Pump.fun Price Forecast: PUMP eyes breakout rally after posting four days of gains

- Pump.fun edges higher for the fifth consecutive day, eyeing a critical resistance breakout.

- A whale has opened a long position on PUMP of over $3 million, with nearly $160,000 in profits.

- The declining revenue of the meme token generation platform stabilizes below 1,300 SOL.

Pump.fun (PUMP) edges higher by over 3% at press time on Tuesday, extending the recovery for the fifth consecutive day. A whale has bet over $3 million on PUMP’s uptrend as it nears a breakout rally, underpinned by the stable revenue in the meme coin platform.

Whale bets big on PUMP as revenue stabilizes

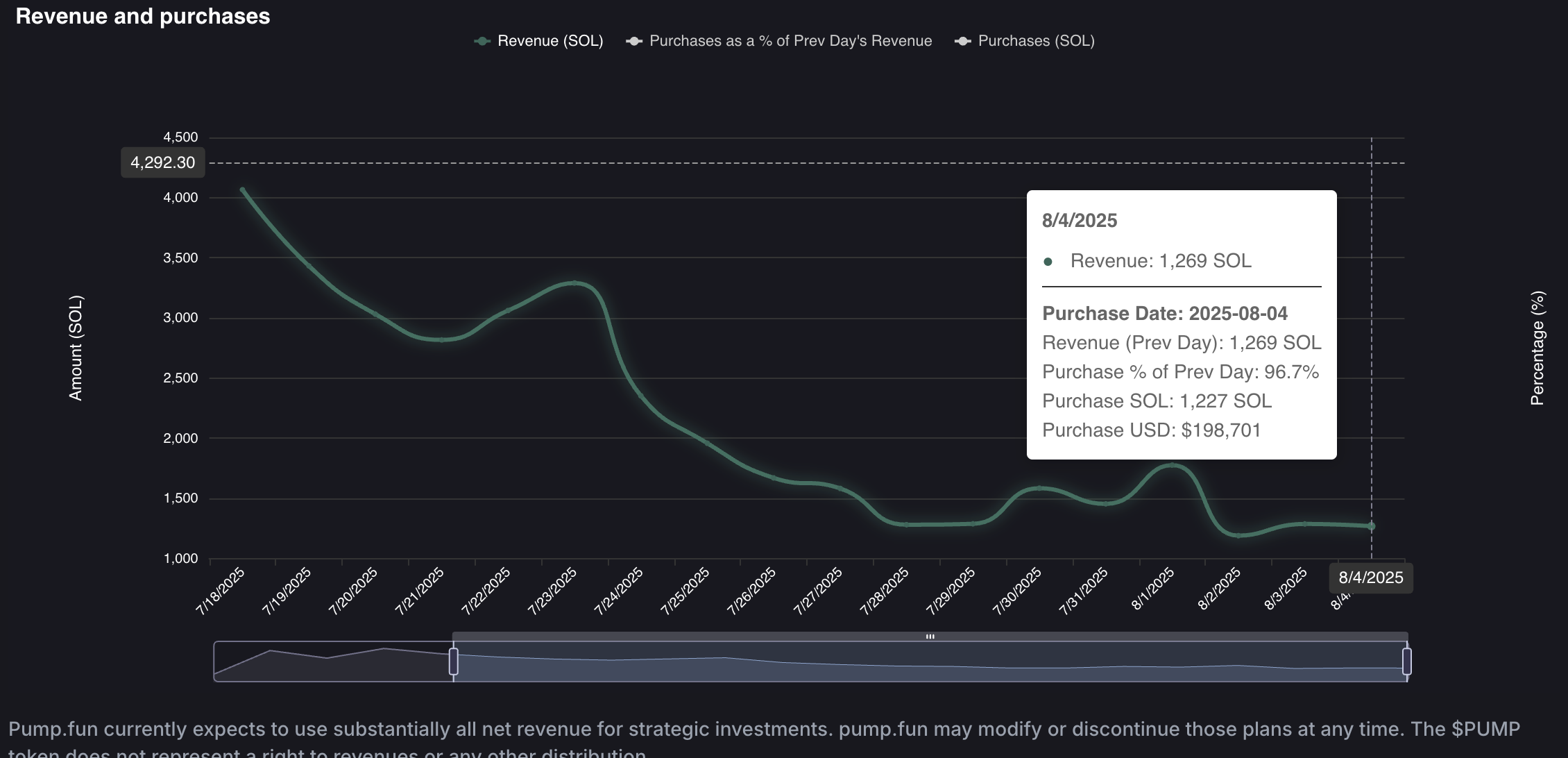

Pump. Fun’s revenue dashboard reflects a broadly stable revenue, as it moves flat at 1,269 SOL. Still, investors may consider the meme coin hype is fading, as revenue has tanked from the 5,091 SOL seen on July 17.

