Ripple Price Forecast: XRP sell-off persists as Ripple developers eye DeFi expansion

- XRP remains under pressure, with its decline approaching $2.00 on Wednesday.

- Ripple CTO David Schwartz and RippleX researcher J. Ayo Akinyele propose native staking features on the XRP Ledger.

- XRP decline could extend below $2.00 amid low retail demand and a weak technical structure.

Ripple (XRP) is largely in bearish hands, trading at $2.12 at the time of writing on Wednesday. A bearish wave is stirring volatility in the broader cryptocurrency market amid a prolonged sell-off.

Since XRP hit a record high of $3.66 on July 18, the path of least resistance has generally been downward. Macroeconomic uncertainty, profit-taking, and the lack of prominent price catalysts are some of the factors weighing on the cross-border token.

If risk-off sentiment persists amid weak derivatives and spot markets, the current decline could extend below the critical $2.00 level.

Ripple developers mull staking on the XRP Ledger

RippleX researcher J. Ayo Akinyele stated that the XRP Ledger has made significant progress over the years, from powering payments and enabling the settlement of real-world assets (RWAs) to supporting real-time liquidity across global markets.

Akinyele argued that the launch of the Canary XRP Exchange Traded Fund (ETF) last week is a sign that adoption is growing, backed by institutional demand. However, the protocol must first figure out how to generate staking rewards and distribute them fairly. The Head of Engineering at RippleX added that native staking on the XRP Ledger could be the next step.

David Schwartz, Ripple's Chief Technology Officer (CTO), replied to Akinyele's post in X, saying that he has been mulling over how XRP is used in Decentralised Finance (DeFi).

"With programmability initiatives and smart contract discussions underway, it seemed like a good time for us to also discuss what other DeFi capabilities natively could look like," Schwartz stated.

XRP trades under pressure amid low retail demand

Retail demand for XRP has not picked up following the October 10 deleveraging event, which liquidated over $19 billion in crypto assets in a single day.

CoinGlass data on the XRP derivatives market shows the futures Open Interest (OI) averaging $3.85 billion on Wednesday, slightly up from Tuesday's $3.6 billion but significantly below the $4.17 billion recorded on November 1.

A steady increase in OI is required to support XRP's short-term recovery, indicating that investors have confidence in the token and the ecosystem and are willing to increase their risk exposure.

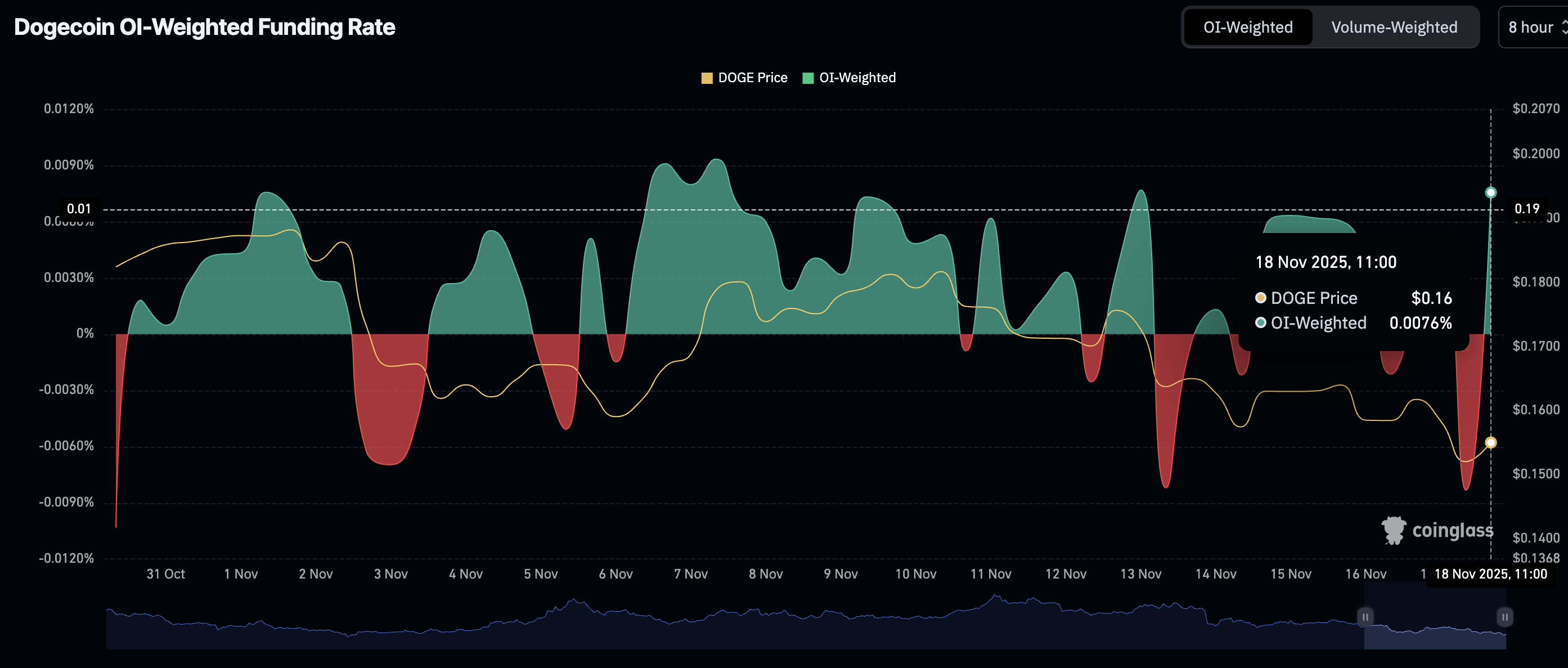

Meanwhile, XRP OI-Weighted Funding Rate has risen to 0.0090% on Wednesday from Tuesday's 0.0005%, as traders increasingly pile into long positions.

The cross-border remittance token must hold above $2.07-$2.10 short-term support to improve risk appetite. Otherwise, signs of further weakness may reinforce the bearish outlook.

Technical outlook: XRP sellers tighten their grip

XRP teeters above support between $2.07 and $2.10 at the time of writing on Wednesday as bears tighten their grip. The Relative Strength Index (RSI) is at 37 and falling toward oversold territory on the daily chart, which asserts the bearish outlook.

Similarly, the Moving Average Convergence Divergence (MACD) indicator has maintained a sell signal since Sunday. The MACD line in blue remains below the red signal line, suggesting risk-averse action for investors.

A break below XRP's immediate support at $2.07-$2.10 could validate an extended correction below the critical $2.00 level. The next key area to watch is $1.90, which was last tested in June.

Still, a trend reversal is possible from the current $2.07-$2.10 support if investors increase their exposure while anticipating a steady rebound toward the 50-day Exponential Moving Average (EMA) at $2.46.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.