Hyperliquid Price Forecast: HYPE offers mixed technical signals amid steady futures open interest

- Hyperliquid stalls below $37.00 after sliding from an all-time high to $30.93.

- The MACD buy signal, combined with a down-trending RSI, could increase the probability of the decline extending below $30.00.

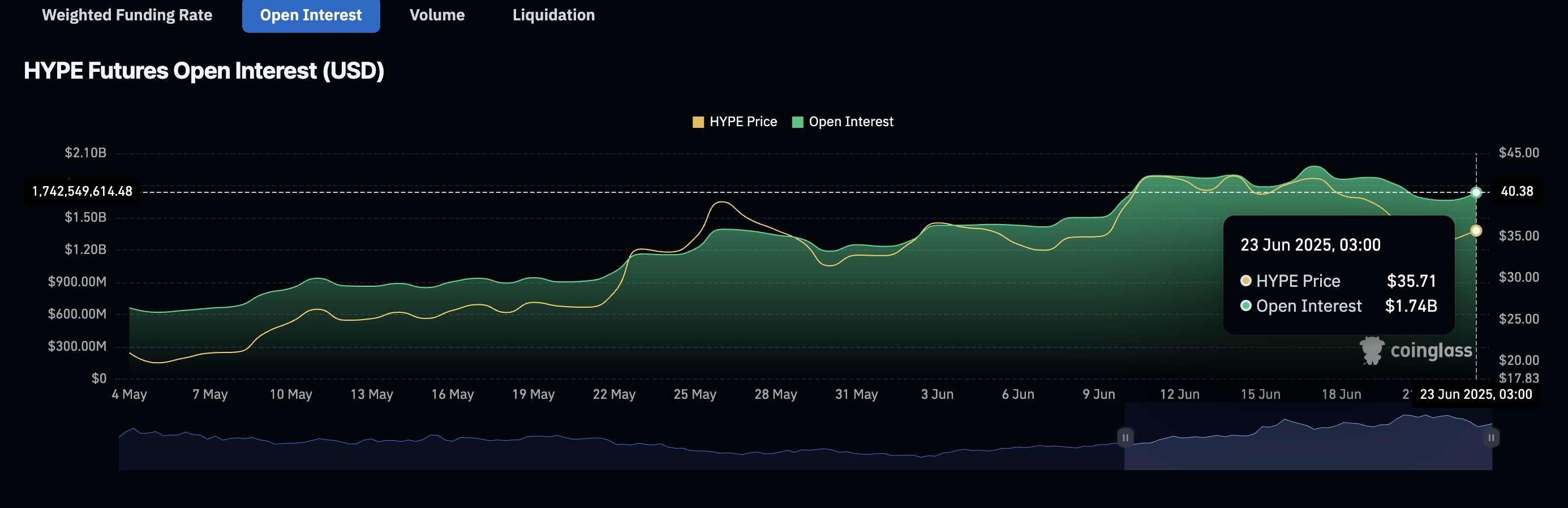

- Hyperliquid futures open interest remains steady at $1.74 billion despite surge in long position liquidations and a sharp price drop.

Hyperliquid (HYPE) has maintained a prolonged downtrend since reaching its new all-time high (ATH) of around $45.71. The Middle East tensions-triggered crash over the weekend extended HYPE’s pullback 32% below the ATH. Support at $30.00 proved helpful, providing liquidity for the upswing that tested resistance at $37.00 before correcting to trade around $34.15 at the time of writing.

Hyperliquid flaunts robust derivatives market

If tensions escalate or Iran retaliates to US strikes on its nuclear facilities, Hyperliquid’s price may fall further, primarily driven by risk-off sentiment.

“Although crypto is decentralized, it remains vulnerable to global instability. In times like this, we often see traders turning to stablecoins as a way to preserve capital,” Andrejs Balans, a risk manager at YouHodler, said in a statement to FXStreet.

However, Hyperliquid’s derivatives market remains interestingly stable despite the sharp increase in volatility. CoinGlass sheds light on HYPE futures contracts Open Interest (OI), which steadied to $174 billion on Monday, indicating rising interest in the token.

Hyperliquid futures Open Interest | Source: CoinGlass

The increase in volume, as liquidations surge to $1.96 million over the past 24 hours, is a bullish indication of a potential short squeeze recovery as traders buy HYPE to cover their positions. Moreover, short position liquidations at $1.55 million significantly surpassed long positions at approximately $413,000 over the past 24 hours. A long-to-short ratio of 1.0606 implies that traders have a higher risk appetite and are betting on Hyperliquid’s recovery.

Hyperliquid derivatives data | Source| CoinGlass

Technical outlook: Hyperliquid recovery falters

Hyperliquid’s price recovery is in jeopardy after facing rejection below the resistance level at $37.00. Key indicators continue to uphold a bearish bias, including the Moving Average Convergence Divergence (MACD) sell signal, which was confirmed on June 17.

The downward trend of the MACD indicator as it approaches the zero line (0.00) reinforces the tight bearish grip, with the Relative Strength Index (RSI) sliding below the midline, indicating increasing sell-side pressure.

HYPE/USDT daily chart

The 50-day Exponential Moving Average (EMA) at $32.77 could trigger a reversal. Still, traders should pay attention to the previously tested support at $30.00. Beyond this level, the 100-day EMA at $28.34 comes into play, with accelerated losses targeting the next key support level at $23.39, tested in mid-May.

The possibility of an immediate trend reversal above $40.00 cannot be ignored, particularly with HYPE futures open interest remaining elevated at around $1.74 billion. Steady interest in the token could boost demand for HYPE, potentially overshadowing sell-side pressure and paving the way for a significant price increase.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.