Gold slips as Trump delays tariffs on EU, thin holiday trading keeps action subdued

- Gold price dips over 0.50% as improved sentiment trims haven flows after last week’s 4.86% surge.

- Trump postpones 50% EU tariffs to July 9, easing short-term trade war fears.

- Strong Chinese Gold imports and Russia-Ukraine tensions keep the bullish outlook intact.

Gold price drops more than 0.50% on Monday amid the lack of demand for haven assets after United States (US) President Donald Trump delayed tariffs on the European Union (EU). In the meantime, trading remains thin due to the closure of the United Kingdom (UK) and US financial markets for holidays. At the time of writing, XAU/USD trades at $3,336.

Market mood improved on Trump’s statement on Sunday, pushing back the enactment of duties on EU products until July 9. Therefore, Bullion is pressured following last week’s gains of over 4.86%, the most significant increase since the week starting on April 7.

On Friday, XAU/USD extended its bullish move as Trump continued to pressure Apple (AAPL) to make iPhones in the US. If not, 25% of duties would be imposed. At the same time, he escalated the rhetoric against the EU, threatening to impose 50% tariffs on its goods. This drove the golden metal from $3,287 to last week’s highest high of $3,365.

Despite retreating, Gold prices are set to continue rallying, as Reuters revealed that “China's net gold imports via Hong Kong more than doubled in April from March, and were the highest since March 2024, data showed.”

Additionally, geopolitical risks remain high after Russia attacked Ukraine for the third straight night, spurring an angry reaction on Trump.

This week, the US economic docket will feature April Durable Goods Orders, the Federal Open Market Committee (FOMC) meeting minutes, the second estimate for Q1 2025 Gross Domestic Product (GDP) and the release of the Core Personal Consumption Expenditures (PCE) Price Index, the Fed’s favorite inflation gauge.

Gold daily market movers: Improvement in risk appetite weighs on Gold prices

- US Treasury bond yields remain steady. The 10-year Treasury note yield fell two basis points (bps) on Friday to 4.509%. Meanwhile, US real yields were down as well, one 4 bps to 2.179%.

- Gold price outlook is optimistic, given the fragile market mood toward US assets sparked by the growing fiscal deficit in the United States, which ignited Moody’s downgrade of US government debt from AAA to AA1.

- The fiscal package approved by the US lower house is projected to raise the debt ceiling by $4 trillion.

- The US Dollar Index (DXY), which tracks the buck’s value against a basket of six currencies, edged down 0.10% at 99.00, a tailwind for the Dollar-denominated precious metal.

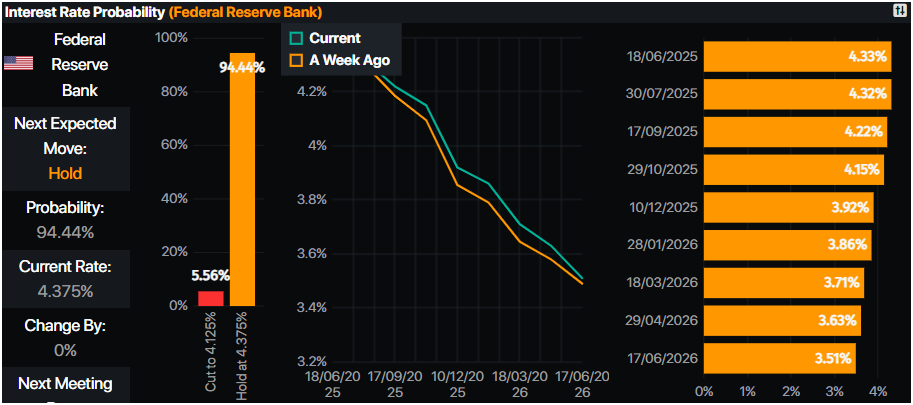

- Money markets suggest that traders are pricing in 47.5 basis points of easing toward the end of the year, according to Prime Market Terminal data.

Source: Prime Market Terminal

XAU/USD technical outlook: Gold’s uptrend to extend to $3,400

Gold prices retreated slightly, and it seems traders are booking profits amid thin liquidity and low volatility in the US in observance of the holiday. Trump’s inconsistency regarding trade policies could keep prices swinging violently once trading resumes on Tuesday.

From a technical perspective, Gold’s bull trend remains intact. If buyers achieve a daily close above $3,300, they could test last week’s high of $3,365. If surpassed, the next stop would be the $3,400 figure, followed by the May 7 high at $3,438 and the all-time high (ATH) at $3,500.

On the bearish side, if Gold drops below $3,300, expect a move to the May 20 daily low of $3,204, ahead of the 50-day Simple Moving Average (SMA) at $3,199.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.