Bitwise XRP ETF Goes Live, Up Next Grayscale; Yet Price Crashes 5%

XRP has fallen 5% this week as its ongoing decline continues despite growing institutional interest. The altcoin is struggling to recover, even with two XRP ETFs already live and two more scheduled to launch next week.

This disconnect has raised questions about why price action remains soft.

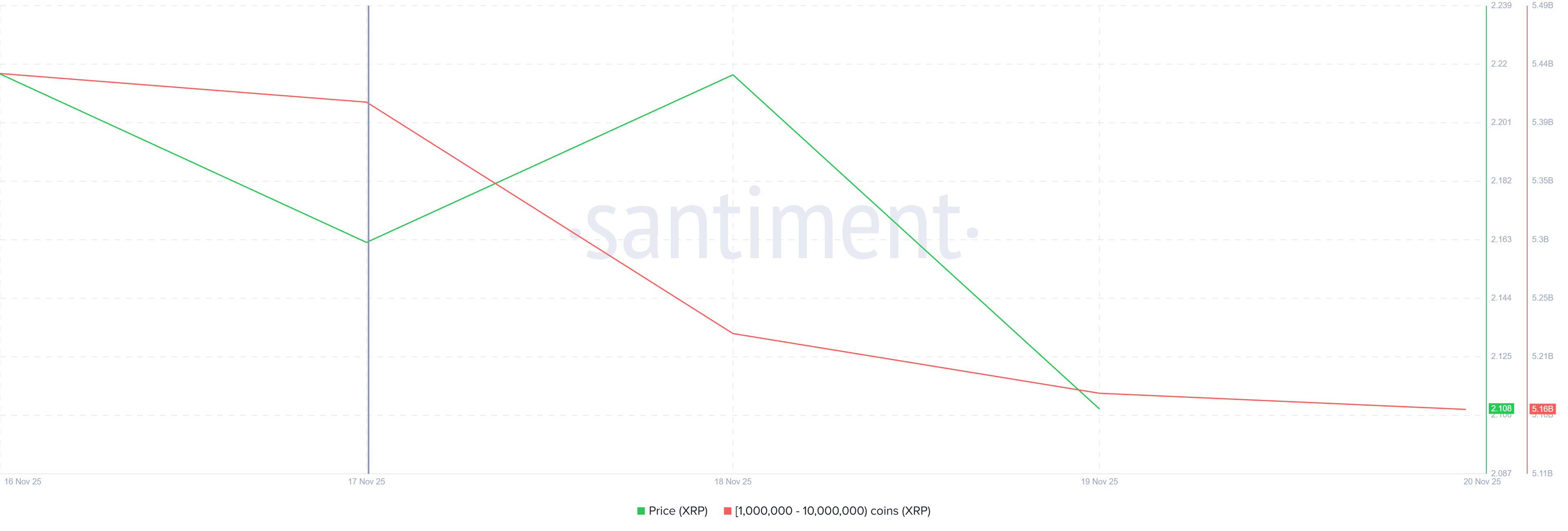

XRP Whales Are Selling

Whale activity offers the clearest explanation for the weakness. Large holders have continued selling throughout the week, adding downward pressure on XRP. In the last 48 hours alone, wallets holding between 1 million and 10 million XRP have sold more than 250 million tokens, worth over $528 million.

Whales remain highly influential due to their ability to shift liquidity and sentiment. Sustained selling from these holders signals a lack of confidence in the near-term outlook. If the selling continues, it could deepen XRP’s decline, especially as the price approaches key support levels.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

