Ripple Price Forecast: XRP tests critical support amid mixed retail and institutional sentiment

- XRP presses down on the 50-day EMA support as risk-averse sentiment spreads despite a positive start to 2026.

- XRP faces declining retail demand, as reflected in futures Open Interest, which has fallen to $4.15 billion.

- The resumption of XRP ETF inflows on Thursday signals an optimistic outlook among institutional investors.

Ripple (XRP) is trading under pressure, resting squarely on support at $2.00 at the time of writing on Friday. The path with the least resistance appears downward, weighed down by declining retail demand despite minor inflows into XRP spot Exchange Traded Funds (ETFs).

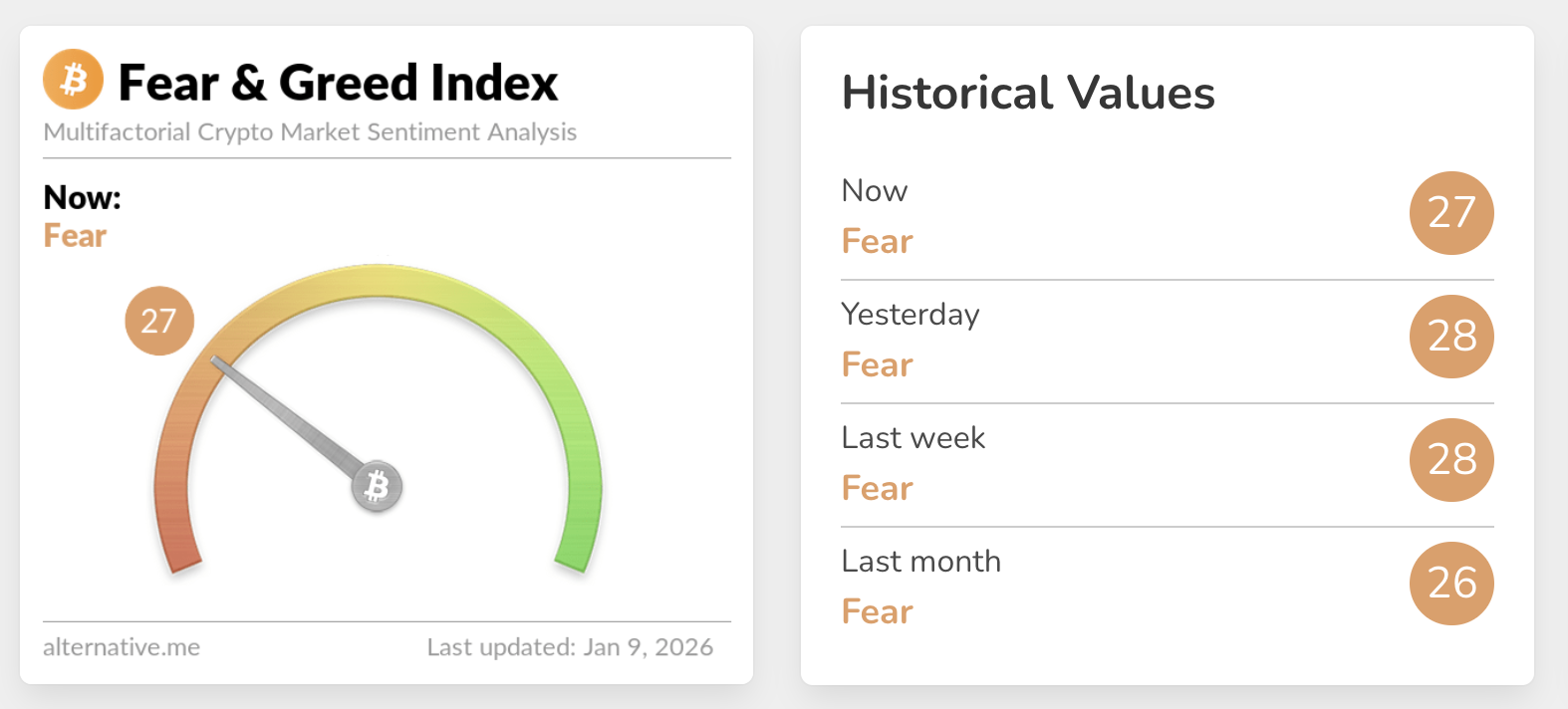

An expanded outlook of the crypto market suggests growing uncertainty, evidenced by a lack of investor confidence. The Crypto Fear & Greed Index is at 27 on Friday, confirming that investors remain worried.

Despite the index rising to 55 on Tuesday, the market failed to gain strength, leading to the ongoing correction. If sentiment fails to improve, XRP could extend the correction to $2.00 and possibly toward the December low at $1.77.

XRP struggles as retail demand remains weak

The XRP derivatives market is slowly shedding gains made since January 1, when the futures Open Interest (OI) expanded from $3.33 billion to $4.55 billion on Tuesday.

CoinGlass data shows the OI, representing the notional value of outstanding futures contracts, has declined to $4.15 billion on Friday, indicating that retail demand is softening. A steady decline in OI suggests that traders are losing confidence in XRP, which leaves prices vulnerable to selling pressure.

