Gold surges as Iran strikes US bases, Israel intensifies Tehran assault

- XAU/USD climbs to $3,385 as Middle East conflict escalates.

- Iran fires missiles at US bases in Qatar, Kuwait, and Iraq; Israel bombs Evin prison in Tehran.

- Fed’s Bowman says she’s open to July rate cut if inflation remains contained.

- Dollar and yields slide, while traders shift focus to Powell’s testimony and PCE inflation data.

Gold prices remain bid during the North American session as breaking news revealed Iran’s attack on US bases in Qatar, in retaliation for the over-the-weekend attack on Iran's nuclear installations by the White House. Meanwhile, US economic data was overlooked mainly as geopolitical tensions in the Middle East intensified. At the time of writing, XAU/USD trades at $3,385, up 0.39%.

Macroeconomic data has been pushed aside as geopolitics grabs most headlines. Iran reported the launch of missiles at US bases in Qatar, Kuwait and Iraq, according to Al Arabiya, citing Israeli media. Alongside this, Iran retaliated, approving the closure of the Strait of Hormuz and launching missile strikes against Israel.

Meanwhile, Israel attacked Evin prison in northern Tehran, which, according to Reuters, “Israel called its most intense bombing yet of the Iranian capital a day after the United States joined the war.”

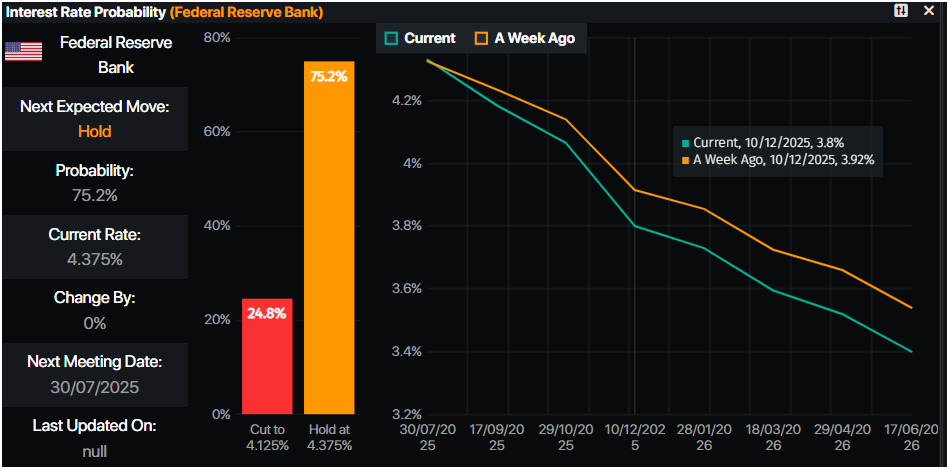

Bullion prices printed another leg up, as Federal Reserve (Fed) Governor Michelle Bowman added to the doves' chorus, saying that she’s open to reducing interest rates at the July Federal Open Market Committee (FOMC) meeting, if inflation pressures remained contained.

The US Dollar Index (DXY), which tracks the buck’s performance against a basket of six currencies, drops 0.25% to 98.52. US Treasury bond yields are also on the back foot, a tailwind for Gold prices.

On the data front, S&P Global revealed that manufacturing activity expanded above estimates but has stalled for the last two months. In the services sector, businesses remain growing at a healthy pace, though June’s print dipped compared to May figures.

The economic docket in the US will feature further Fed speakers, led by Fed Chair Jerome Powell's testimony at the US Congress on Tuesday. Traders would digest the latest Consumer Confidence figures, Durable Goods Orders, housing and jobs data, along with the release of the Fed’s preferred inflation gauge, the Core Personal Consumption Expenditures (PCE) Price Index.

Daily digest market movers: Gold price rally extends, as Iran retaliates over US bases

- On Saturday, the United States (US) delivered an attack to three of Iran’s nuclear facilities – Fordow, Natanz, and Isfahan. US President Donald Trump described the mission as “a very successful attack,” and warned that “there are many other targets” if Iran remains reluctant to peace talks.

- The US Operation Midnight Hammer involved B-2 Spirit bombers and Tomahawk missiles from US submarines.

- Recently, the US S&P Global Manufacturing PMI for June came in at 52, above expectations of 51 but unchanged compared to the previous reading. The Services PMI dipped from 53.7 to 53.1 in June, a tick above estimates of 52.9.

- The US 10-year Treasury note yield is down seven basis points (bps) at 4.306%. US real yields, which are inversely correlated with Gold prices, followed suit, down at 1.978%.

- The Fed's monetary policy report recently revealed that there are early signs that tariffs are contributing to higher inflation. However, their full impact has yet to be reflected in the data. The report added that the current policy is well-positioned and that financial stability is resilient amid high uncertainty.

- Money markets suggest that traders are pricing in 57.5 basis points of easing toward the end of the year, according to Prime Market Terminal data.

Source: Prime Market Terminal

XAU/USD technical outlook: Gold price climbs towards $3,400

Rising geopolitical tensions sparked an uptrend in Gold prices, with the yellow metal bouncing off daily lows beneath $3,350, but buyers failed to crack the $3,400 figure. However, the Relative Strength Index (RSI) favors dip buyers with the RSI remaining bullish.

For a bullish resumption, XAU/USD must clear $3,400. Once hurdled, the following key resistance levels, such as the $3,450 mark and the record high of $3,500, lie ahead.

Conversely, if Gold tumbles below $3,350, the pullback could extend toward the 50-day Simple Moving Average (SMA) at $3,315. Further losses are seen once cleared, at the April 3 high-turned-support at $3,167.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.