Ripple Price Forecast: On-chain metrics signal bullish breakout as XRP holds $3

- XRP is positioned above the 50-period EMA and the $3.00 short-term support level.

- The Spent Output Profit Ratio remains above 1, indicating XRP supply is still in profit, but investors are reluctant to sell.

- XRP’s Net Unrealized Profit/Loss grinds toward 0.50, signaling a potential local bottom.

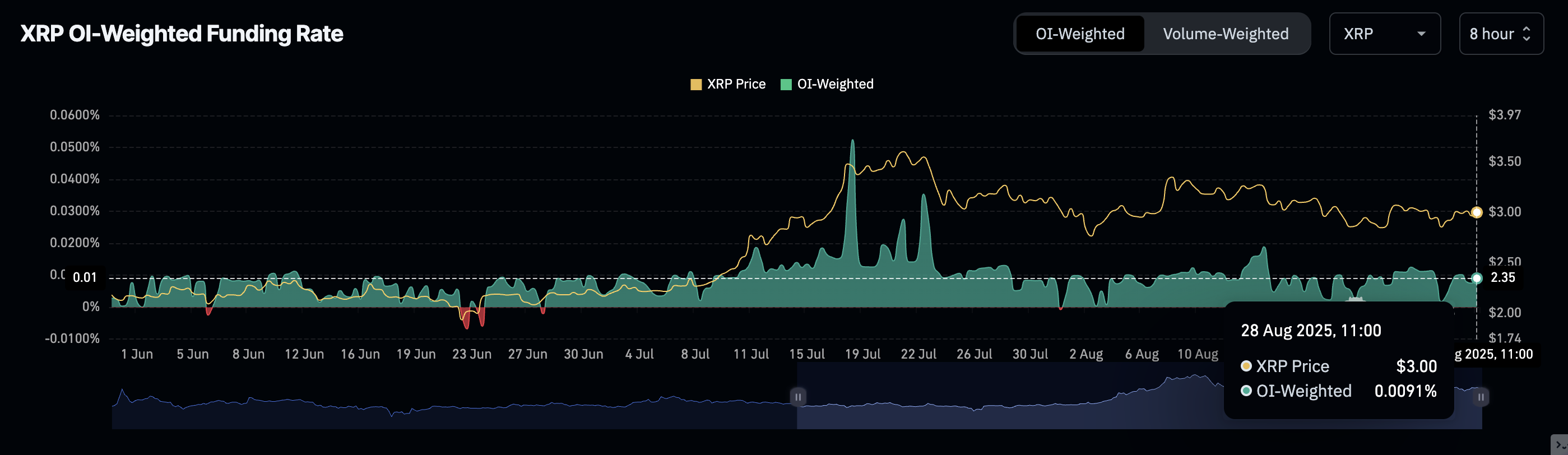

Ripple (XRP) shows signs of recovery, holding support at $3.00 on Thursday. Interest in the cross-border money remittance token has steadied over the past few days, underpinned by the futures weighted funding rate rising to 0.0090% from 0.0018% recorded on Tuesday.

As traders increasingly leverage long positions in XRP, the growth in funding rate will continue to back positive market sentiment, increasing the probability of a short-term bullish breakout.

