Gold rallies as weak US jobs data, tariffs stoke stagflation fears

- Gold gains on safe-haven demand, steady US Treasury yields, and Trump’s tariffs kicking in.

- Continuing Claims reach levels last seen in November 2021, fueling dovish Fed bets.

- Stagflation risks emerge as inflation stays elevated while US employment weakens.

Gold price reverses its course and registers solid gains on Thursday as the latest round of jobs data in the United States (US) points to a weakening labor market. Consequently, investors increased their dovish bets as the Federal Reserve (Fed) is expected to resume its easing cycle in September. The XAU/USD trades at $3,385, up 0.45%.

Earlier, the Department of Labor revealed that the number of Americans filing for unemployment benefits rose above estimates, compared to the prior print. Although the print was close to forecasts, economists' focus shifted to Continuing Claims, which rose toward levels last seen in November 2021.

Recent weakness in the labor market, alongside higher prices, raised concerns among economists. A Bloomberg headline reads, “Stagflation Concerns Ripple Through Wall Street as Tariffs Hit”.

Bullion prices pushed higher as investors seeking safety bought the non-yielding metal, which was also underpinned by the fall of US Treasury yields.

Meanwhile, higher tariffs set by US President Donald Trump took effect on Thursday, providing a tailwind for Gold. The countries affected are Switzerland, Brazil and India, which have been unable to strike a deal with Washington.

Traders' eyes turn to Fed officials' speeches, with participants eyeing cues about the central bank's next move. On the data front, the University of Michigan Consumer Sentiment for August will be unveiled, along with inflation expectations.

Daily digest market movers: Gold boosted by Continuing Claims as stagflation woes increase

- US Initial Jobless Claims for the week ending August 2 rose by 228K, above estimates of 221K and the prior print of 218K. Even though the data hints at the ongoing cooling of the labor market, Continuing Claims were the main reason that investors became concerned about a stagflationary scenario. Claims increased to 1.97 million in the week ended July 26, hitting its highest level since November 2021.

- Initially, the US Dollar fell, though it recovered some ground, on breaking news that the Trump administration is considering current Fed Governor Christopher Waller to become the next Fed Chair.

- The US Dollar Index (DXY), which tracks the performance of the Buck’s value against a basket of its peers, is up 0.10% at 98.29. The US Dollar’s recovery capped Gold’s advance toward $3,400.

- The US 10-year Treasury note yield was losing three basis points, though it has paired those losses, sitting at 4.24% unchanged though failing to cap Gold prices.

- Atlanta Fed President Raphael Bostic reiterated his view that one cut is appropriate for this year but added that there is a lot of data before the next meeting.

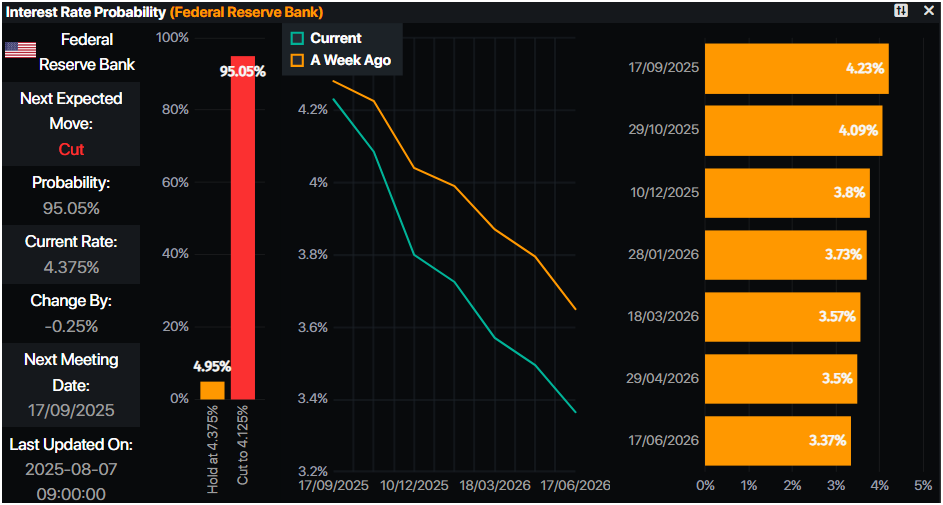

- Fed Interest Rate Probabilities show that traders had priced in a 95% chance of a quarter of a percentage rate cut at the September meeting, according to Prime Market Terminal data.

Source: Prime Market Terminal

Technical outlook: Gold price remains bullish, but traders are reluctant to clear $3,400

Gold price continues to advance steadily, following the August 1 aggressive 2% gain that drove the yellow metal up from around $3,281 toward $3,363. Since then, the XAU/USD has meandered within the $3,350-$3,397 range, with buyers yet unable to crack the $3,400 figure. The Relative Strength Index (RSI) shows that bulls are in charge as the index rises, though it remains below the latest peak.

For a bullish continuation, buyers need to climb above $3,400. This clears the way to challenge June’s 16 peak at $3,452, followed by the record high of $3,500. Conversely, if XAU/USD tumbles below the confluence of the 50-day and 20-day Simple Moving Averages (SMAs) around $3,350/$3,346, expect Gold prices to slide toward the 100-day SMA at $3,275, previously breaking $3,300.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.