Cardano Price Forecast: ADA dips below $0.37, hitting two-month low as bearish momentum builds

- Cardano price hovers around $0.36 on Thursday after falling more than 7% so far this week.

- On-chain data indicate bearish sentiment, as social dominance declines while dormant wallet activity rises.

- The technical outlook suggests further downside, as momentum indicators show bearish pressure gaining traction.

Cardano (ADA) price trades in the red, slipping below $0.37 on Thursday after correcting more than 7% so far this week. The ongoing pullback could deepen further as ADA’s social dominance declines and dormant wallet activity rises, suggesting bearish sentiment among traders. On the technical side, deteriorating momentum indicators suggest further downside.

Cardano’s on-chain signals turn bearish

Santiment’s Social Dominance metric for Cardano supports a bearish outlook. The index measures the share of ADA-related discussions across the cryptocurrency media. It has consistently fallen since mid-November, reaching an annual low of 0.032% on Thursday. This fall indicates fading market interest and weakening sentiment among Cardano investors.

[08-1766029457182-1766029457183.59.05, 18 Dec, 2025].png)

Santiment’s Age Consumed index, shown below, also hints at bearish signs. The spikes in this index suggest dormant tokens (tokens stored in wallets for a long time) are in motion, and it can be used to spot short-term local tops or bottoms.

As in the case of Cardano, history shows that a decline followed the spikes in ADA’s price as holders moved their tokens from wallets to exchanges, thereby increasing selling pressure. The most recent upticks on December 10 and Monday suggested that ADA was ready for a downtrend.

[08-1766029481740-1766029481741.16.58, 18 Dec, 2025].png)

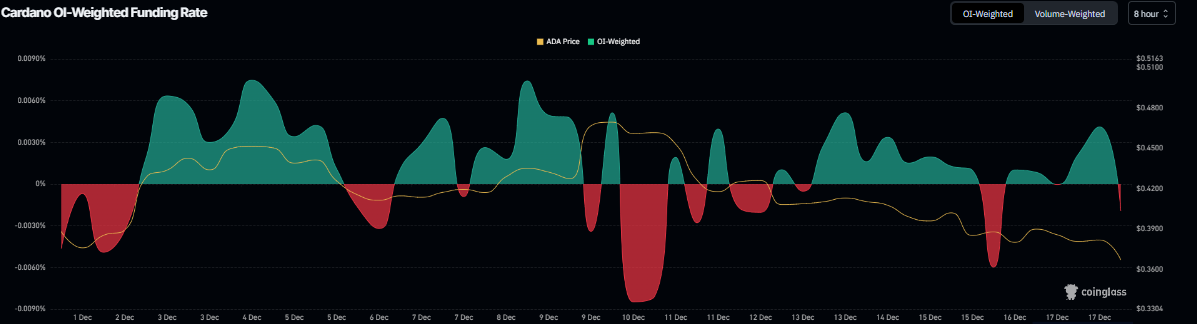

On the derivatives front, data further supports a negative outlook for Cardano. Coinglass’s OI-Weighted Funding Rate data show that the number of traders betting that the price of ADA will slide further exceeds those anticipating a price increase.

The metric turned negative on Thursday, down 0.0019%, suggesting that shorts are paying longs. Historically, when the funding rates have flipped negative, ADA prices have fallen sharply.

Cardano Price Forecast: ADA bears are in control of the momentum

Cardano price was rejected from the upper trendline of the falling wedge pattern (formed by connecting multiple highs and lows with two trendlines since mid-October) on December 9 and declined 21.8% through Wednesday. At the time of writing on Thursday, ADA is trading down, reaching a two-month low of $0.36.

If ADA continues its downward trend, it could extend the fall toward the October 10 low of $0.27.

The Relative Strength Index (RSI) on the daily chart reads 32, nearing oversold territory, indicating strong bearish momentum. Additionally, the Moving Average Convergence Divergence (MACD) indicator showed a bearish crossover on Wednesday, further supporting the negative outlook.

However, if ADA recovers, it could extend the advance toward the 50-day EMA at $0.47.