XRP Futures Weighted Funding Rate | Source: CoinGlass

XRP consolidates as on-chain metrics signal breakout

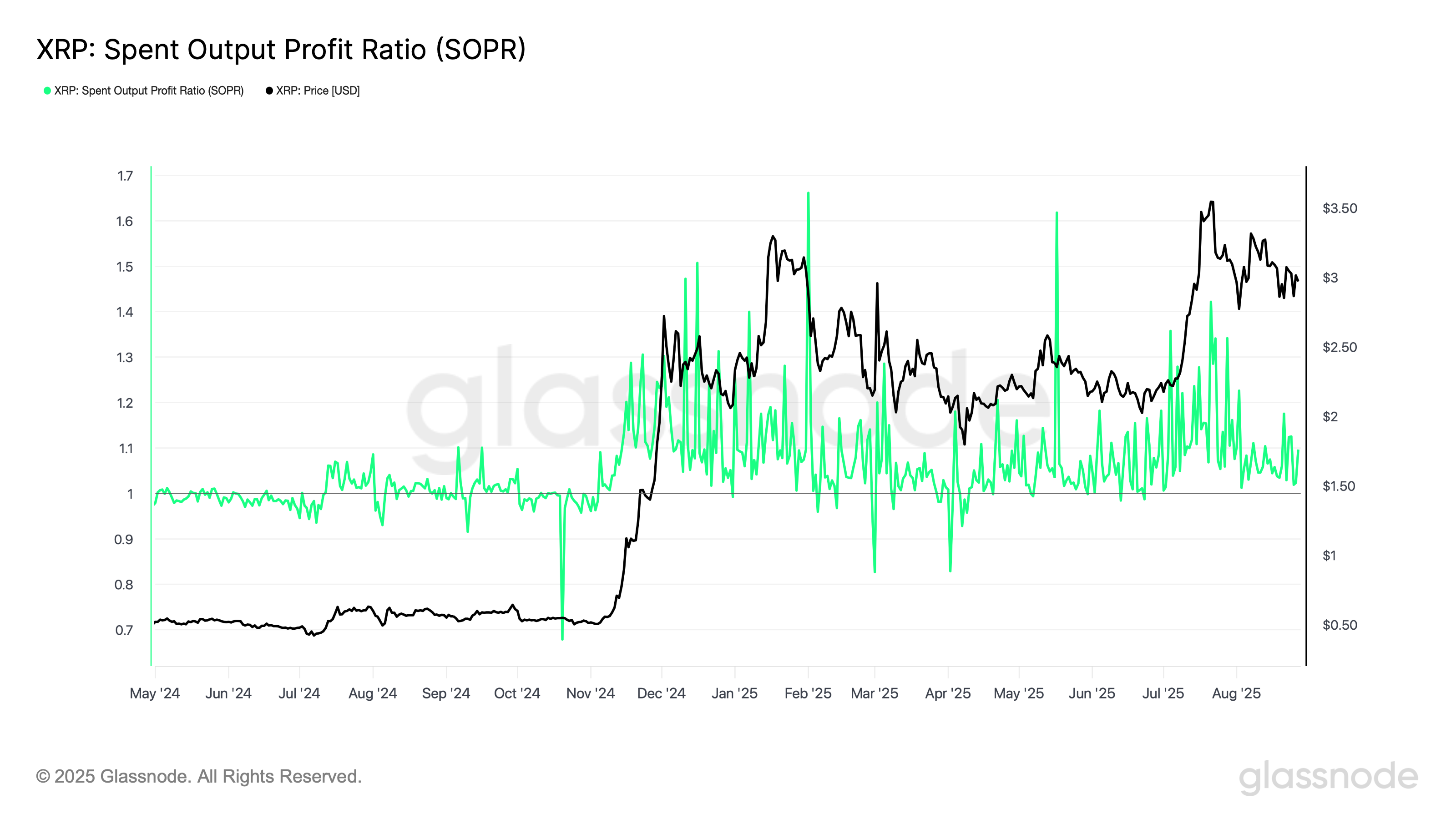

The XRP Spent Output Profit Ratio (SOPR) metric has, over the last few weeks, edged lower toward a ratio of 1, following rampant profit-taking after the price hit a new record high of $3.66 on July 18.

According to Glassnode, SOPR is “the realized value (USD) divided by the value at creation (USD) of the output.” Simply put, this metric highlights the value of the price sold divided by the price paid.

When the SOPR is above 1, it means that holders of the spent XRP tokens are in profit at the time of the transaction and in loss when the metric is less than 1.

Investors are often inclined to sell when in profit and would prefer to hold when the SOPR is below 1. Based on the current SOPR of 1.09, investors are reluctant to sell, possibly anticipating XRP price recovery above the $3.00 short-term support.

