New Token Launches on Pump.fun Surge in Early December – Is Meme Season Back?

The meme coin market is showing clearer signs of recovery in December. Pump.fun — the leading platform for launching meme coins — is reporting a renewed increase in newly created tokens.

Analysts also note that investor sentiment is shifting toward a higher risk appetite as the year draws to a close.

How Is Pump.fun Reflecting December’s Increased Risk Appetite?

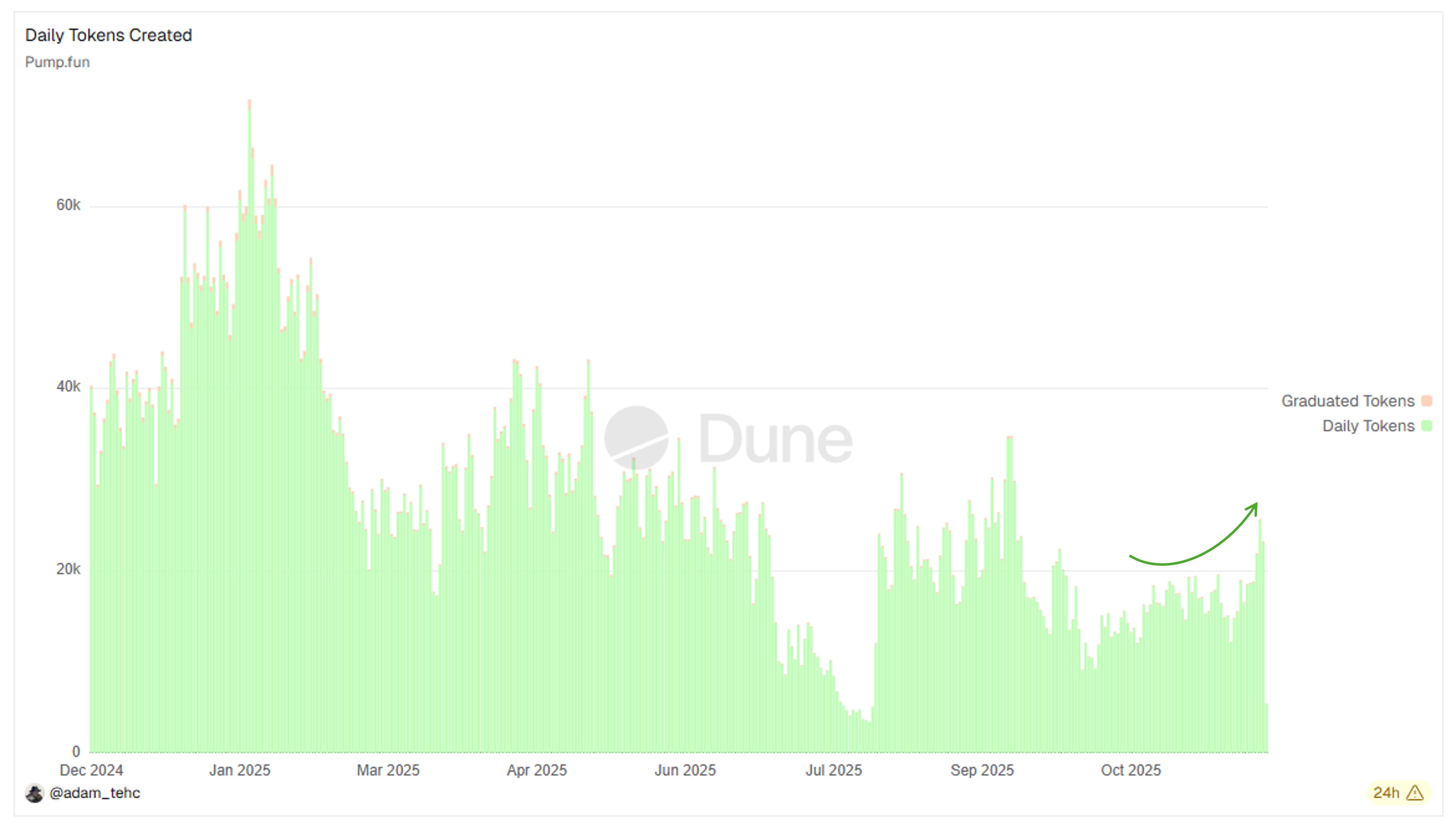

Dune data shows that the number of new meme tokens created daily on Pump.fun has stayed above 20,000 throughout December. On December 2, the figure exceeded 25,000. This was the highest level since mid-September, marking a notable shift.

