Citigroup Predicts Stablecoin Market to Reach $3.7 Trillion By 2030

A recent study from the Citi Institute, Citigroup’s research organization, claims that the global stablecoin market could reach as high as $3.7 trillion by 2030. This was its most bullish estimate, but the base case was $1.5 trillion.

It acknowledged a few risks that could lead to a bearish scenario of $0.5 trillion, but the report largely remained optimistic. In any event, this sector could tremendously impact global markets.

Citigroup Is Extremely Bullish on Stablecoins

Citigroup’s researchers had one clear reason to be optimistic about stablecoins: friendly regulation worldwide. The Citi Institute’s report was titled “Digital Dollars.” It called special attention to stablecoins’ growing integration with the US dollar. This could serve as the motor for long-term growth:

“Government adoption of blockchain falls into two categories: enabling new financial instruments and system modernization. Stablecoins are now major holders of US Treasuries, starting to influence global financial flows. Their growing adoption reflects sustained demand for US dollar-denominated assets,” claimed Artem Korenyuk, a managing director at Citi.

The organization was particularly interested in mandates that stablecoin issuers hold reserves of US Treasuries. It predicts that non-USD stablecoins, including CBDCs, will ultimately exist on the margins, with 90% of the stablecoin market sticking to the dollar.

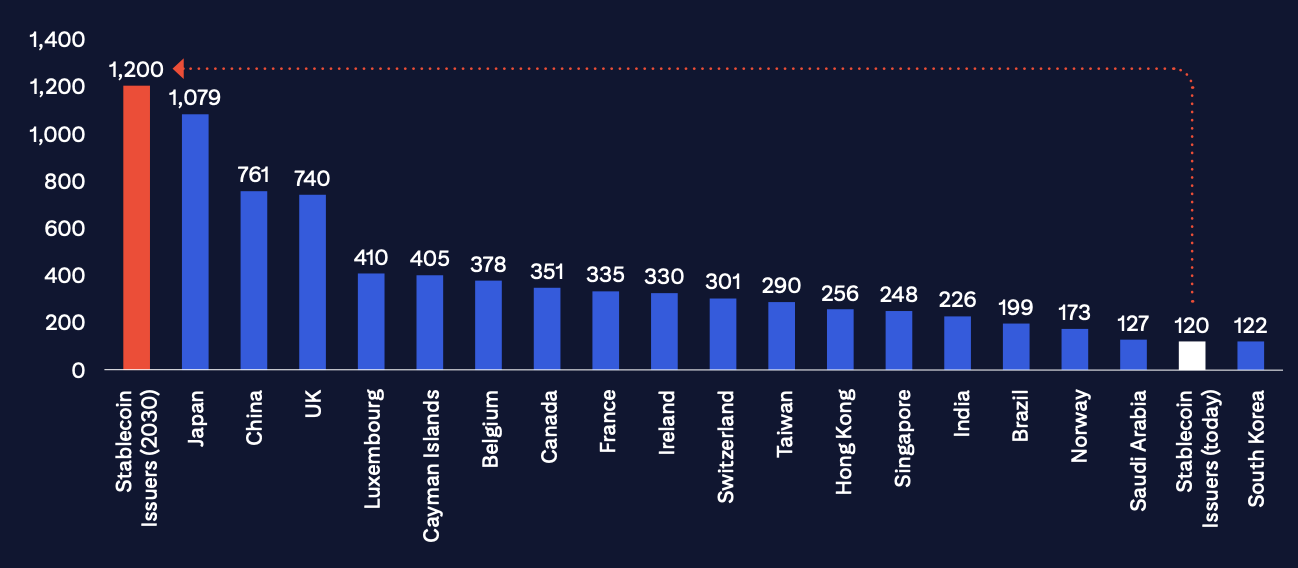

These reserve mandates would, therefore, cause the issuers to become major holders of Treasury bonds.

Potential Stablecoin Treasury Holdings. Source: Citigroup

Potential Stablecoin Treasury Holdings. Source: Citigroup

By doing this, regulators will compel stablecoin issuers to substantially change their internal policies. Citigroup predicts that this could better integrate stablecoins with the TradFi ecosystem.

Although stablecoins “pose some threat to traditional banking” for several reasons, these regulations will encourage a cooperative model instead. Public sector blockchain spending will also help this dynamic.

Still, Citigroup acknowledged significant risks in this rosy picture of stablecoins. Although its most bullish estimate is a $3.7 trillion global sector by 2030, its bearish outcome is only half a trillion.

That’s a very significant spread. The largest risks include fraud, contagion from de-pegging events, and confidentiality concerns.

It’s important to remember, however, that Citigroup has a surprisingly long history with crypto. It first considered entering the sector four years ago and continually publishes novel research on the market.