.