Analyst Highlights Ethereum Key Levels With $2,772 Being Strongest — Details

The Ethereum market has seen an eventful display throughout 2025, kicking off the year with bearish momentum, where it witnessed a significant downturn of over 60% as of April. Interestingly, this year also marked the establishment of a new all-time-high for the king of altcoins, reaching values around $4,955 in August.

At the moment, Ethereum has deviated by nearly 40% from its all-time-high price, raising questions concerning how the token would end the year. Notably, market analyst Ali Martinez has published a recent analysis, highlighting significant price levels that the bullish speculations ultimately depend on.

URPD Reveals Significant Accumulation At $2,772 — What This Means

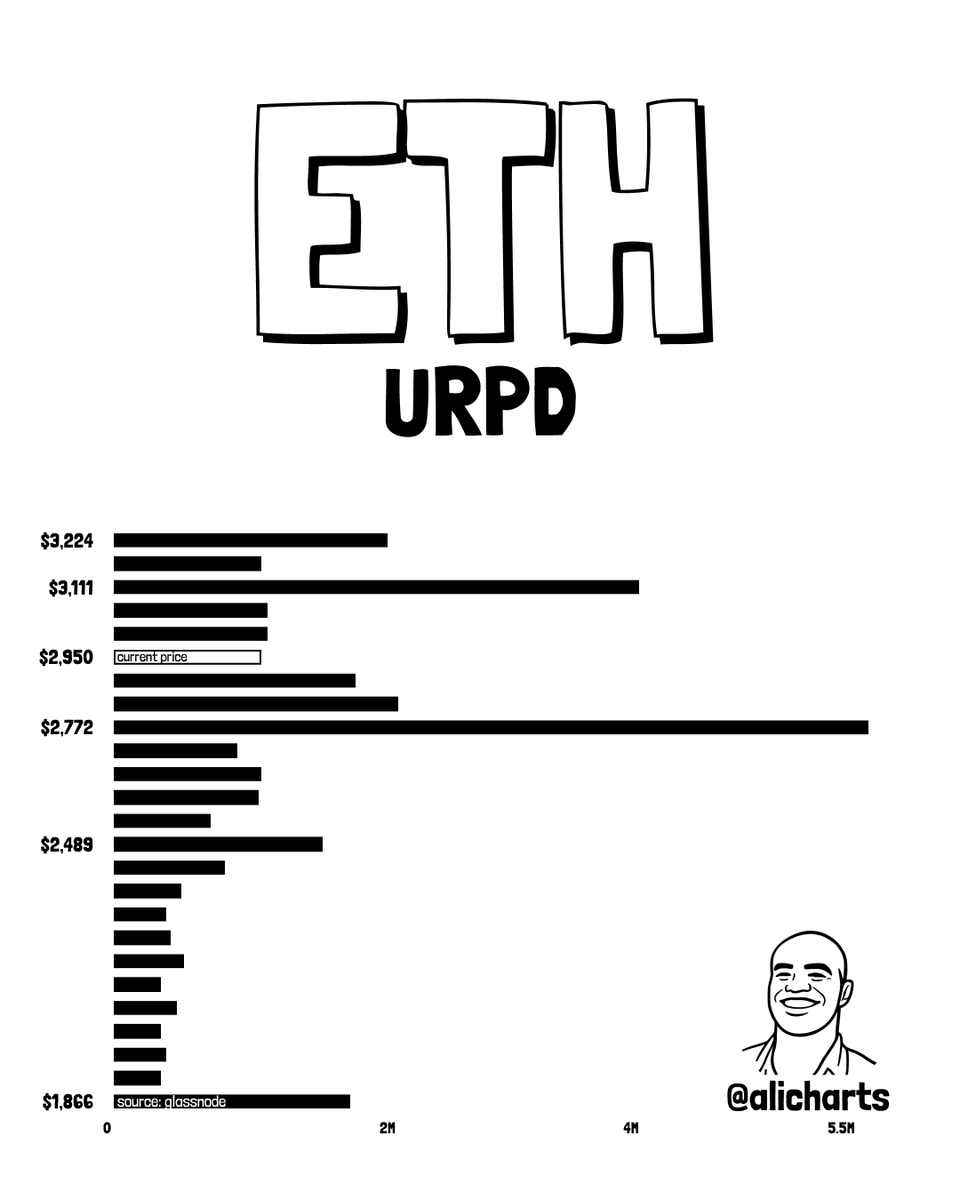

In an X post on December 19, Martinez reports that specific price zones should at least serve as cushions to Ethereum’s bearish move. The post relies on data obtained from the URPD (UTXO Realized Price Distribution) metric, which reveals price levels where the current supply of a cryptocurrency last moved on-chain.

In the chart shared below, we see a high concentration of acquired Ethereum supply at the $2,772 price mark, suggesting that a significant number of investors purchased their holdings at this price, or around it. Therefore, investors are more likely to defend their holdings around this level, thus transforming it into a strong psychological support.

Interestingly, more tokens are expected to be purchased at this level, adding to the amount of buy momentum, counteracting the extant sell-pressure. If Ethereum, however, attempts a further push to the upside, significant resistance levels at the $3,211 and $3,224 price levels lie in wait.

Related Reading: Ethereum Exchange Outflows Soar To $978M: Sign Of Dip Buying?

Related Reading: Ethereum Exchange Outflows Soar To $978M: Sign Of Dip Buying?

$2,489 And $1,866 Next Supports In Line If $2,772 Fails

If its heavily-defended support fails, the Ethereum price could see a free-fall towards the next psychological support. Martinez points out that this cushion sits at $2,489. From the chart, a fair bit of ETH supply was last transacted at this price region. Because the magnitude of transactions is ostensibly insignificant, $2,489 could likely only provide temporary relief to the falling Ethereum price, if it is reached.

Therefore, there could be a continued series of sales until the Ether token sees its last significant support around the $1,866 price. In this scenario, the Ethereum market would be experiencing a major sentiment shift as a result of its uncurbed fall to its last support. As of this writing, Ethereum is valued at approximately $2,987. Data from CoinMarketCap shows that the token has gained by 5.56% in 24 hours.