XRP Whale Holding. Source: Santiment

XRP Whale Holding. Source: Santiment

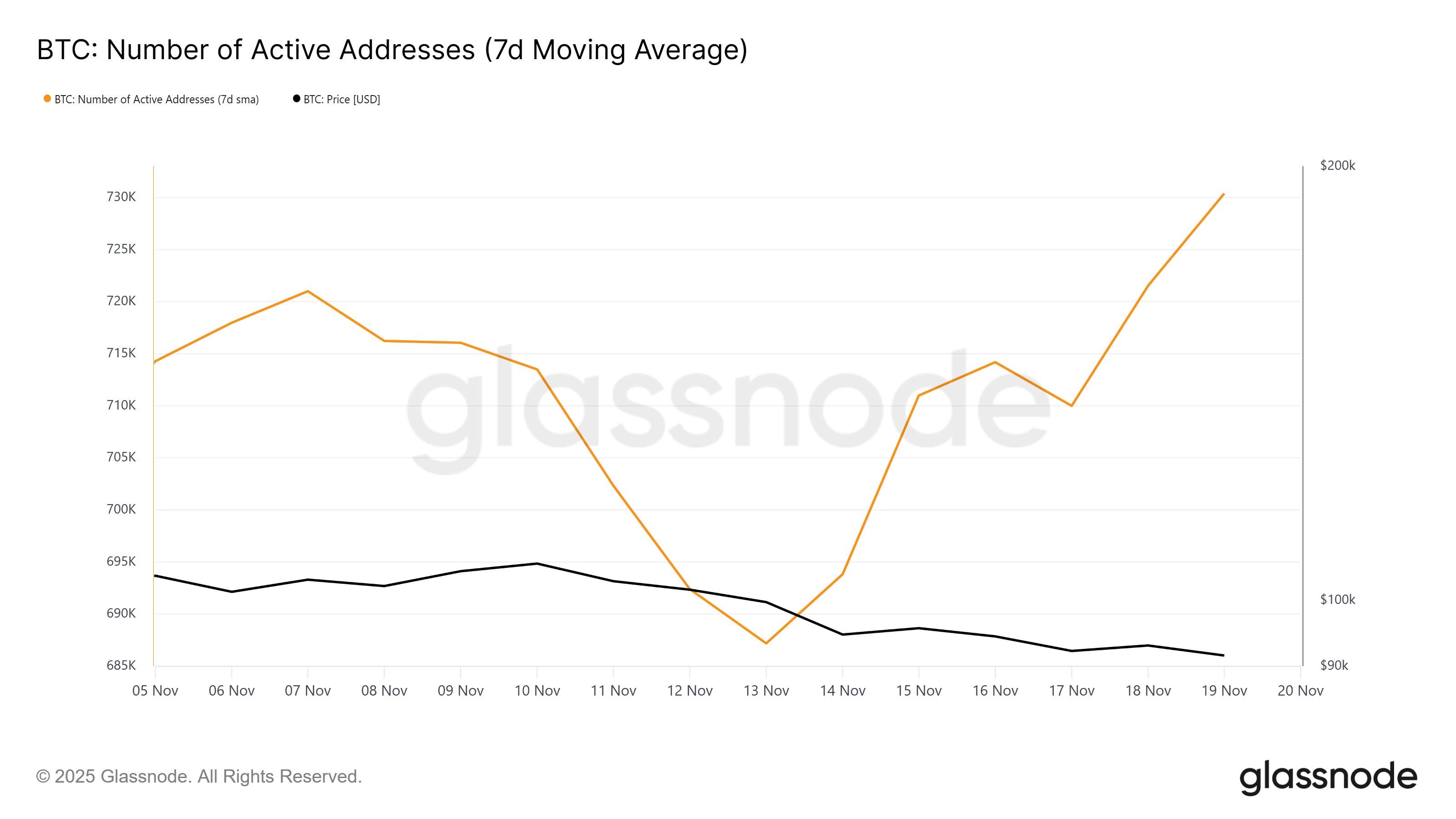

Macro momentum, however, paints a more nuanced picture. New XRP addresses have surged over the past week, climbing to a monthly high. This rise appears linked to the launch of Caanary Capital’s ETF (XRPC) and Bitwise’s ETF (XRP), both of which are driving renewed participation in the network.

Additional inflows are expected as Grayscale’s XRP Trust ETF (GXRP) and Franklin Templeton’s XRP ETF (XRPZ) go live on Monday. These launches are likely encouraging new users to enter the market, providing a counterweight to whale selling and offering potential support for future price stability.

