Ripple Price Forecast: XRP whales accumulate as network growth concerns persist

- XRP rebounds above $2.90 on improving sentiment and rising demand.

- Wallets holding between 1 million and 10 million coins reflect a risk-on sentiment, increasing exposure.

- Muted network growth and low funding rates suggest a lack of conviction in XRP’s recovery.

Ripple (XRP) is edging higher above support at $2.90 on Tuesday following a widespread sell-off in the broader crypto market, which saw Bitcoin (BTC) reach an intraday low of $108,666.

Cryptocurrencies “faced a slow bleed throughout most of the previous week, apart from a short-lived rip higher following Jerome Powell’s Jackson Hole comments hinting at possible September rate cuts citing labor market risks and inflation pressures while shifting toward a more flexible, data-driven framework,” K33 Researchers said in a market report.

The cross-border money remittance token is poised to break out above the $3.00 pivotal level, potentially prompting bulls to double down on their influence and push XRP toward its record high of $3.66, reached on July 18.

XRP whales buy the dip

Large volumes of XRP have remained largely unaffected by recent price fluctuations, increasing their exposure. According to Santiment’s data, addresses holding between 1 million and 10 million XRP now account for approximately 10.6% of the total supply, up from 9.8% in early July and 9.14% in early March.

If whales continue buying the dip, demand could eventually outstrip supply, enabling bulls to carve out a recovery path above the near-term $3.00 resistance. A risk-on sentiment may strengthen in the coming weeks, supported by potential interest rate cuts in September.

[17-1756222204269-1756222204270.12.06, 26 Aug, 2025].png)

XRP Supply Distribution | Source: Santiment

Despite the steady demand from select whale cohorts, a muted network growth could suppress the XRP price recovery in the coming days and weeks. Santiment’s on-chain data highlights a sharp drop to approximately 4,400 newly created addresses. Network growth represents the rate of the protocol’s adoption. Sharp or steady declines indicate a reduction in interest in XRP, which could lead to price stagnation or extend the decline.

[17-1756222217886-1756222217887.17.51, 26 Aug, 2025].png)

XRP Network Growth | Source | Santiment

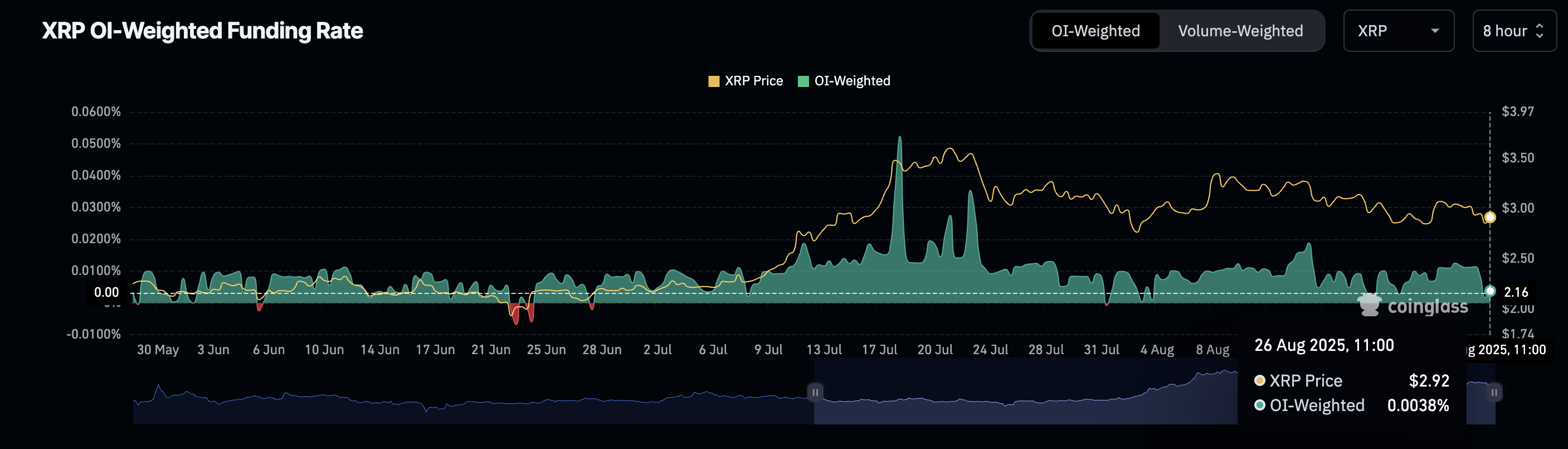

The demand for leverage long positions has decreased amid the price decline, as evidenced by the futures weighted funding rate holding near the mean line. CoinGlass data shows the funding rate at 0.0038% down from the peak in July at 0.0524%. Low funding rates imply that fewer traders are leveraging long positions in XRP, reflecting a lack of conviction in short-term price increases.

XRP Futures Weighted Funding Rate | Source: CoinGlass

Technical Outlook: XRP bulls regain control

XRP price is extending its rebound above support at $2.90, backed by growing positive sentiment. A break is anticipated above the 50-day Exponential Moving Average (EMA) resistance at $2.94 as bulls look forward to breaching the pivotal $3.00 level.

The Relative Strength Index (RSI), which is rebounding toward the midline after declining to 42 in the bearish region, points to increasing demand for XRP.

Still, the Moving Average Convergence Divergence (MACD) indicator must offer a buy signal to affirm the bullish outlook. This signal will manifest with the blue MACD line crossing above the red signal line and the red histogram bars turning green above the mean line.

XRP/USDT daily chart

Key areas of interest for traders are the 50-day EMA resistance at $2.94 and the 100-day EMA support at $2.75. Price action on either side of this range could shape XRP’s direction in the short term. Beyond the crucial $3.00 level, bulls would expand their gaze to the all-time high of $3.66 and later launch XRP into price discovery.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.