XRP SOPR metric | Source: Glassnode

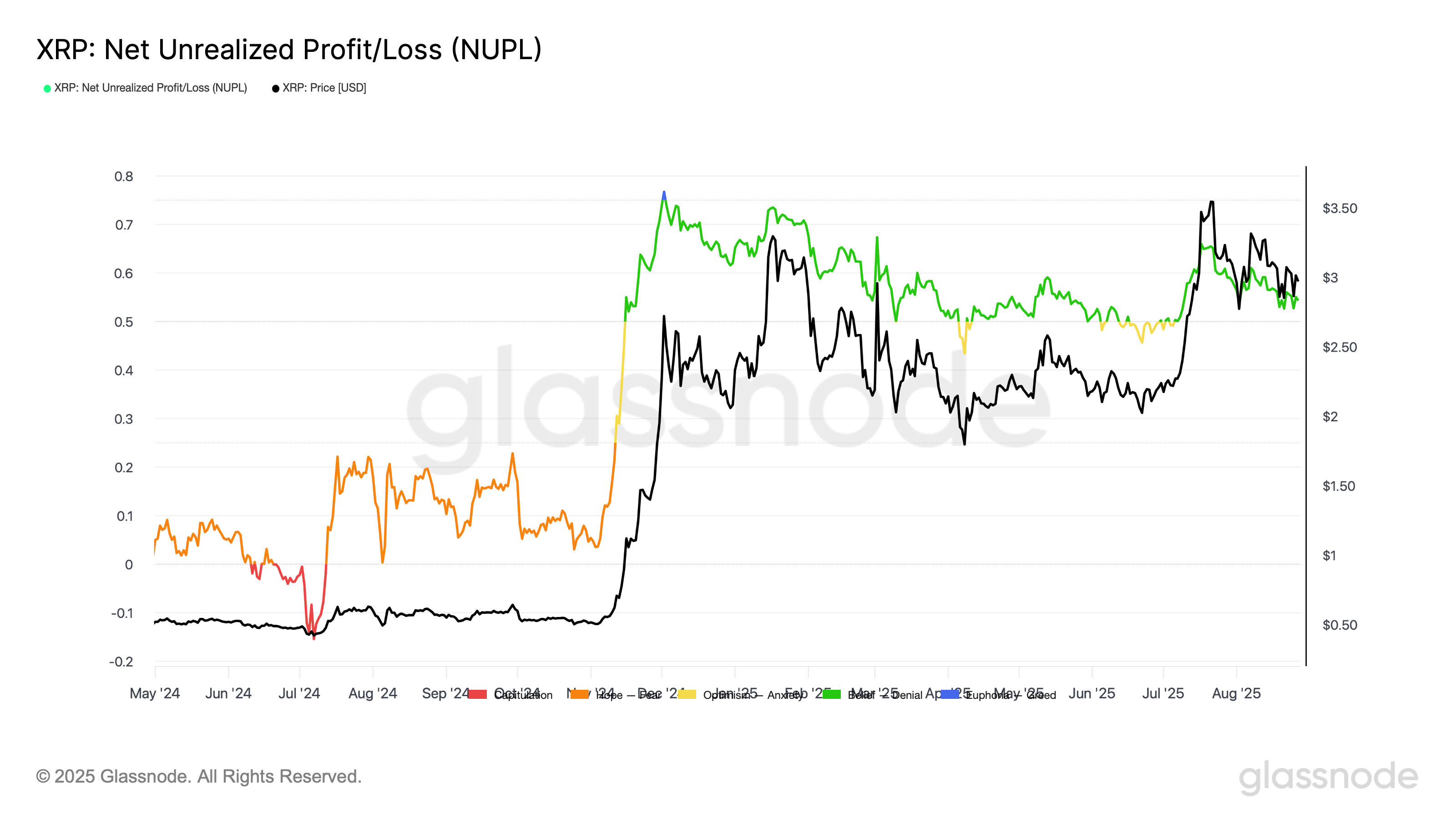

Similarly, the Net Unrealized Profit/Loss (NUPL) stands at 0.54 and is grinding toward the critical 0.50 level. NUPL is the supply of XRP that is in profit or loss at any given time and to what extent.

An NUPL reading near 0.5 indicates a potential local bottom within the cycle. Investors will likely take advantage of the cooling in the XRP price from its all-time high to increase exposure, anticipating a short-term bullish breakout.

XRP NUPL metric | Source: Glassnode

Technical outlook: XRP bulls target 12% breakout

XRP price is trading around $3.00, extending its consolidation ahead of a potential breakout. The 50-period Exponential Moving Average (EMA) provides support at $2.95 on the 4-hour chart, backing the short-term bullish sentiment.

The Relative Strength Index (RSI), currently sideways below the midline at 48, signals market indecision. Traders will look at the RSI’s return above the midline to assess the uptrend’s strength.

However, with the Moving Average Convergence Divergence (MACD) indicator also sideways below the mean line, the push and pull between the bulls and the bears could last longer than expected.

XRP/USDT 4-hour chart

As for the anticipated breakout, traders will look for the blue MACD line to cross above the red signal line, reinforcing the bullish grip. Key areas of interest for traders are the next resistance at $3.35, which was tested on August 15 and the 100-period EMA at $2.76 in the event market dynamics shift and XRP accelerates the decline below the 50-period EMA at $2.95.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.