Fartcoin recovery gains traction on steady confidence of whales

- Fartcoin extends its recovery for the third consecutive day, posting 12% gains by press time on Thursday.

- A 30% spike in Fartcoin futures Open Interest and heightened funding rates reflect elevated retail demand in the derivatives market.

- On-chain data showcases strong support from large wallet investors, fueling the short-term recovery.

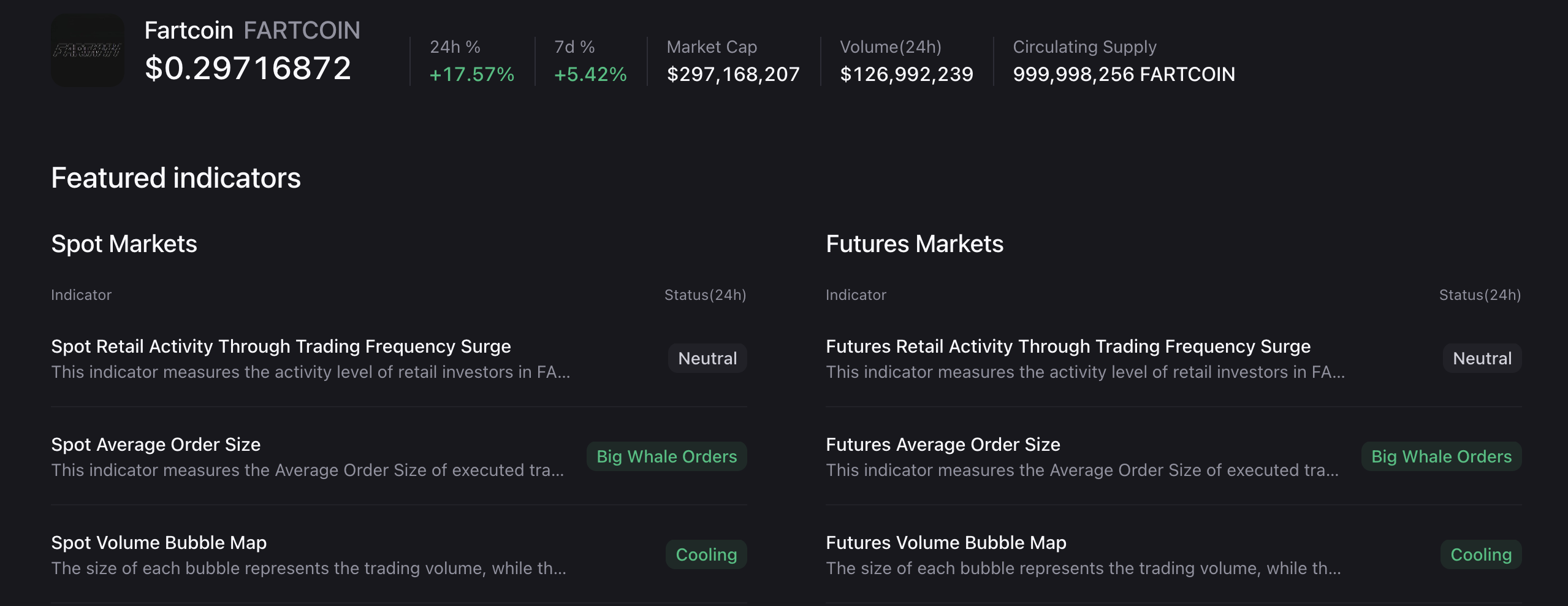

Fartcoin (FARTCOIN) is regaining strength, rising 12% by press time on Thursday, and tests the upper resistance trendline of a falling channel pattern on the daily chart. Both the derivatives and on-chain data suggest that the renewed demand for the meme coin is backed by large wallet investors, commonly referred to as whales. Technically, Fartcoin is poised for a breakout rally amid early signals of resurgent bullish momentum.

Whales are building bullish Fartcoin positions

Retail interest in Fartcoin is resurfacing, aligning with the short-term recovery, increasing the likelihood that the meme coin can sustain bullish momentum. According to CoinGlass, the FARTCOIN futures Open Interest (OI) has risen by 30% to $220.69 million in the last 24 hours. This sharp increase in OI reflects a massive buying of long positions by traders anticipating further gains.

