Ethereum Price Forecast: ETH breaches key support as validator entry flips exits

Ethereum price today: $4,300

- Ethereum validator entry queue surpassed exits for the first time since July, reaching a two-year high.

- The rise in validator entry follows strong institutional accumulation from Ethereum treasury firms led by BitMine and SharpLink.

- ETH eyes the $4,100 support after breaching a key ascending trendline again.

Ethereum (ETH) trades around $4,300 on Thursday after its validator entry queue reached a two-year high and flipped validator exits for the first time since July.

Ethereum validator entry outpaces exits amid institutional accumulation

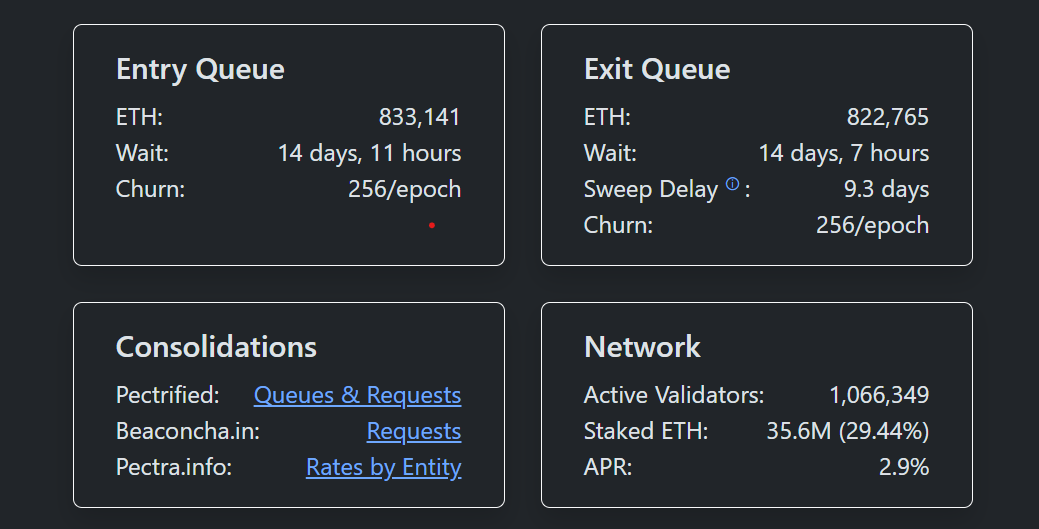

Ethereum validator entry queue has surpassed validator exits on Thursday, the first time since July, according to data from Validatorqueue.com.

The validator queue manages the rate at which validators join and leave the network, preventing disruptions from rapid staking or unstaking activities.

The entry queue, which represents the total amount of coins waiting to be activated for staking, reached a two-year high of 860,300 ETH on Tuesday. At the same time, the exit queue, which manages the unstaking rate, has declined from an all-time high of 1.05 million ETH on August 29 to 822,700 ETH as of Thursday.

Ethereum Validator Queue. Source: Validatorqueue.com

The flip has alleviated fears of a potential sell-off, stemming from the large number of coins that had earlier lined up for unstaking last month. This aligns with predictions from analysts that the August surge in validator exits was largely prompted by investors rebalancing their liquid staking and lending portfolios rather than preparing for profit-taking.

Staking protocol Everstake highlighted in an X post that the growth in validator entry was spurred by an increase in network confidence and rising institutional interest in ETH.

Several Ethereum treasury companies have expanded their ETH holdings over the past weeks, increasing their collective balance to 3.60 million ETH, according to data from the Strategic ETH Reserve website.

The leading ETH treasury, BitMine Immersion Technologies (BMNR), bought over 80,000 ETH from Galaxy Digital via an over-the-counter (OTC) on-chain transfer in the past few days, according to Arkham data cited by smart wallet tracker EmberCN.

SharpLink Gaming (SBET) also announced a purchase of about 39,500 ETH on Tuesday.

Ethereum Price Forecast: ETH resumes battle at key ascending trendline

Ethereum saw $80.9 million in futures liquidations over the past 24 hours, comprising $68.6 million and $12.3 million in long and short liquidations, according to Coinglass data.

Following a rejection at the resistance near $4,500, ETH has breached an ascending trendline support that extends from June 22. The top altcoin could find support near the $4,100 level, which is strengthened by the 50-day Simple Moving Average (SMA).

ETH/USDT daily chart

A bounce off $4,100 could see ETH retackle the $4,500 resistance. However, a decline below could push ETH toward $3,500.

The Relative Strength Index (RSI) is testing its neutral level after failing to cross above its moving average, while the Stochastic Oscillator (Stoch) has declined into its oversold region, indicating a dominance in bearish momentum.