Daily Token Created on Pump.fun. Source: Dune

Daily Token Created on Pump.fun. Source: Dune

This rebound still cannot match the peak levels seen in early 2025. However, it signals a shift in investor psychology.

Many appear to believe that this is a favorable moment for retail capital to flow back into low-cap and newly launched tokens.

Although the number of new tokens shows a mild upward trend, Pump.fun’s revenue and DEX volume remain down more than 80% compared to early 2025.

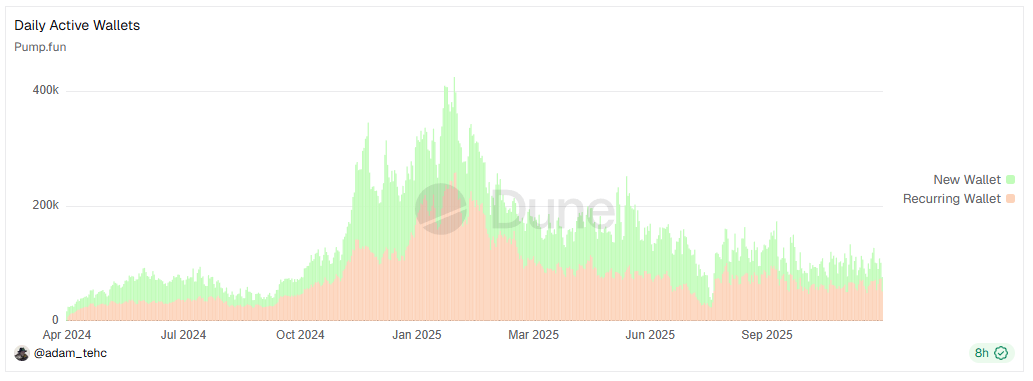

Daily Active Wallets on Pump.fun. Source: Dune

Daily Active Wallets on Pump.fun. Source: Dune

One positive indicator stands out: the number of active addresses — including new addresses and returning users — has consistently stayed around 100,000 on average since August. The market experienced multiple major liquidation events during this period, yet user participation did not drop sharply.

Additionally, Michael Nadeau, founder of The DeFi Report, highlighted a notable comparison between user retention in Web2 and on Pump.fun. Pump.fun achieved higher retention rates, with 12.4% in Week 4 and 11.4% in Week 8. In contrast, Web2 averages range from 5% to 10% in Week 4 and 2% to 5% in Week 8.

These data points appear encouraging within a market environment defined by falling valuations and persistent extreme fear during the final quarter of the year.

Furthermore, well-known trader Daan Crypto Trades observed that meme coins have outperformed major altcoins over the past two weeks.

Crypto Sector Performance. Source: Daan Crypto Trades

Crypto Sector Performance. Source: Daan Crypto Trades

“Over the past two weeks, memes were the outperformer for a change. It has been a long time since those did well. This is after a long streak of outperformance back in 2023 & 2024,” Daan Crypto Trades stated.

He added that this performance could be an early sign that the market is ready to accept higher risk levels. However, he also cautioned that the trend may be short-lived and might not reflect a long-term shift.

A recent report from BeInCrypto also highlighted at least three indicators suggesting that the meme coin season could return in December. If that scenario plays out, the Pump.fun ecosystem may attract retail investors — those who embrace high risk in pursuit of large potential returns.

At the time of writing, the Pump.fun Ecosystem ranks as the market’s third-best performing category during the first week of December, according to Coingecko.