Indices Trading

Trading stock indices reduces the concentration risk of trading in individual share. Popular indices such as Australia 200, Nas100, Hong Kong 50 and Germany 30 offer opportunities in countries such as Australia, US, Hong Kong and Europe respectively.

Trading stock indices reduces the concentration risk of trading in individual share. Popular indices such as Australia 200, Nas100, Hong Kong 50 and Germany 30 offer opportunities in countries such as Australia, US, Hong Kong and Europe respectively.

Indices

- NameSellBuyChange1D Charts

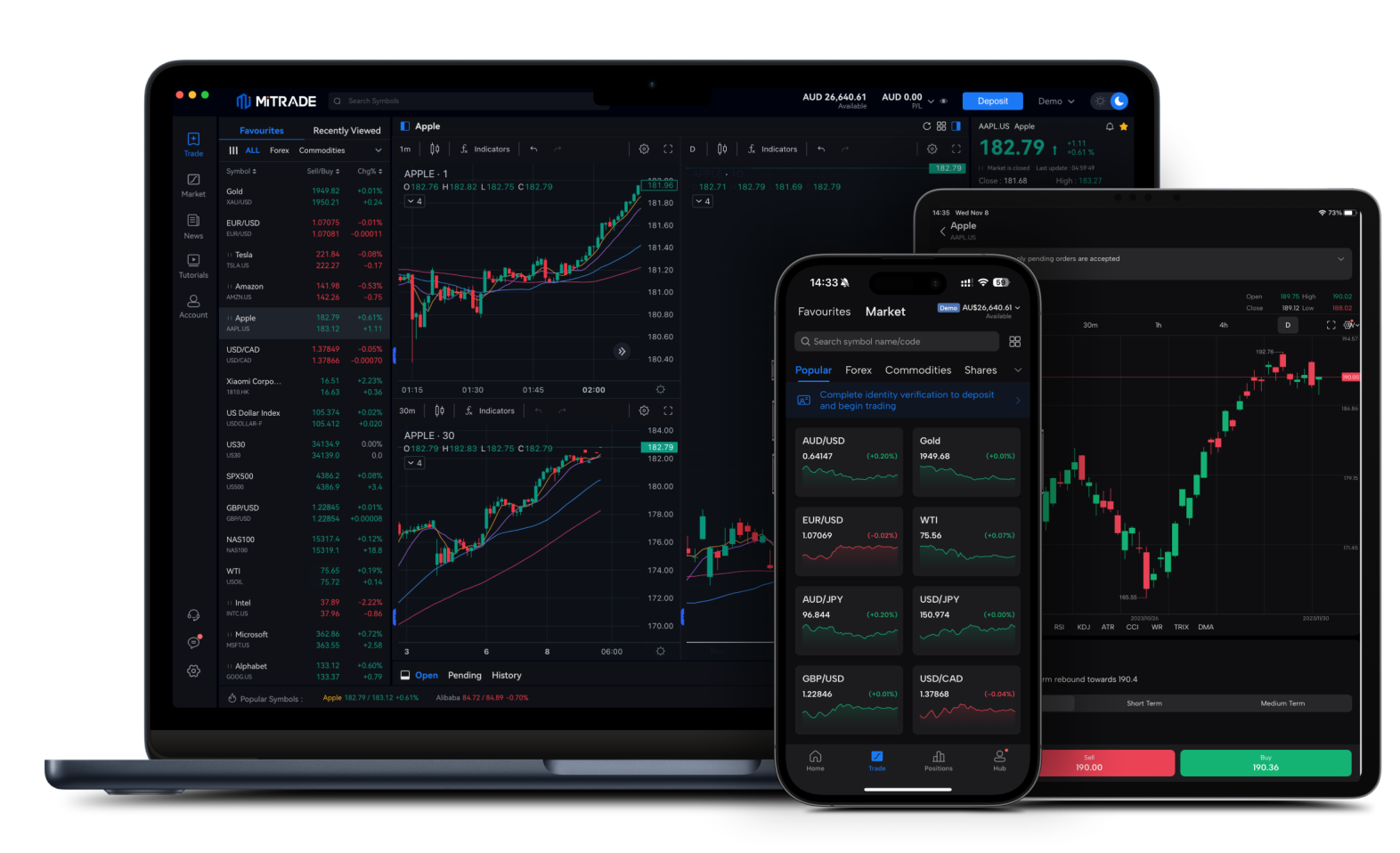

Multi-platform Compatibility

We offer seamless trading for you via Mitrade mobile app for Android & iOS, web platform, and desktop application for Windows & macOS. You are free to trade on any platform, anywhere, and anytime.

Why Choose Mitrade?

Simple and Intuitive Platform

Experience a platform that integrates market updates, trading analysis, trading and account management with risk management tools and more.

Competitive Trading Costs

Enjoy low-cost trading, zero commissions, low overnight fees, and competitive and transparent spreads.

Low Threshold Amount

The minimum size per trade is as low as 0.01 lots.

Regulated by the Relevant Regulatory Bodies

We understand the safety of your funds is of paramount importance. Therefore, all client funds are segregated from our operational funds.

Negative Balance Protection

You will not lose more than your deposit with our negative balance protection for your account.

Exceptional Customer Support

Enjoy fast and responsive customer service from a team of dedicated professionals.

Why Choose Mitrade?

Simple and Intuitive Platform

Experience a platform that integrates market updates, trading analysis, trading and account management with risk management tools and more.

Competitive Trading Costs

Enjoy low-cost trading, zero commissions, low overnight fees, and competitive and transparent spreads.

Low Threshold Amount

The minimum size per trade is as low as 0.01 lots.

Regulated by the Relevant Regulatory Bodies

We understand the safety of your funds is of paramount importance. Therefore, all client funds are segregated from our operational funds.

Negative Balance Protection

You will not lose more than your deposit with our negative balance protection for your account.

Exceptional Customer Support

Enjoy fast and responsive customer service from a team of dedicated professionals.