XRP New Addresses. Source: Glassnode

XRP New Addresses. Source: Glassnode

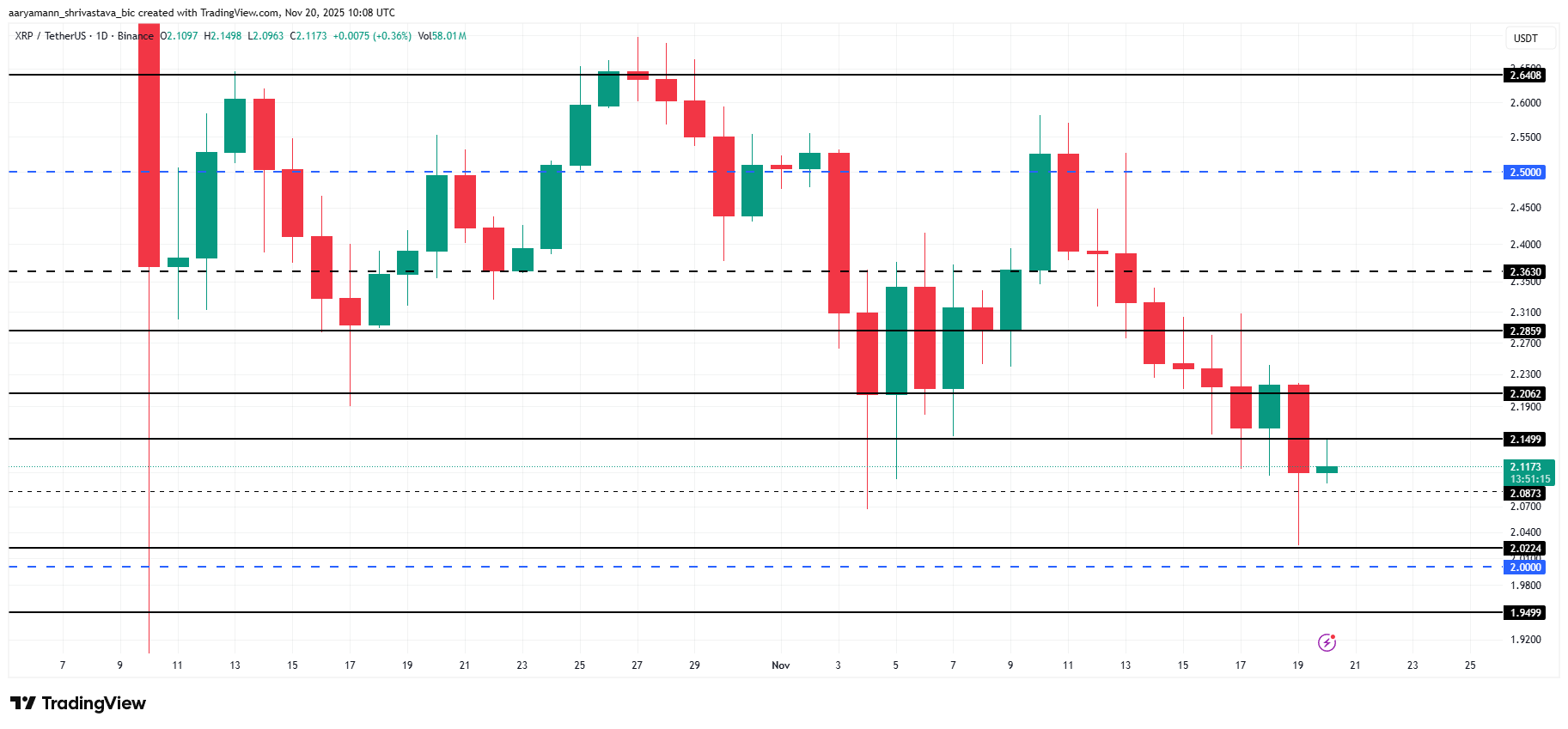

XRP Price Continues To Fall

XRP trades at $2.11 at the time of writing, maintaining support at $2.08. The asset is marking a monthly low and facing mixed sentiment due to conflicting signals from whales and new entrants. Price stability will depend on whether fresh capital outweighs ongoing sell-offs.

If inflows from new addresses continue, they may offset the recent whale selling. This could help XRP rebound above $2.20 and push toward $2.28. ETF-driven demand has the potential to restore short-term momentum and encourage accumulation.

XRP Price Analysis. Source: TradingView

XRP Price Analysis. Source: TradingView

If XRP breaks below the $2.08 support, the downside risk increases. The price could fall to $2.02 or slip below $2.00 if selling intensifies. Such a decline would invalidate the bullish thesis and reflect a deeper shift in market sentiment.