CryptoQuant data shows that the OI surge is driven by whales, as evidenced by the average order size. Apart from derivatives, the whales are buying in the spot market, signaling strong confidence in the meme coin.

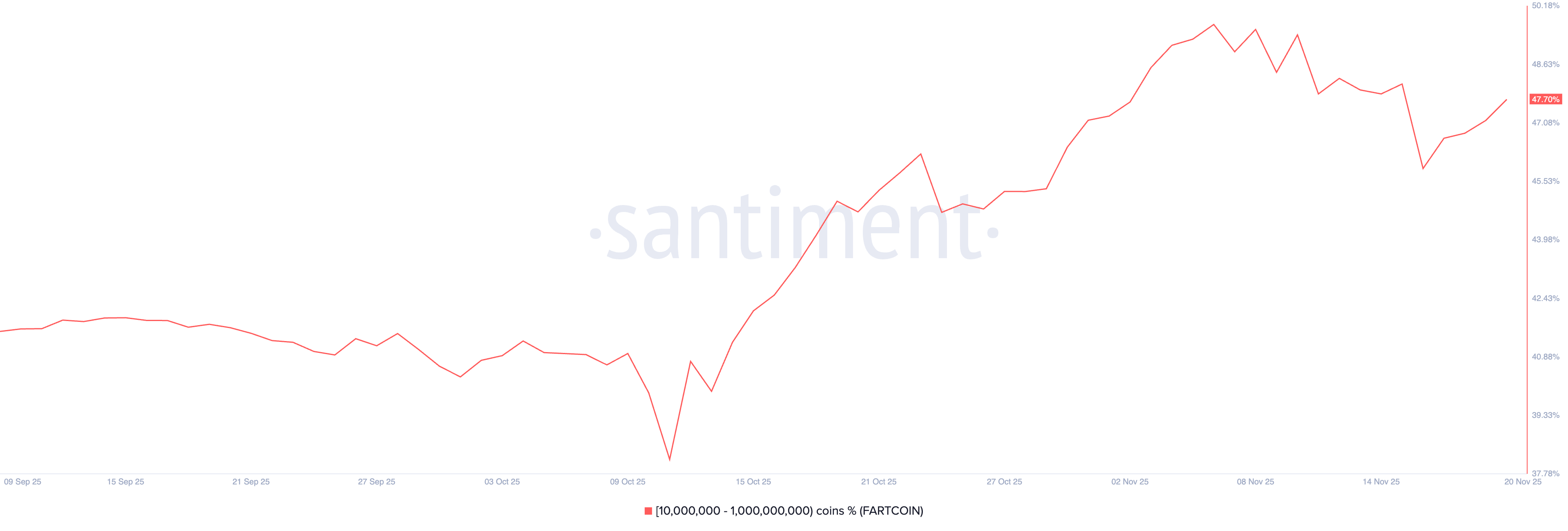

Santiment data shows that investors with 10 million to 1 billion tokens have increased their exposure to 47.70% of the on-chain supply, up from 45.87% on Sunday. As large wallet investors acquire more tokens, FARTCOIN is likely to surge as supply declines and sentiment strengthens, with smart money signaling conviction.

Fartcoin builds strength for a potential breakout rally

Fartcoin’s recovery challenges a local resistance trendline of a falling channel pattern on the daily chart, near the $0.30 round figure. If the Solana-based meme coin successfully holds a daily close above this level, it could confirm the pattern breakout and kickstart a bullish trend.

A potential breakout rally could target the declining 50-day Exponential Moving Average (EMA) at $0.39, followed by the 50% Fibonacci retracement, drawn from the $1.69 peak of July 22 and the $0.17 low of October 10, at $0.54.

Corroborating the chances of a breakout rally, the Relative Strength Index (RSI) at 48 is gradually ascending towards the midline as selling pressure wanes. At the same time, the Moving Average Convergence Divergence (MACD) regains buoyancy, extending the uptrend above the signal line to avoid a crossover, with rising green histogram bars signaling renewed bullish momentum.

Meanwhile, the Rate of Change (ROC) at 3.54 resurfaces above the zero line, marking a positive shift in trend momentum. A steady rise in ROC above zero indicates stronger bullish momentum.

If FARTCOIN fails to sustain bullish momentum, it could revert within the falling channel, potentially threatening the $0.22 low from Friday.