Crypto Gainers: Bitget jumps on Morph Chain deal, Ondo and Fartcoin extend recovery

- Bitget Token records double-digit gains amid Morph Chain partnership and $1 billion token burn.

- Ondo bounces off a crucial Fibonacci retracement support level, with bulls eyeing further gains.

- Fartcoin recovery prepares for a potential falling wedge pattern breakout.

Bitget Token (BGB), Ondo (ONDO), and Fartcoin (FARTCOIN) have emerged as top-performing tokens over the last 24 hours, achieving double-digit gains. The recovery run in these tokens prepares for a new bullish start as capital rotation from top altcoins searches for fundamentally firm alternatives.

Bitget eyes further gains amid treasury transfer, token burn

Bitget team has announced the transfer of its 440 million ($2.27 billion) BGB token holdings to Morph Chain in a strategic partnership. The Morph Chain will immediately burn half of the assets to induce token scarcity, building on the 30 million tokens burned in Q2 2025.

The rest of the tokens will be released gradually at a 2% per month rate to support liquidity incentives, use case expansion, and other services.

In response to the treasury transfer and token burn, the BGB token surged over 10% on Tuesday. At the time of writing, the exchange token has gained nearly 1% on Wednesday, extending the uptrend for the third consecutive day.

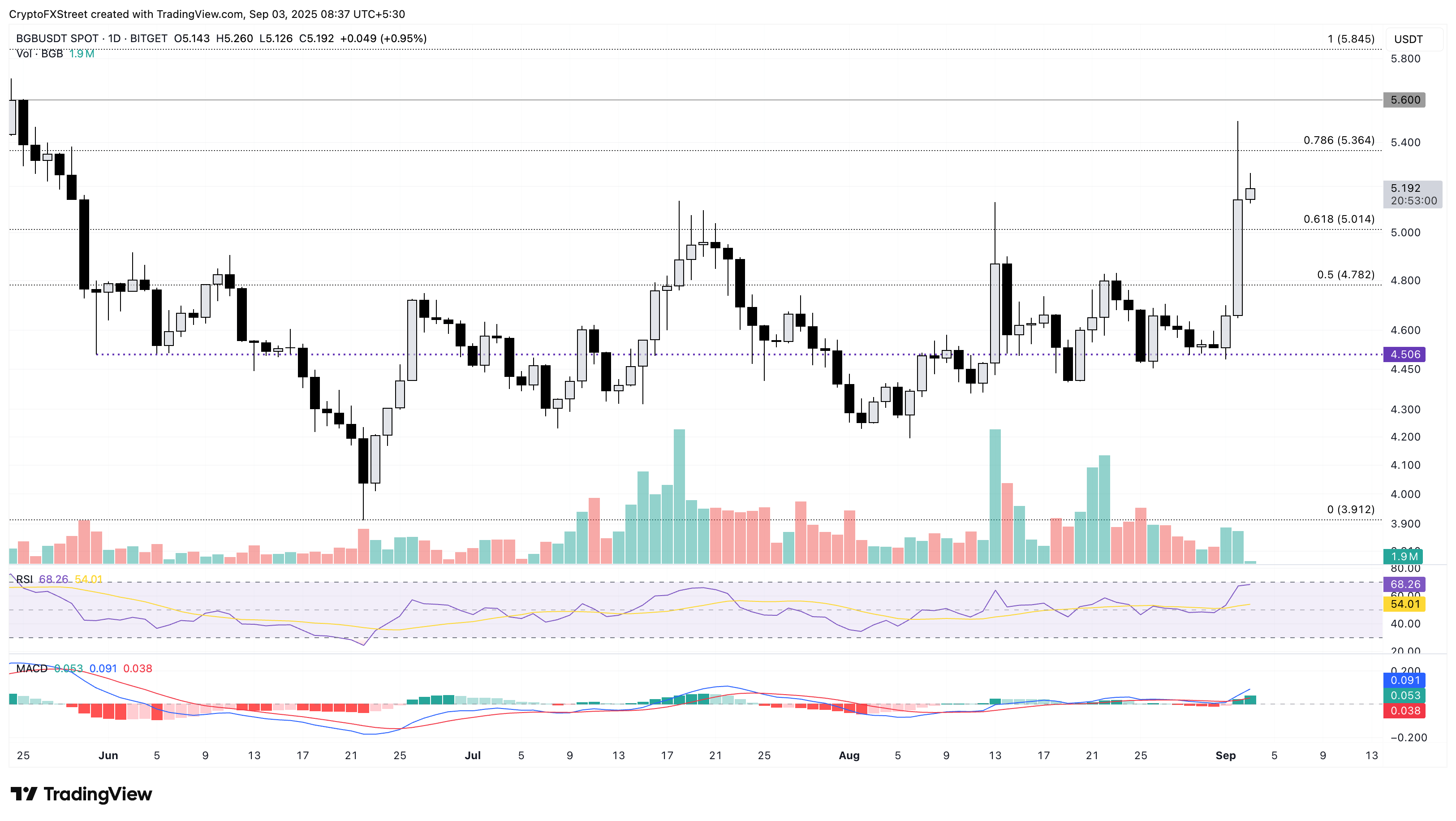

The BGB recovery run targets the 78.6% Fibonacci level at $5.36, which is drawn from the $5.84 peak of May 23 to the $3.91 low of June 22. If BGB marks a decisive close above this level, it could rally to the $5.84 peak.

The uptrending Moving Average Convergence Divergence (MACD) and its signal line, after the crossover on Monday, marked a bullish shift in trend momentum. Additionally, the Relative Strength Index (RSI) is at 68, moving flat near the overbought boundary, suggesting heightened buying pressure nearing the saturation levels.

BGB/USDT daily price chart.

Looking down, a potential reversal below the 61.8% Fibonacci level at $5.01 could extend the decline to $4.78, aligning with the 50% retracement level.

Ondo recovers with the RWAs' expansion

Ondo Finance announced the debut of over 100 tokenized stocks and Exchange Traded Funds (ETFs), as previously reported by FXStreet. Ondo edges higher by over 2% at press time on Wednesday, extending the 7% rise on Tuesday, driven by the expanding Real World Asset (RWA) tokenization by Ondo on the Ethereum network.

The bounce back in ONDO from the 23.6% Fibonacci level at $0.87, which is drawn from the $1.60 high of December 15 to $0.67 low of June 22, targets the 38.2% Fibonacci level at $1.02.

The MACD reverses to converge with its signal line, indicating that the trend momentum is turning bullish. Additionally, the RSI at 52 has crossed above the halfway line, suggesting upside potential for further growth.

ONDO/USDT daily price chart.

Looking down, if ONDO fails to uphold the newfound momentum, it could retest the $0.87 support floor.

Fartcoin eyes further gains with wedge pattern breakout

Fartcoin trades in the green by 0.50% at press time on Wednesday, following the 10% jump from the previous day. The meme coin’s recovery marks an upcycle within a falling wedge pattern on the daily chart.

A potential close above the trendline at $0.85 could target the $1.00 psychological milestone.

The MACD prepares for a crossover above its signal line, which would trigger a buy signal as bullish momentum revives. Still, the RSI is at 43, inching closer to the halfway line to overcome the bearish influence.

FARTCOIN/USDT daily price chart.

Looking down, if FARTCOIN marks a close below the previous week’s low at $0.683, it would invalidate the wedge pattern, potentially targeting the $0.57 support level.