Toncoin Price Forecast: TON eyes a 20% surge amid increasing Open Interest, whales' buying spree

- Toncoin edges higher, extending the 5% gains from Tuesday and trading close to its 200-day EMA.

- Large-wallet investors have acquired 120,000 tokens in July so far.

- Steady interest in Toncoin drives the TON Open Interest closer to its all-time high.

Toncoin (TON) edges higher by over 1% at press time on Wednesday, adding on the 5% gains from Tuesday, hinting at an uprising from a short-term consolidation phase. The interest surrounding TON remains steady, based on the rising Open Interest and the ongoing buying spree of large investors, commonly referred to as whales.

At a time of increased demand, Toncoin’s trendline breakout rally aims to surpass the 200-day Exponential Moving Average (EMA) at $3.551, potentially targeting the $4.21 resistance level.

A boost in whale confidence

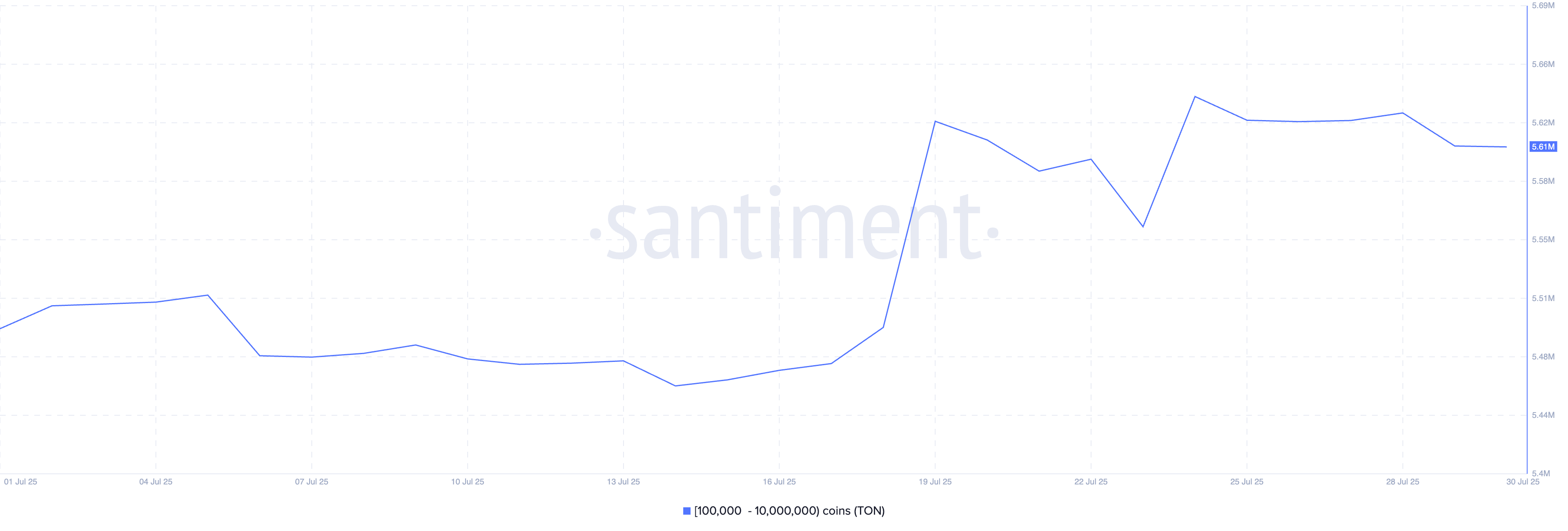

Santiment data shows the group of investors holding over 100,000 TON have acquired 120,000 TON so far in July, expanding the portfolio to 5.61 million TON. Sidelined investors could consider this a buying opportunity as the whales’ buying spree often foreshadows a bullish run.

Toncoin supply distribution. Source: Santiment

Heightened optimism surrounds Toncoin derivatives

The interest surrounding Toncoin holds steady, as evidenced by the Open Interest (OI) chart shared below. CoinGlass’ data shows a 12.55% surge over the last 24 hoursin TON OI, reaching $344.57 million and inching closer to its all-time high of $362.85 million set on August 26, 2024. A rise in OI reflects increased capital inflows in the TON futures and option contracts.

OI-weighted funding rate at 0.0060% suggests a buy-side dominance as bulls are imposed to pay the funding rates when positive, offsetting the swap and spot price imbalance caused by sharp price movements.

TON derivatives. Source: Coinglass

Toncoin aims to surpass the 200-day EMA

Toncoin’s trendline breakout rally bounces off the 100-day EMA, targeting the 200-day EMA at $3.551. The Relative Strength Index (RSI) reads 63 on the daily chart, pointing upwards, suggesting increased buying pressure with still room for growth before reaching overbought levels.

Still, the Moving Average Convergence Divergence (MACD) indicator suggests that investors limit their exposure as the average lines move closer to each other, hinting at a potential trend reversal. This aligns with the idea of capping buying activities near a crucial resistance.

Investors may find an entry opportunity with a decisive push above the $3.515 resistance level, last tested on July 22, or the 200-day EMA at $3.551. In such a case, the breakout run could target the $4.211 peak marked on April 1, which would represent a 20% rally from the current price levels.

TON/USDT daily price chart.

On the downside, a reversal from the overhead resistance might trigger a pullback to the 100-day EMA at $3.176.