Bitcoin Exchange Inflow Hits $2 Billion As Profit-Taking Phase Lingers

After days of intense bearish action, the price of Bitcoin appears to be entering a calmer state, as it recovers above the $86,000 level. The latest on-chain data shows that several investors tried to take some profit in the past week, providing a basis for the premier cryptocurrency registering a double-digit loss.

Bitcoin Exchange Inflow Spikes As Price Faces Downward Pressure

In a recent post on the social media platform X, crypto analyst Ali Martinez revealed that significant Bitcoin amounts were sent to centralized exchanges in the past week. Data from Santiment shows that about $20,000 BTC (worth nearly $2 billion) has been moved to these exchanges in the past seven days.

The relevant indicator in this on-chain observation is the Exchange Inflow metric, which tracks the volume of an asset (in this case, Bitcoin) that flows to centralized exchanges within a specified period. This metric is often important because one of the prominent exchanges’ service offerings is selling.

Hence, an increase in the Exchange Inflow metric suggests the potential offloading of an asset by investors. The resulting increased supply of this cryptocurrency in the open market often adds downward pressure on the coin’s price, especially if there is no corresponding increase in demand.

In a separate post on X, CryptoQuant’s head of research, Julio Moreno, shared a data piece supporting the recent spike in exchange inflows. According to data highlighted by the crypto researcher, the Bitcoin exchange inflows stood at about 81,000 BTC (the highest level seen since mid-July) on Friday, November 21.

Ultimately, this recent spike in exchange inflows explains the volatility experienced by the price of Bitcoin on Friday. The flagship cryptocurrency succumbed to significant bearish pressure, seeing its price fall to just above $80,000 as the weekend approached.

As of this writing, the price of BTC stands at around $86,070, reflecting an over 2% jump in the past 24 hours.

Bitcoin In Profit-Taking Phase: CryptoQuant CEO

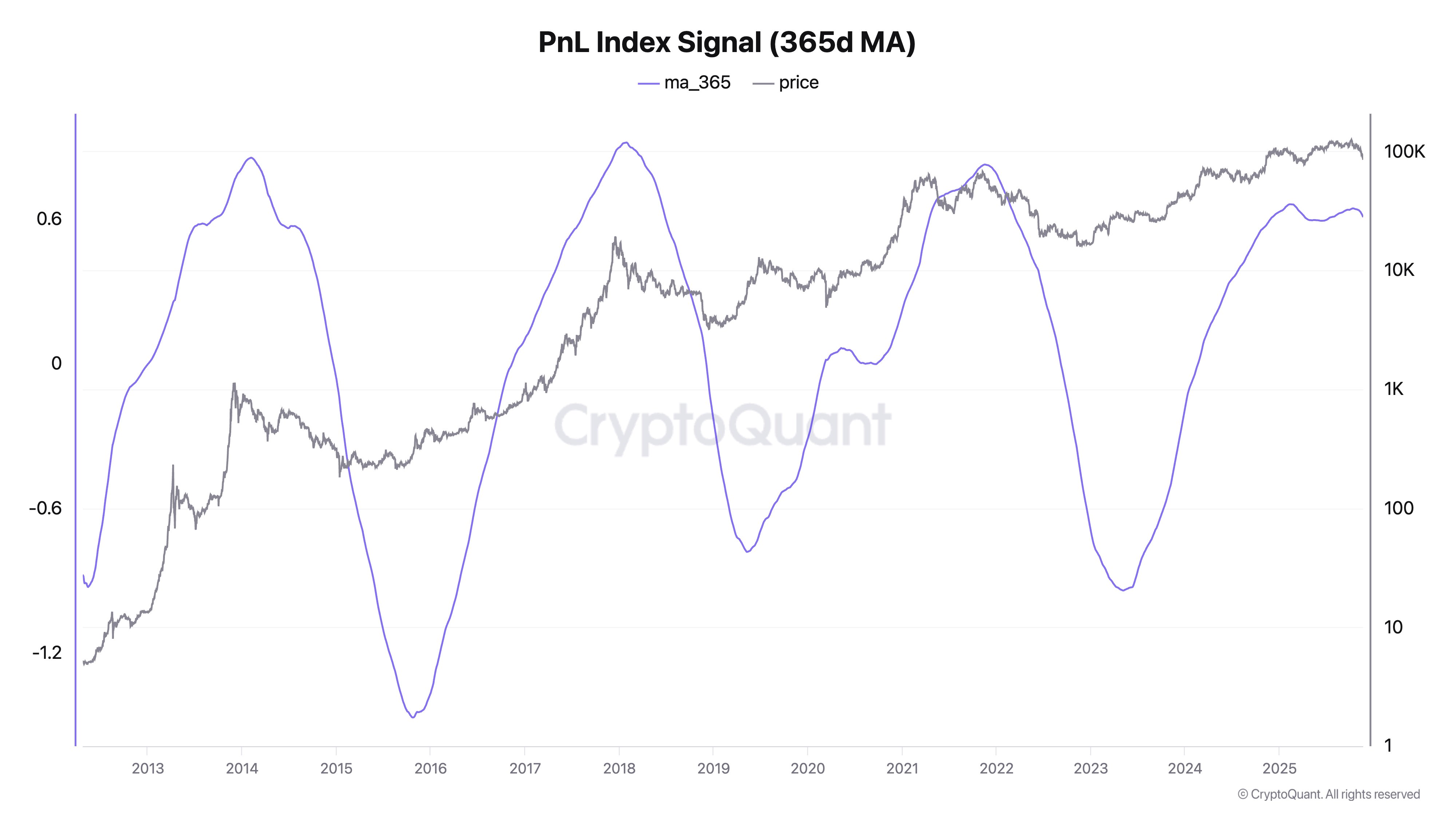

CryptoQuant CEO Ki Young Ju revealed that Bitcoin is in a profit-taking phase, as evidenced by the rising exchange inflows. The crypto founder made this assertion based on the PnL Index Signal, which measures profit and loss levels using all wallets’ cost basis.

With the current reading of the PnL Index Signal, Ju proclaimed that the classic cycle theory says that BTC is entering a bear market. According to the CryptoQuant CEO, only macro liquidity can override the profit-taking cycle—just as seen in 2020.

Hence, all eyes will be on the Federal Open Market Committee (FOMC) meeting in December, especially with the falling expectations of an interest rate cut by the US Federal Reserve (Fed).