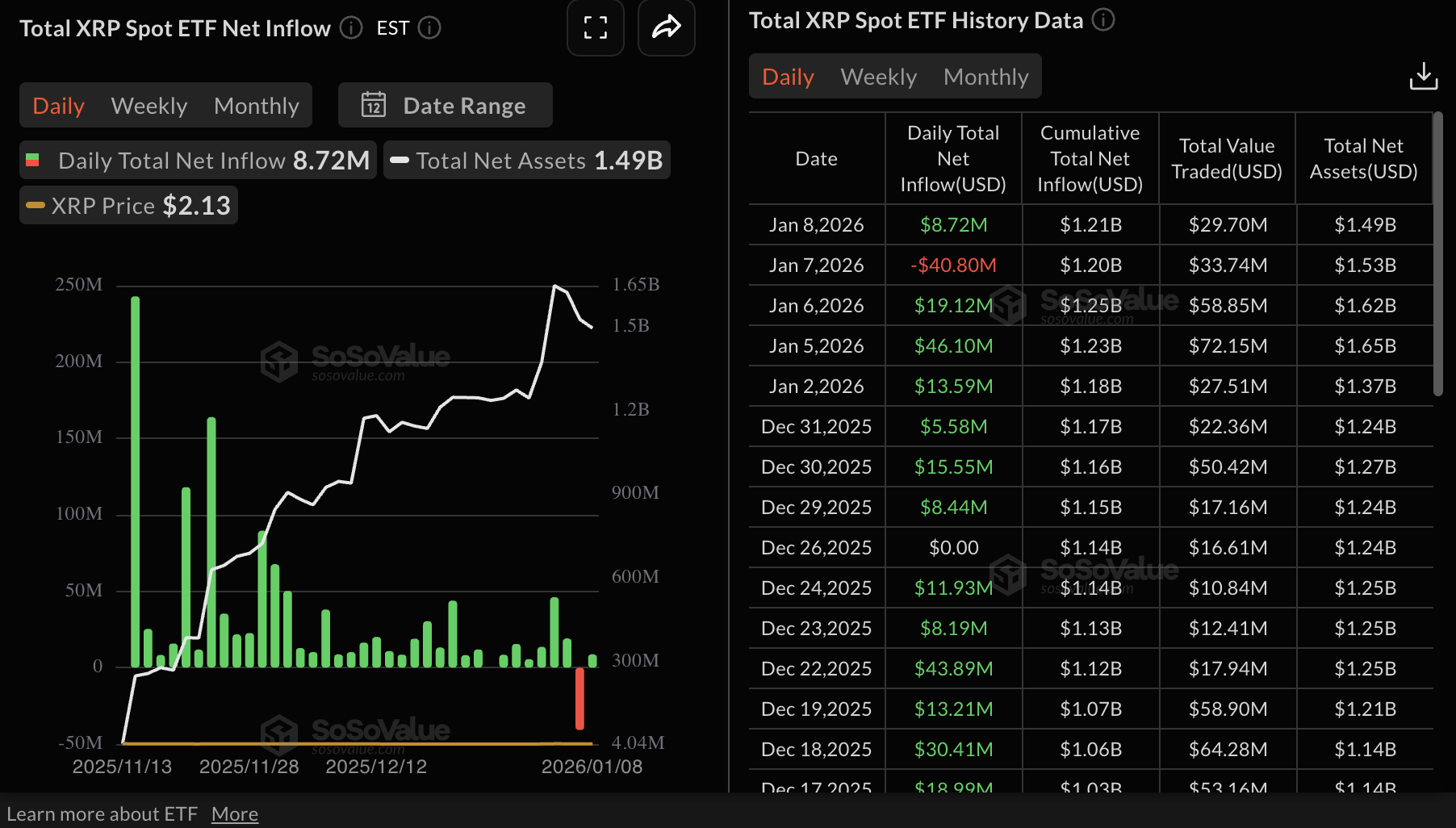

As retail demand gradually dwindles, institutional interest is back on track, as reflected by the XRP spot ETFs recording nearly $9 million in inflows on Thursday. SoSoValue data shows that the ETFs broke their record of steady inflows on Wednesday, with outflows totaling $41 million that day. The resurgence of inflows could be a signal that institutional interest in US-listed ETFs will continue.

XRP technical outlook: XRP holds key support as risk-off sentiment persists

XRP is trading at $2.10 at the time of writing on Friday as investors extend risk-aversion measures. The 100-day Exponential Moving Average (EMA) caps the upside at $2.22, while the 200-day EMA at $2.34 holds slightly below a descending trendline that has been hindering breakouts since the record high of $3.66 in July.

The Relative Strength Index (RSI) at 54 on the daily chart continues to extend its decline from overbought territory, indicating that bullish momentum is faltering.

Conversely, traders may consider leaning into risk, given that the Moving Average Convergence Divergence (MACD) indicator has maintained a buy signal since January 1, which could prevent further declines below the 50-day EMA at $2.07.

A sustained breakout above the 100-day EMA and the 200-day EMA resistance cluster at $2.22-$2.34 could increase the odds of XRP rising beyond the descending trendline toward the $3.00 level.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.