Arbitrum Price Forecast: ARB pares losses as network rolls out $40 million DeFi incentive

- Arbitrum gains bullish momentum, increasing the chances of a 16% breakout to $0.58 resistance.

- Arbitrum launches a $40 million DeFi incentive program to reward targeted user actions.

- The DeFi program is designed to span four seasons, starting with lending markets.

Arbitrum (ARB) price is poised for a breakout, trading above $0.50 on Wednesday. Renewed investor optimism in the broader cryptocurrency market and the launch of a Decentralized Finance (DeFi) incentive program, back ARB’s short-term bullish outlook.

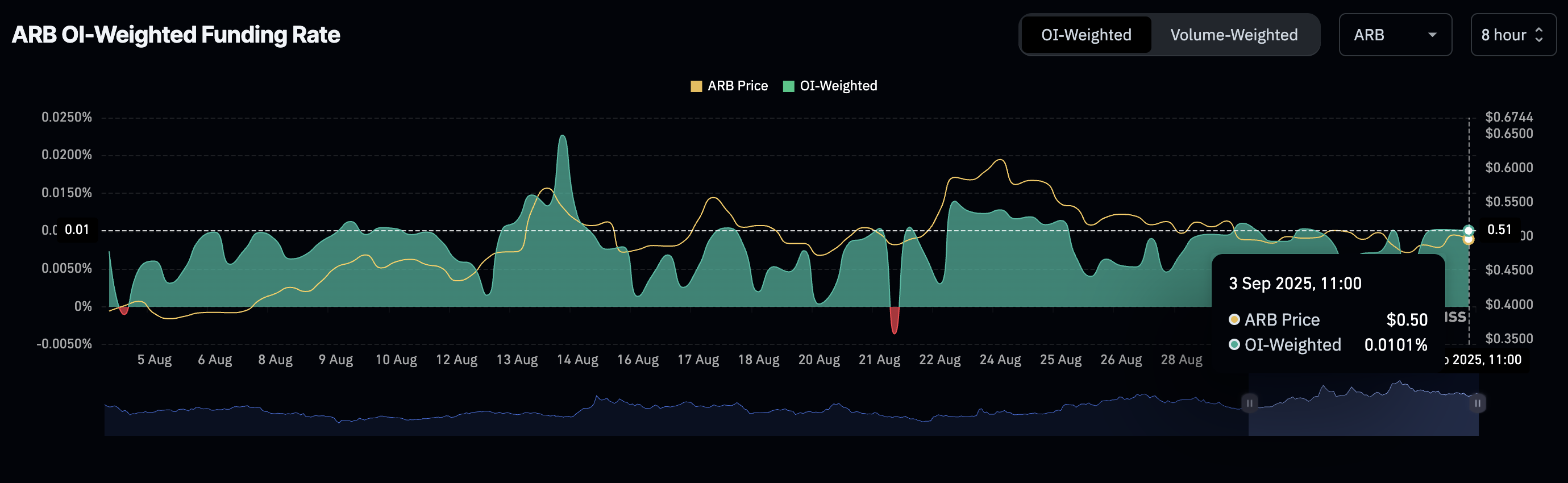

The ARB futures Weighted Funding Rate has stabilized at around 0.0101%, recovering from the 0.0003% level seen on Tuesday and affirming the bullish grip. A steady increase in this metric would imply that traders are increasingly leveraging long positions in ARB.

ARB Futures Weighted Funding Rate | Source: CoinGlass

Arbitrum debuts $40 million DeFi incentive program

Arbitrum has launched the DeFi Renaissance Incentive Program (DRIP) in collaboration with Entropy, a Decentralized Autonomous Organisation (DAO) on the network. The incentive program is powered by Merkl, a platform that empowers protocols to augment user engagement and accelerate growth.

Entropy will oversee the 80 million ARB in user incentives valued at $40 million. DRIP has been designed to span four seasons, targeting specific sector verticals at any given time.

Lending markets will kick start the first season, with a special focus on the growth of leverage looping on Arbitrum One. Users will be able to earn ARB tokens by borrowing against a specified list of yield-bearing Ethereum (ETH) and stable assets across participating lending protocols.

“By rewarding borrow demand across multiple lending markets and assets, the program aims to funnel organic liquidity to Arbitrum and bolster its position as the leading DeFi blockchain,” Arbitrum highlighted in a blog post.

Avalanche (AAVE), MORPHO, FLUID, EULER, DOLOMITE and SILO are some of the lending markets participating in DRIP’s season one. Collateral assets include EtherFi, Lido, Renzo, Kelp, GMX, Spark, Ethena, Maple, Resolv, USDai and Theo.

Users can claim rewards at the end of every two-week epoch. Users will have three months to claim the rewards after the first season concludes.

Technical outlook: Arbitrum bulls regain control

Arbitrum price holds above a confluence established by the 50-period Exponential Moving Average (EMA) and the 100-period EMA at $0.50 on the 4-hour chart.

The short-term bullish outlook is supported by a sustained buy signal from the Moving Average Convergence Divergence (MACD) since Tuesday. Bullish momentum is poised to accelerate as the green histogram bars expand above the mean line.

Based on the Relative Strength Index (RSI) position at 57 and rising toward overbought territory, buying pressure is increasing. Higher RSI readings would affirm the bullish outlook, increasing the chances of a 16% breakout to the resistance at $0.58.

ARB/USDT 4-hour chart

Still, traders should exercise caution, as investors may move quickly to take profits, contributing to selling pressure. In the event of a reversal below the confluence support at $0.50, declines could accelerate toward $0.46, a level that was tested on Monday.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.