Gold falls as risk appetite grows on prospects of a EU-US trade deal

- Gold awaits key US data as traders weigh economic performance and Fed outlook.

- Improved risk sentiment on EU-US trade progress puts pressure on Gold.

- XAU/USD loses grip on breakout, $3,372 turns into resistance ahead of key data.

Gold is extending losses for a second straight session on Thursday, pressured by a shift toward risk-on sentiment and a firmer US Dollar.

At the time of writing, XAU/USD is hovering above $3,360, retreating from recent highs near $3,457 on renewed hopes of an EU-US trade deal ahead of the August 1 tariff deadline.

Improved risk sentiment on EU-US trade progress pressures Gold

Speaking at an AI summit on Wednesday, US President Donald Trump commented on tariffs and trade.

While Trump reiterated that countries would have a “simple tariff of anywhere between 15% and 50%,” he also stated that negotiations with the EU were “serious”.

But risk appetite improved when Trump announced that, “If they agree to open up the union to American businesses, then we will let them pay a lower tariff.”

German Chancellor Friedrich Merz also echoed optimism ahead of meetings with French President Emmanuel Macron in Brussels on Wednesday. Merz told reporters that, “We are hearing at this very moment that decisions may be forthcoming... We are meeting at a time that could not have been better.”

The remarks hint at a more strategic and structured approach to trade, which has boosted investor optimism about the possibility of a deal.

However, the European Union is still negotiating for key concessions, reportedly pushing for a baseline tariff of 15%. They are also seeking greater clarity on how sector-specific tariffs, such as those on pharmaceuticals, autos and semiconductors, would be applied.

These sectors are considered critical to the EU economy, and Brussels is seeking assurances that they won’t face disproportionate penalties under any new US tariff regime.

Gold daily digest market movers: Jobless Claims, PMIs, and Fed expectations

- Gold prices on Thursday may also react to a slate of fresh US economic data, which could influence interest rate expectations, Treasury yields, and the Gold Market.

- At 12:30 GMT, the weekly Initial and Continuing Jobless Claims figures will be released, offering insight into labor market conditions. This will be followed at 13:45 GMT by preliminary S&P Global Manufacturing and Services PMIs for July, key forward-looking indicators of business activity. Finally, at 14:00 GMT, New Home Sales data for June will provide an update on the US housing market and whether pressures from high mortgage rates continue to weigh on demand.

- Jobless claims have surprised to the downside in recent weeks, reinforcing expectations that the Federal Reserve (Fed) may keep interest rates elevated for longer. This trend supports US Treasury yields and the Greenback, both headwinds for non-yielding assets like Gold.

- This week, Initial Jobless Claims are expected at 227,000, slightly higher than the prior 221,000, potentially signaling early signs of labor market softness. However, confirmation through broader data would be needed to shift Fed expectations meaningfully.

- On the PMI front, Manufacturing is forecast to rise to 52.5 (from 52), while Services is seen at 53 (from 52.9), suggesting growing business confidence and economic momentum.

- The market is increasingly weighing the potential for a more stable global trade environment, which, coupled with resilient US economic data and the possibility of the Fed maintaining higher interest rates, may shift investor preference toward risk assets and US yields over Gold.

- Conversely, weaker-than-expected numbers may boost dovish sentiment, supporting bullion.

