Pi Coin Price Nears All-Time Low, And Even Bitcoin Can’t Save It Anymore

Pi Coin has failed to sustain its recovery over the past few days, leaving investors increasingly skeptical about its near-term outlook.

Despite Bitcoin holding steady above $110,000, Pi Coin’s detachment from the broader market makes its decline more likely to continue.

Pi Coin Has A Lot Of Work Ahead Of It

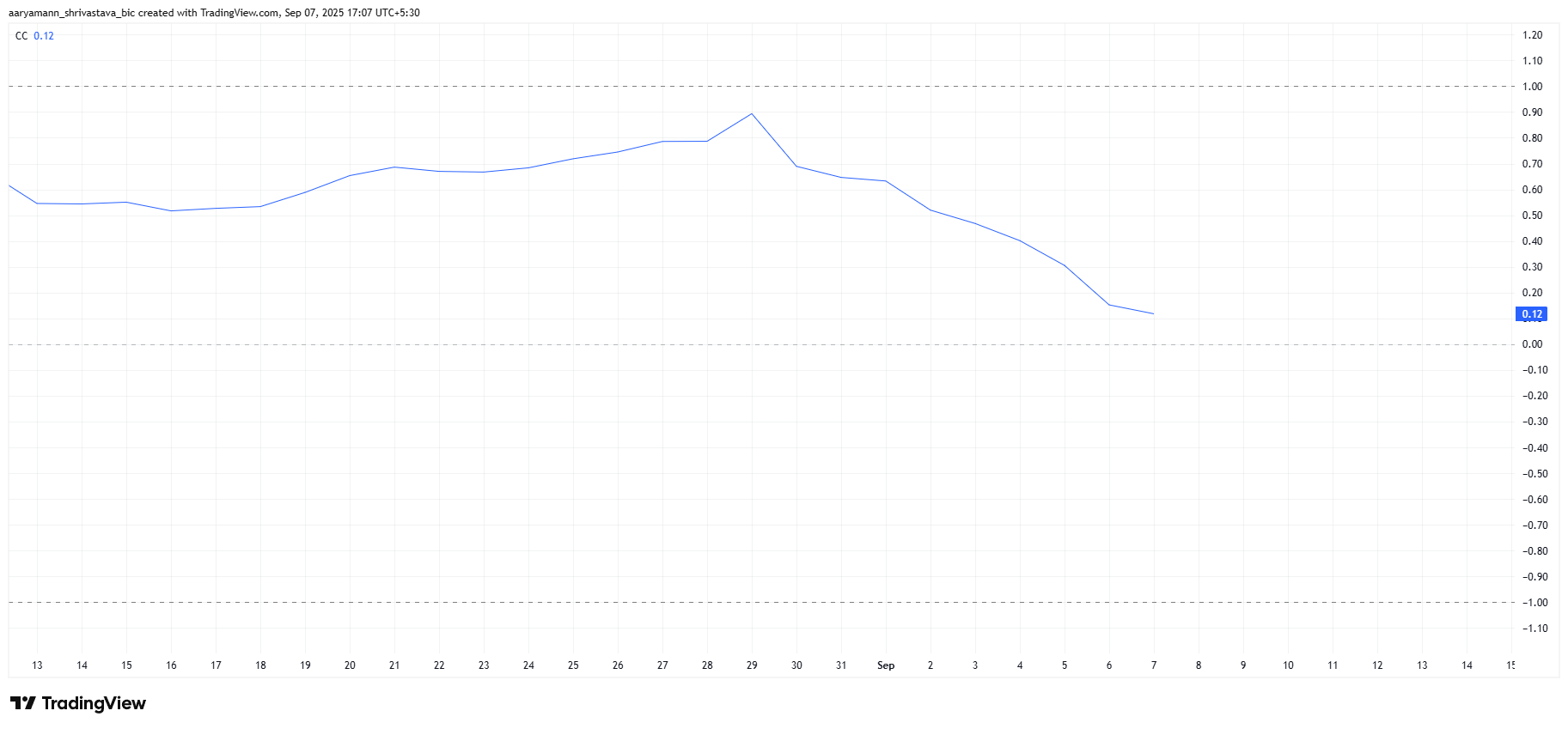

The correlation between Pi Coin and Bitcoin is currently at just 0.12, signaling that the altcoin is no longer tracking the moves of the world’s largest cryptocurrency. This growing divergence is worrisome, especially as Bitcoin shows signs of stability.

