XRP Price Holds Above $2 Again — What’s Next For The Altcoin?

The XRP price has been on a steep downward spiral throughout the second half of 2025, falling from its all-time high of around $3.65. However, finding support at the $2 mark has been a consistent theme during the altcoin’s period of decline.

Most recently, the XRP price fell this week from its local high close to $2.20 before bouncing back from the $2 mark. While the coin’s value continues to hover around this psychological price point, below is a look at other relevant levels that could determine its future trajectory.

Key On-Chain Levels For XRP

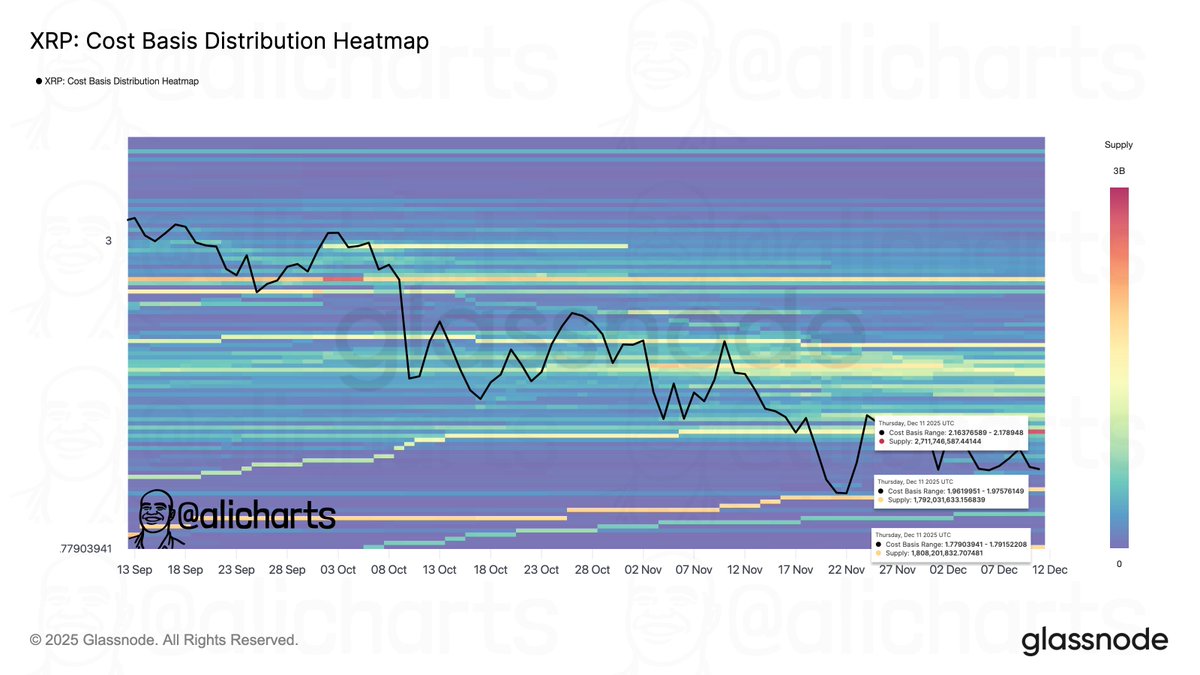

In a December 12 post on social media platform X, crypto analyst Ali Martinez shared on-chain insights into the current market outlook for the XRP token. Using Glassnode’s Cost Basis Distribution Heatmap, the market pundit identified three key levels for the XRP price.

The Cost Basis Distribution Heatmap tracks the average cost basis of the total XRP token supply. With the help of a heatmap, this metric highlights different price levels and the density of investors who purchased their tokens within and around these price levels.

The deep red shade on the heatmap indicates an investor cluster with their cost basis around the highlighted price regions. These zones often act as dynamic support and resistance, depending on whether the current XRP price is below or above them.

Martinez highlighted that the $1.96 and 1.78 zones are the next support cushions for the price of XRP. As seen with recent rebounds around the $1.96 level, the altcoin will likely also bounce back (if it loses the current immediate support) at $1.78, as investors tend to double down and defend their positions by buying more when the price returns to their cost basis, thereby keeping the token’s price afloat.

Meanwhile, Martinez noted that the $2.17 level is a resistance zone for the XRP price, as several investors with their cost basis around it are likely to sell when the price returns to this zone. This selling activity, in turn, puts downward pressure on the altcoin and prevents its price from breaking out.

Ultimately, this on-chain observation reveals that the XRP price needs to at least break the resistance at $2.17 to kickstart any fresh upward trajectory. On the flip side, a loss of the $1.96 support could see the fourth-largest cryptocurrency fall to as low as $1.78.

XRP Price At A Glance

As of this writing, the price of XRP stands at around $2.01, reflecting no significant change in the past 24 hours. Meanwhile, the altcoin is down by nearly 2% on the weekly timeframe, according to CoinGecko’s data.