Zcash Rebounds as Developers Clarify Exit Was Structural, Not a Walkout

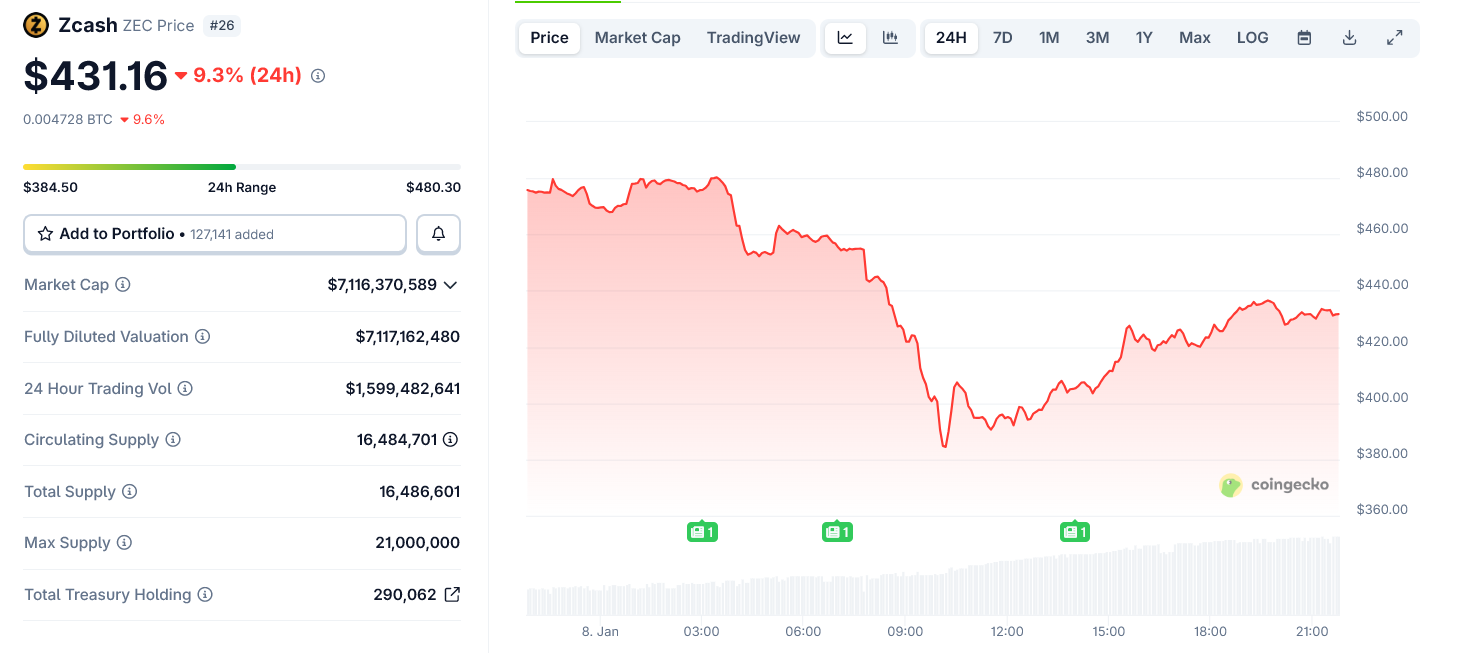

Zcash (ZEC) rebounded on January 8 after an initial sharp sell-off triggered by concerns over its core development team.

The recovery followed fresh clarification from Electric Coin Company (ECC) leadership, which helped ease fears that the privacy-focused blockchain had been abandoned.

ECC Clarification Reframes the Exit

ZEC price fell more than 20% at one point, briefly dropping below $390, before recovering above the $430 level.

Trading volume spiked during the decline, suggesting forced selling driven by headline risk rather than a change in protocol fundamentals.

Zcash Price Recovery After Sudden Crash. Source: CoinGecko

Zcash Price Recovery After Sudden Crash. Source: CoinGecko

The sell-off followed an earlier statement from ECC CEO Josh Swihart. The entire ECC team had left after what he described as “constructive discharge” due to governance disputes with the Bootstrap nonprofit board.

That initial message sparked concern that Zcash had lost its core developers.

However, follow-up clarification later in the day reframed the situation. Swihart said the team remains fully committed to Zcash and has reorganized under a new startup structure.

Also, he emphasized that the move was driven by structural constraints of nonprofit governance. It was not a departure from the project itself.

Crucially, the clarification stressed that the Zcash protocol remains unaffected and fully operational.

No consensus rules, cryptographic systems, or network infrastructure were changed.

Zcash Governance Dispute, Not a Protocol Crisis

The dispute centers on governance and organizational control rather than technical development. ECC staff exited the nonprofit structure overseeing Zcash development but retained the same team, mission, and roadmap under a new corporate entity.

This distinction appeared to be missed in early market reactions. Initial interpretations framed the event as a mass resignation or project breakdown, which accelerated selling pressure.

As additional context emerged, sentiment began to stabilize.

Several industry figures publicly criticized the early narrative, arguing that the market reaction overstated the situation. Commentary from infrastructure leaders described the event as a corporate restructuring rather than a developer exodus.

That pushback helped shift focus away from worst-case assumptions and toward the underlying continuity of development.

While governance tensions remain unresolved, the immediate risk of a protocol disruption appears to have been overstated. The market now turns to how the new development structure executes and whether clearer communication can prevent similar shocks.