Gold Price Forecast: US Dollar weakness, renewed tariff threats, and safe-haven appeal lift Gold

- Gold prices jump on renewed US-China tensions.

- US Dollar weakness once again drives Gold gains.

- Gold prices add 2% at the time of writing, threatening trendline resistance.

Gold prices are trading positively on Monday, driven by market uncertainty and an increased demand for safe-haven assets.

Market sentiment has turned cautious due to a series of developments, including US President Donald Trump’s intention to double tariffs on steel and aluminium from 25% to 50%. The growing tariff threats and escalating trade tensions have posed a significant risk to risk assets, while a weaker US Dollar has been supportive of Gold prices.

Tensions between the US and China have also intensified, with Beijing pushing back against Trump's accusations that it violated a trade agreement reached in Geneva.

Gold daily digest: Trump tariffs, US-China trade wars come back in focus

- In his post on Truth Social on Friday, Trump stated:” China, perhaps not surprisingly to some, HAS TOTALLY VIOLATED ITS AGREEMENT WITH US. So much for being Mr. NICE GUY!”

- The Geneva deal had established a 90-day pause on escalating tariffs between the two nations, with the US reducing tariffs on Chinese goods from 145% to 30%, and China lowering tariffs from 125% to 10%. The agreement also included provisions for China to lift restrictions on the export of critical minerals essential to US industries.

- In response to Trump's accusations, China's Ministry of Commerce labelled them as "groundless" and asserted that the US had introduced several "discriminatory restrictive measures," including export control guidelines for AI chips, a sales ban on chip design software, and the revocation of Chinese student visas. China emphasized its commitment to safeguarding its legitimate rights and interests and vowed to take "resolute and forceful measures" if the US continued its actions.

- With the US Dollar under renewed pressure, increased demand for safe havens could see Gold prices continue to receive a positive boost from the shift in sentiment.

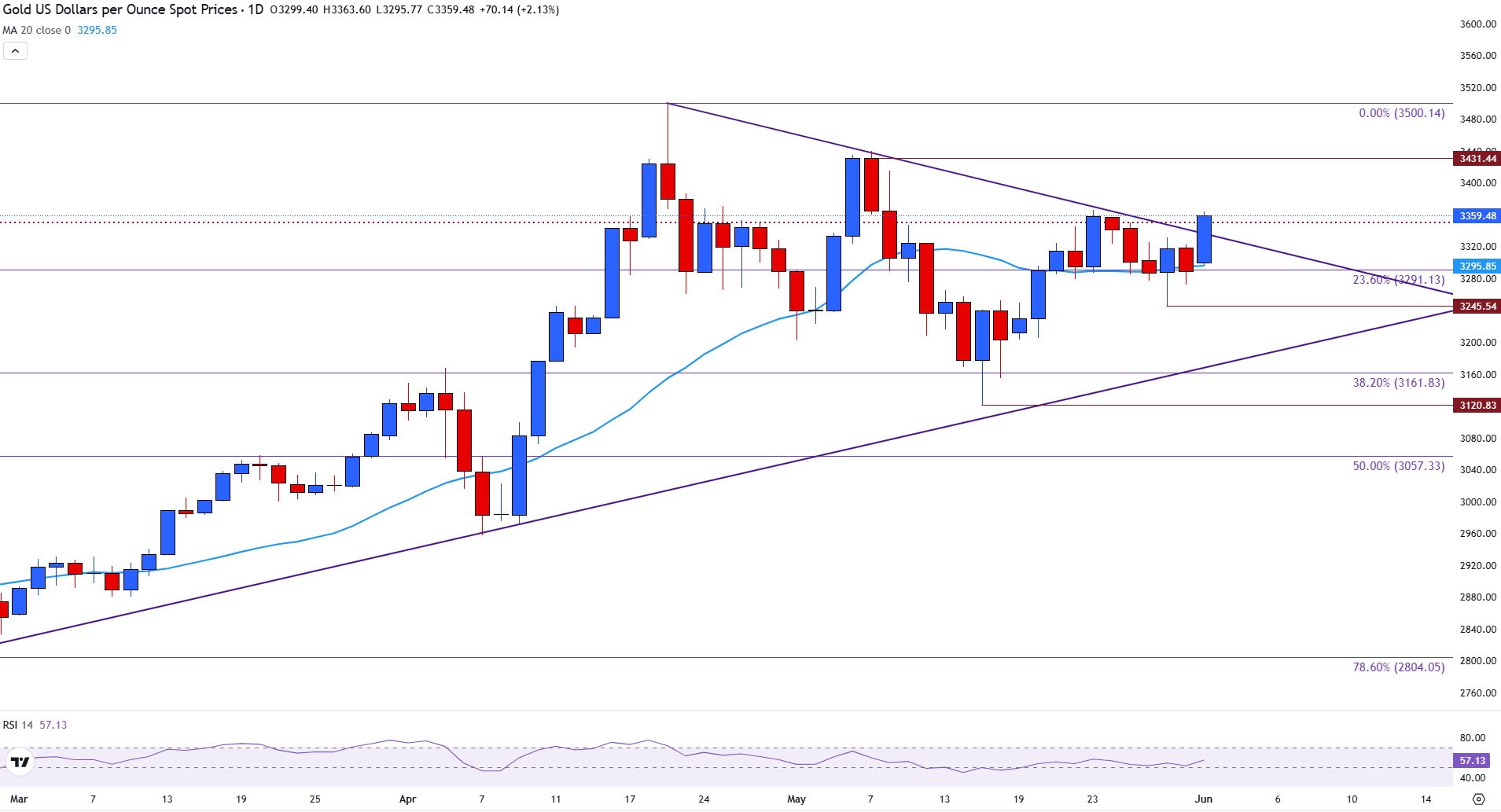

Gold technical analysis: XAU/USD tests trendline resistance

Gold prices are currently testing the upper bound of the symmetrical triangle, providing resistance around the critical psychological level of $3,350.

The 20-day Simple Moving Average (SMA) is holding near $3,295, just below the $3,300 psychological level.

A 2% price increase in today’s session so far has allowed prices to adopt a bullish tone, reflected by an uptick in the Relative Strength Index (RSI), which has risen to 57.

For the next significant move, a clear break of trendline resistance could see prices retest the May high near $3,431, potentially opening the door for a retest of the April 22 all-time high of $3,500.

If prices fail to remain upbeat, a move below $3,300 could see Gold prices move back toward the 23.6% Fibonacci retracement level of the January-April move, near $3,291, and toward the 38.6% Fibonacci level of that same move at $3,161.

Gold daily chart

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.