Pi Coin’s decoupling from Bitcoin is counterproductive at a time when BTC is holding firm above $110,000, a crucial support level. Instead of benefiting from Bitcoin’s strength, Pi Coin’s weakness signals eroding investor confidence, making the risk of a further decline more apparent.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Pi Coin Correlation To Bitcoin. Source: TradingView

Pi Coin Correlation To Bitcoin. Source: TradingView

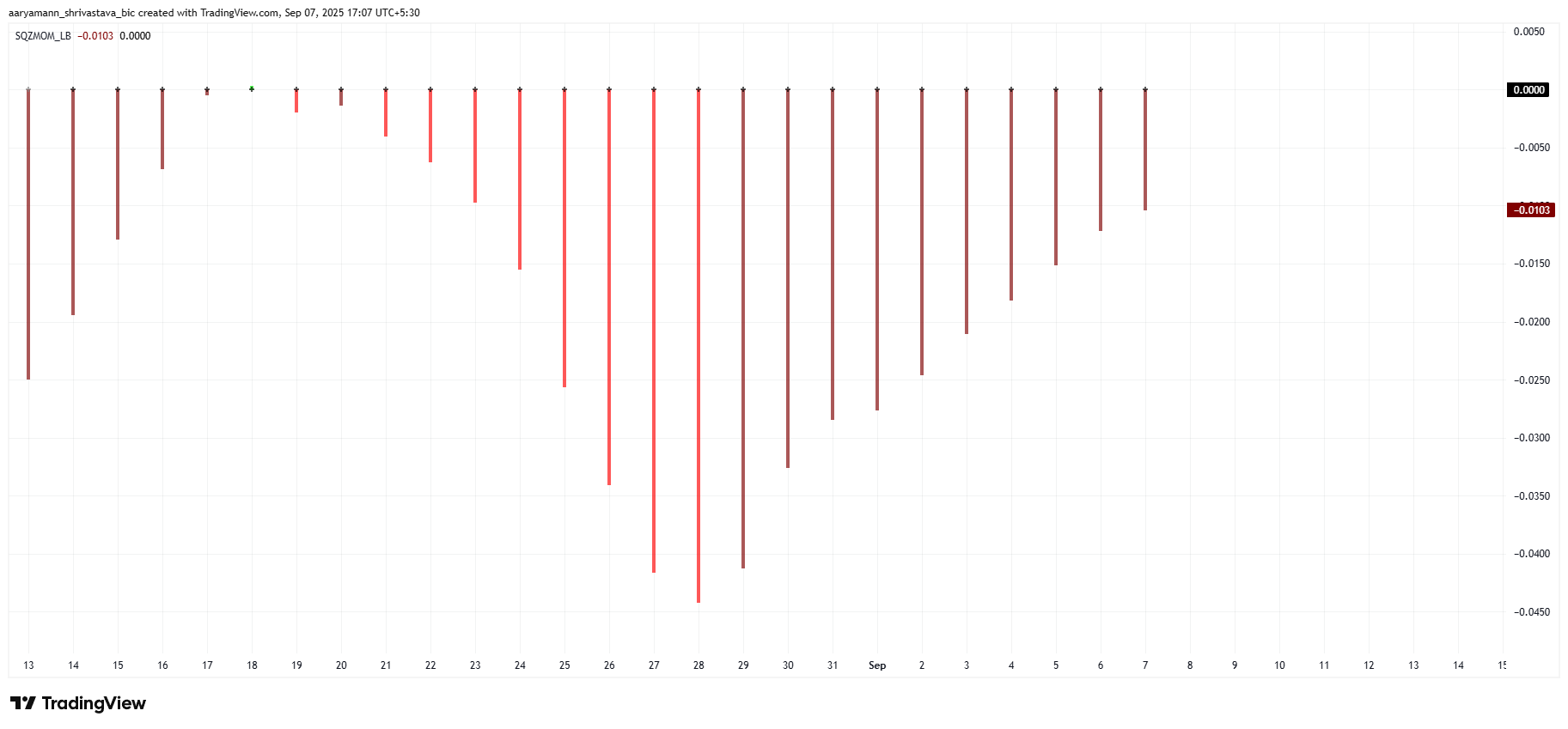

Technical indicators also suggest that the volatility of Pi Coin may soon increase. The Squeeze Momentum Indicator is flashing black dots, a sign that a squeeze is forming. When this releases, price action could experience sharp moves depending on broader market direction.

Given the bearish environment, a volatility spike would likely accelerate Pi Coin’s decline rather than trigger a recovery. Without stronger inflows or supportive investor sentiment, the upcoming squeeze could become a key driver pushing the token closer to new lows.

Pi Coin Squeeze Momentum Indicator. Source: TradingView

Pi Coin Squeeze Momentum Indicator. Source: TradingView

PI Price Needs Help

Pi Coin’s price is currently trading at $0.345, holding just above the crucial support of $0.344. For now, the altcoin’s short-term resilience hinges on maintaining this level, but market signals suggest it may not last much longer.

If the support fails, Pi Coin’s price could slip through $0.334 and fall toward its all-time low of $0.322. A break below that point may open the door to further downside pressure and potentially new record lows.

Pi Coin Price Analysis. Source: TradingView

Pi Coin Price Analysis. Source: TradingView

The only scenario that could invalidate this bearish outlook is a bounce off $0.344, allowing Pi Coin to climb toward $0.360. However, with weak sentiment and limited correlation to Bitcoin, chances of recovery remain slim at this stage.