Pump.fun revenue. Source: fees.pump

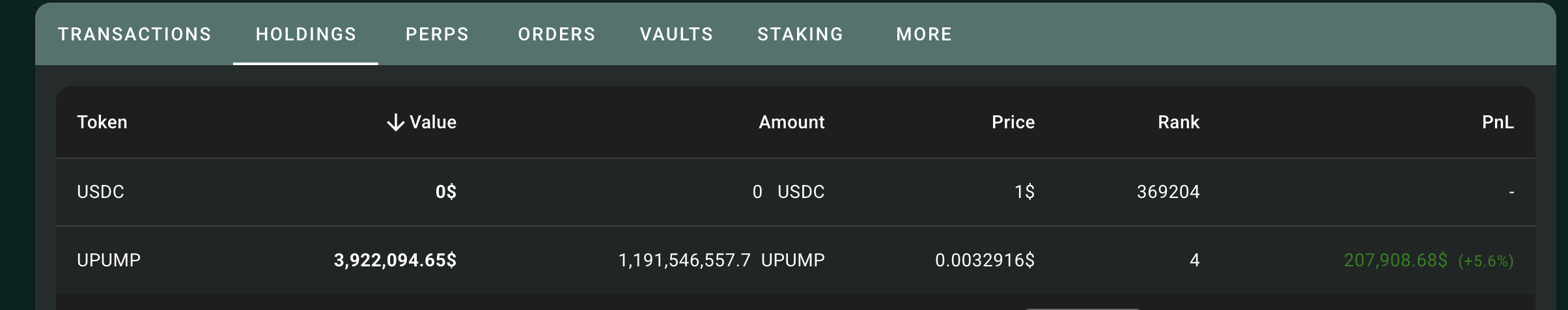

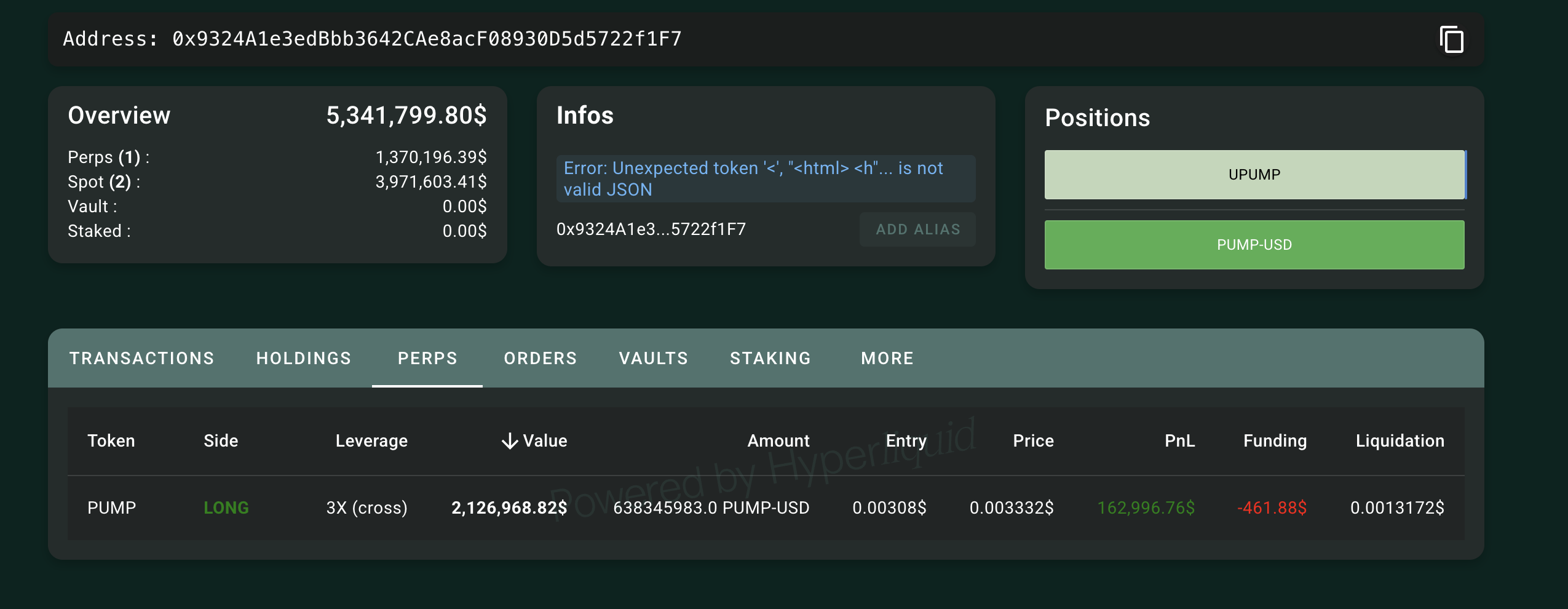

Despite the broadly stable revenue, a whale anticipating a reversal run has opened a long position of 594 million PUMP tokens leveraged by 3x on Hyperliquid, worth $1.83 million. The whale acquired 1.06 billion PUMP tokens from the spot market.

Whale holding. Source: HypurrScan

At present, the whale holds over $160,000 in profits.

Perp holding. Source: HypurrScan

PUMP eyes extended gains with range breakout

PUMP recovery run surpasses the $0.003260 resistance level on the 4-hour chart, last tested on Thursday, signaling a potential range breakout. Prices should mark a decisive candle close above this level to support the uptrend.

In such a case, the PUMP token price could test the $0.003776 level, which aligns with the low of July 19. That would represent a near 14% surge from current price levels.

Technical indicators maintain a bullish bias. The Relative Strength Index (RSI) reads 67 on the 4-hour chart, indicating heightened buying pressure.

The Moving Average Convergence Divergence (MACD) and its signal line sustain an uptrend above the zero line, suggesting rising bullish momentum.

PUMP/USDT daily price chart.

Looking down, a reversal under the $0.003260 level would nullify the breakout chances, potentially testing the $0.002262 support floor.