Two meme coins to watch as Bitcoin trades sideways

- Bitcoin remains range-bound, with support above $107,000 and resistance at $112,500.

- MemeCore surges over 38% to $1.32, shrugging off risk-off sentiment driven by macro uncertainty.

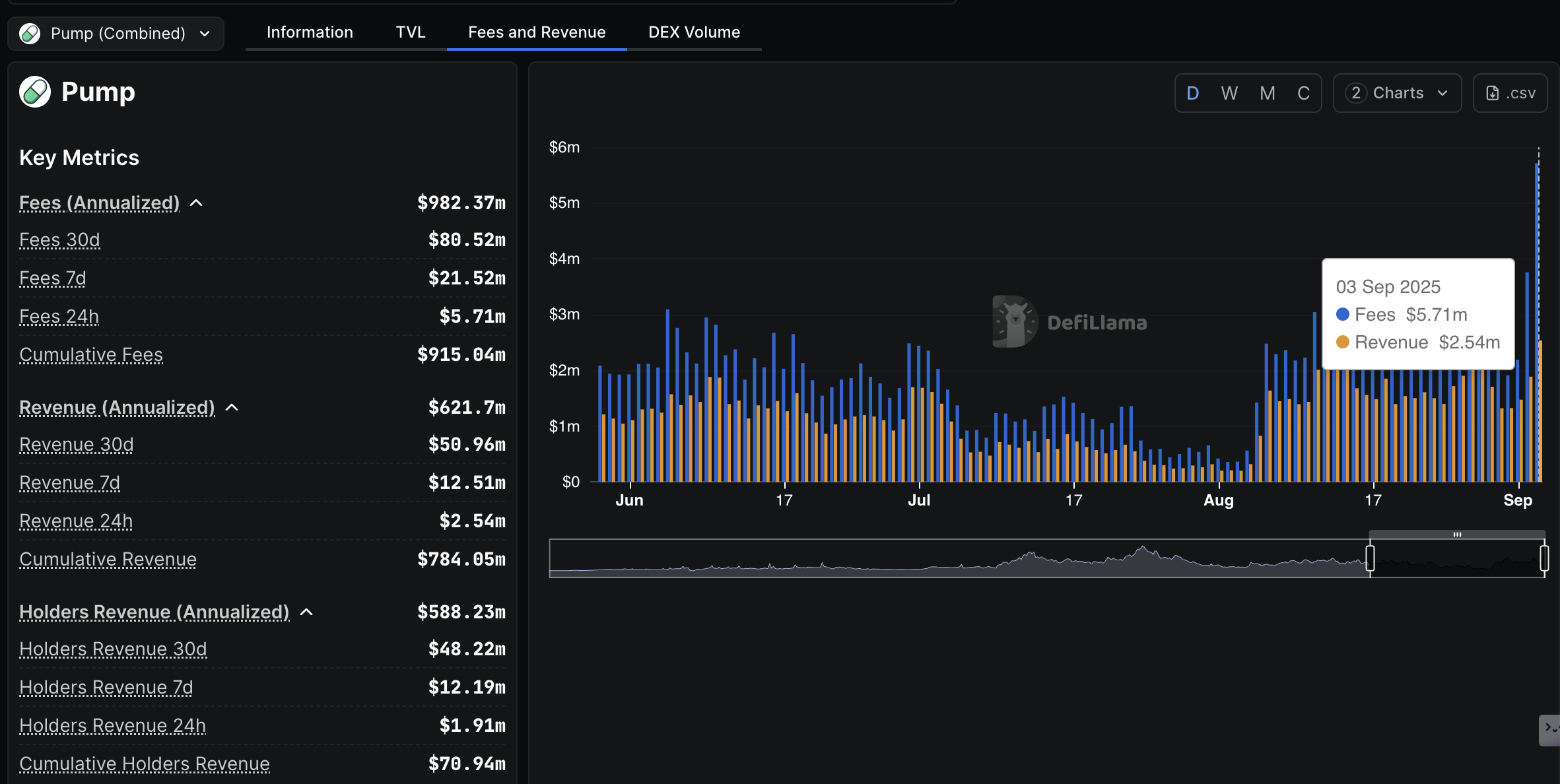

- Pump.fun breaks out, backed by multiple buy signals, as platform revenue skyrockets to $2.54 million.

Bitcoin (BTC) remains in a sideways trading pattern, extending between support above $107,000 and mid-week resistance at around $112,500. Risk-on sentiment has kept the majority of investors on the sidelines ahead of the United States (US) Federal Reserve’s (Fed) September interest rate decision.

The central bank's direction of monetary policy would help shape sentiment for risk asset classes such as crypto and equities.

Meanwhile, investor interest is shifting to select meme coins, including MemCore (M) and Pump.fun (PUMP). Investors could seek refuge in these tokens during the current risk-off sentiment if Meme Core and PUMP sustain their rallies in the coming days.

Bitcoin risks further decline

Bitcoin holds marginally below $110,000, down over 1.5% on Thursday. Short-term indicators suggest that the downtrend may extend toward the support level slightly above $107,000, which was tested on Monday and Tuesday.

The Moving Average Convergence Divergence (MACD) indicator has confirmed a sell signal on the 4-hour chart, encouraging risk-off sentiment. The sharp decline in the Relative Strength Index (RSI) suggests that bullish momentum is fading as selling pressure intensifies.

BTC/USDT 4-hour chart

MemeCore rallies as crypto majors wobble

MemeCore is among the best-performing cryptocurrencies on Thursday, up over 38% to exchange hands at $1.37. Interest in the token began in late August after it struck a local bottom at around $0.36.

The path of least resistance is upward, underpinned by a maintained MACD buy signal since Friday. Although the Relative Strength Index (RSI) is extremely overbought at 84, the sharp move up reflects immense buying pressure.

Still, traders should remain cautious in the event of a trend correction, possibly due to aggressive profit-taking, considering the dominant risk-off in the broader cryptocurrency market.

M/USDT 4-hour chart

Pump.fun surges as app revenue skyrockets

Pump.fun price is trading at $0.0043, up over 7% at the time of writing on Thursday. The token, native to the meme coin launchpad, exhibits a solid bullish outlook, supported by growing platform revenues and multiple buy signals in the 4-hour timeframe.

If the MACD indicator maintains the buy signal, more investors will buy PUMP, increasing the likelihood of a strong rally despite the broader crypto market being suppressed by risk-off sentiment driven by macroeconomic uncertainty.

PUMP/USDT 4-hour chart

Profit-taking is an overhanging risk traders must consider when trading PUMP following the breakout. The RSI at 73 indicates overbought conditions, which are often a precursor to price correction.

Pump.fun platform revenue has skyrocketed over the last few days following months of low activity in the meme coin sector. The meme coin launchpad generated a daily revenue of $2.54 million, up from approximately $206,000 on August 1.

Pump.fun revenue | Source: DefiLlama

The surge in revenue could benefit PUMP as the network directs most of the funds toward token buybacks. Reducing the circulating while demand increases has the potential to trigger strong rallies in PUMP.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.