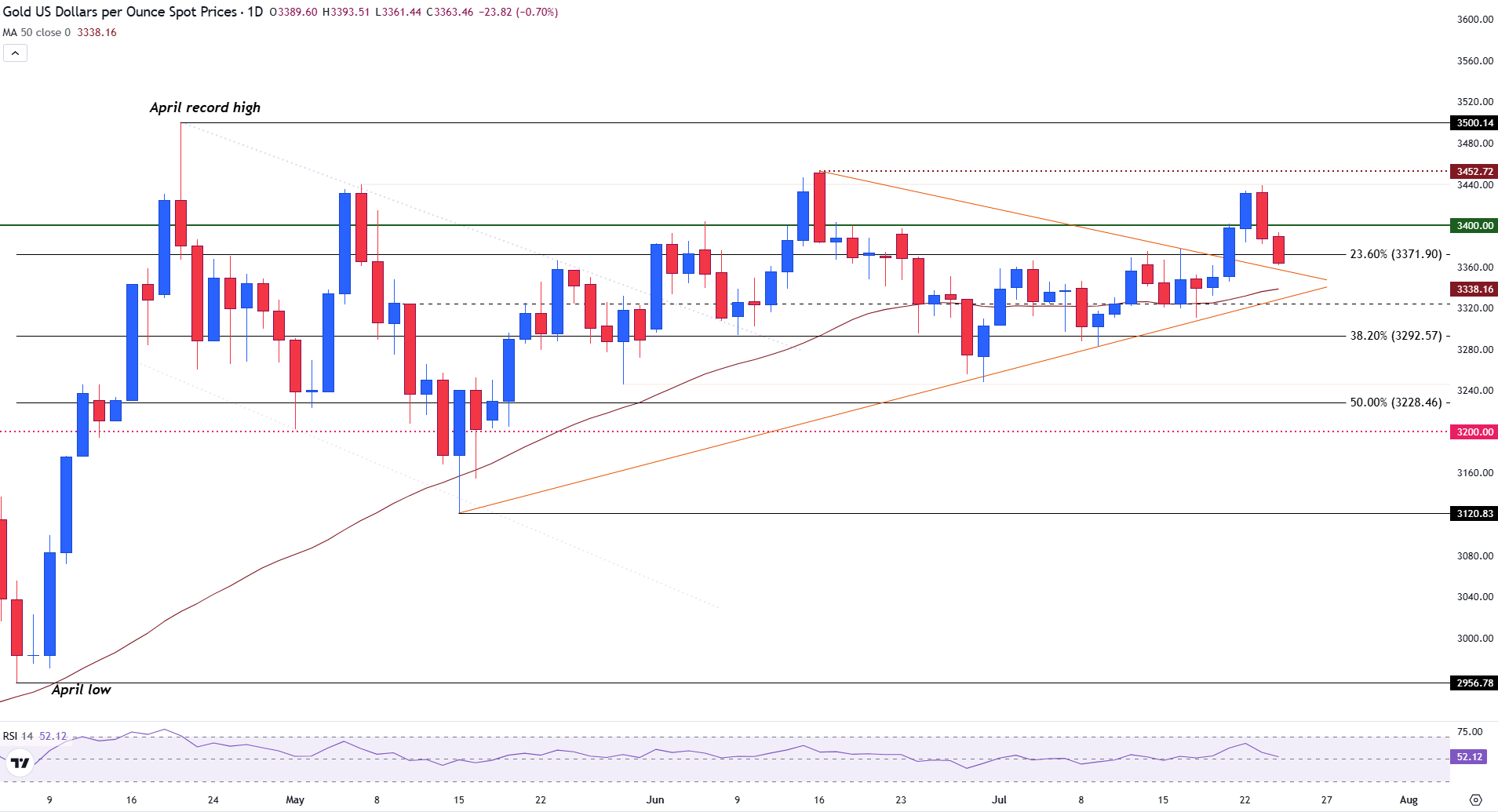

Gold technical analysis: XAU/USD loses grip on breakout, $3,372 turns into resistance ahead of key data

Gold (XAU/USD) is trading around $3,363, extending losses after failing to hold gains above the key $3,400 level. The recent move has pushed the price below the 23.6% Fibonacci retracement of the April low-to-high move, which currently provides resistance at $3,372.

This breakdown puts the spotlight on support at $3,338, where the 50-day Simple Moving Average (SMA) and prior triangle resistance intersect.

A sustained move below this level would weaken the bullish structure and open the door toward the 38.2% Fibonacci retracement at $3,292, followed by $3,228 (50% Fibo level), both marking deeper correction zones.

On the upside, bulls need to reclaim $3,372 to shift short-term momentum back toward $3,400 and then $3,457, the recent swing high. A close above those levels would revive prospects for a move toward the April record high near $3,500.

The Relative Strength Index (RSI) at 52 continues to signal neutral momentum, suggesting Gold is consolidating ahead of critical macro data.

Gold daily chart

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.