2 Vanguard ETFs to Buy With $1,000 and Hold Forever

Key Points

Gaining exposure to stocks through ETFs offers more diversification.

There are now thousands of ETFs that investors can purchase.

In addition, ETFs are more liquid than mutual funds.

- 10 stocks we like better than Vanguard S&P 500 ETF ›

Exchange-traded funds (ETFs) provide investors with the opportunity to gain exposure to a basket of stocks or different financial assets. They can be purchased like stocks and are more liquid than mutual funds.

There are now thousands of ETFs all over the world, meaning there are plenty for investors to choose from, whether its growth or value stocks, small- and large-cap stocks, dividend stocks, or stocks from various geographic regions.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Here are two Vanguard ETFs to consider buying now with $1,000 and hold for the long term.

Image source: Getty Images.

Vanguard S&P 500 ETF

The Vanguard S&P 500 ETF (NYSEMKT: VOO) is an easy way for investors to purchase the broader benchmark S&P 500 index, which contains 500 large-cap stocks in the U.S. across a variety of sectors. The goal of the market-cap weighted S&P 500 is to mirror the broader market.

As certain stocks have gotten bigger, particularly those fueled by artificial intelligence (AI) that have hit $1 trillion market caps, the index has gotten more concentrated. Here are the top 10 stocks by weighting in the Vanguard S&P 500 ETF, as of Sept. 30:

Nvidia -- 7.95%

Microsoft -- 6.73%

Apple -- 6.60%

Amazon -- 3.72%

Meta Platforms -- 2.78%

Broadcom -- 2.71%

Alphabet Class A -- 2.47%

Tesla -- 2.18%

Alphabet Class C -- 1.99%

Berkshire Hathaway Class B -- 1.61%

The top 10 stocks in the S&P 500 made up close to 39% of the total index at the end of the third quarter. This is certainly concerning because if they struggle or the AI trade struggles, the market may experience a significant correction. So concerned investors can practice dollar-cost averaging to help smooth out their cost basis over time.

Furthermore, I wouldn't recommend putting your entire portfolio into the S&P 500 right now. But I still think investors should have at least some exposure to the broader market forever. History shows that between 1964 and 2024, the S&P 500 generated a total return of 39,054% and a compound annual gain of 10.4%.

I suspect the AI trade will create volatility and lead to pullbacks in the broader market, but I don't think AI is going away or is just a fad. It's also possible that over time, investors rotate more into other stocks in the S&P 500. If you hold the index for a long time, the data shows that your investment should perform well.

Vanguard High Dividend Yield ETF

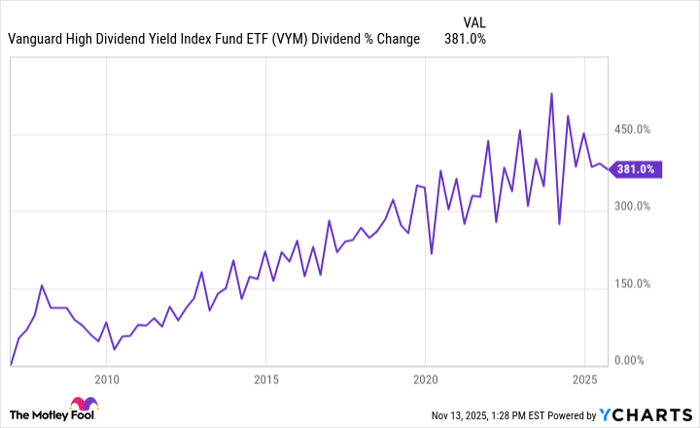

The Vanguard High Dividend Yield ETF (NYSEMKT: VYM) seeks to follow the performance of the FTSE High Dividend Yield index, which tracks companies that it considers (of course) to have high dividend yields. It has a trailing-12-month dividend yield of nearly 2.50% and has paid and grown its payout since the mid- to late-2000s.

VYM Dividend data by YCharts.

The words "high dividend" in the ETF's title can be misleading in some ways because investors have been warned to be wary of dividends that look too good to be true. But the Vanguard High Dividend Yield ETF is full of high-quality companies that have been paying dividends for decades. Here are the five largest sectors in the fund:

Financials -- 21.6%

Technology -- 13%

Industrials -- 13%

Healthcare -- 12.4%

Consumer Discretionary -- 10.1%

Within the ETF's top 10 holdings are three companies -- Walmart, AbbVie, and Proctor & Gamble -- that are Dividend Kings, meaning they have paid and raised their dividends annually for at least 50 consecutive years. Proctor & Gamble's record is 69 years; AbbVie's is 53 years, and Walmart's is 52. Companies with this kind of track record are going to do everything in their power to avoid a dividend cut because the payout has become a core part of their investment thesis.

Ultimately, I think it's a good idea to buy some stocks and ETFs for pure appreciation, while owning others for income. This adds diversification into an investment strategy, and purchasing ETFs only increases this diversification.

Should you invest $1,000 in Vanguard S&P 500 ETF right now?

Before you buy stock in Vanguard S&P 500 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard S&P 500 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $594,786!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,143,832!*

Now, it’s worth noting Stock Advisor’s total average return is 1,021% — a market-crushing outperformance compared to 190% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 17, 2025

Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends AbbVie, Alphabet, Amazon, Apple, Berkshire Hathaway, Meta Platforms, Microsoft, Nvidia, Tesla, Vanguard S&P 500 ETF, Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF, and Walmart. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.