Could BigBear.ai Become the Next Palantir Technologies?

Key Points

BigBear.ai and Palantir deliver artificial intelligence capabilities to the federal government.

While Palantir's third-quarter revenue rose 63% year over year, BigBear.ai's Q3 sales plunged 20%.

BigBear.ai made a major acquisition, adding AI platform Ask Sage to its offerings.

- 10 stocks we like better than BigBear.ai ›

The artificial intelligence powerhouse Palantir Technologies (NASDAQ: PLTR) has supplied outstanding stock price performance to shareholders. Over the last 12 months through Nov. 14, shares soared more than 186%. As Palantir's CEO, Alex Karp, noted, "The reality is that Palantir has made it possible for retail investors to achieve rates of return previously limited to the most successful venture capitalists in Palo Alto."

Palantir made a name for itself through its work with the U.S. government. Another company specializing in AI solutions for the federal government is BigBear.ai (NYSE: BBAI). Like Palantir, its stock also shot up, in this case by more than 254% over the past year through Nov. 14.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Could BigBear.ai follow in Palantir's footsteps to deliver further outsized share price returns? Let's take a closer look at the company to find out.

Image source: Getty Images.

BigBear.ai's sales performance

To evaluate whether BigBear.ai can become the next Palantir, a key factor to consider is financial performance, starting with sales. For example, in the third quarter, Palantir's revenue rose 63% year over year to $1.2 billion. Meanwhile, BigBear.ai's Q3 sales fell 20% year over year to $33.1 million.

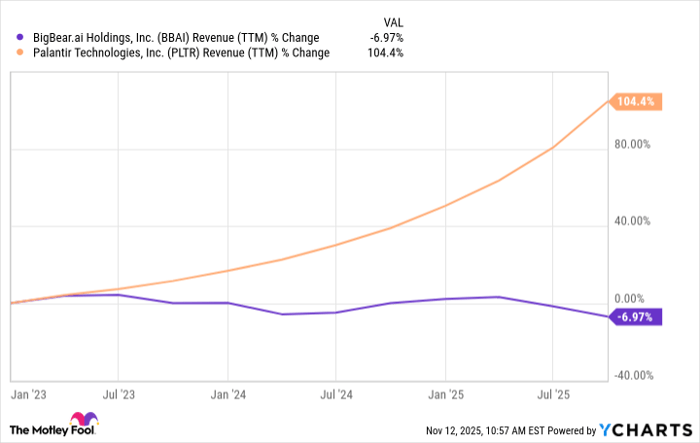

This is just one quarter, but looking back over recent years, Palantir's sales have steadily increased, while BigBear.ai's revenue growth has struggled, as seen in this chart.

Data by YCharts.

This year has been a particularly tough one for BigBear.ai. The Trump administration initiated several budget cuts, including what it called "wasteful Defense Department contracts." As a result, the company lost revenue from some U.S. Army programs.

Despite this environment, the fact that Palantir's sales continued to grow in 2025 is telling. The company's U.S. government revenue rose an impressive 52% year over year in Q3 to $486 million. This suggests Palantir's solutions were considered important for the government to maintain, while the same cannot be said about BigBear.ai's offerings.

BigBear.ai's lack of profitability

Another financial factor to consider is that BigBear.ai's business is not profitable. The company exited Q3 with an operating loss of $21.9 million, more than double the prior year's loss of $10.5 million. Palantir is highly profitable with Q3 operating income of $393.3 million, a strong increase from $113.1 million in 2024.

BigBear.ai's rising operating loss points to a deteriorating financial state, where the cost of running operations exceeds its earnings. If this continues to be the case over time, it could signal problems with the company's business model, product viability, or competitive position, rather than being a result of government budget cuts.

BigBear.ai had $2.5 million in Q3 net income, but that was due to a change in the fair value of its notes and warrants. Looking at the past three quarters, BigBear.ai had a net loss of $288 million compared to a loss of $157.3 million last year.

For it to duplicate the kind of share price performance Palantir has delivered over the past few years, BigBear.ai's financials would need to strengthen significantly.

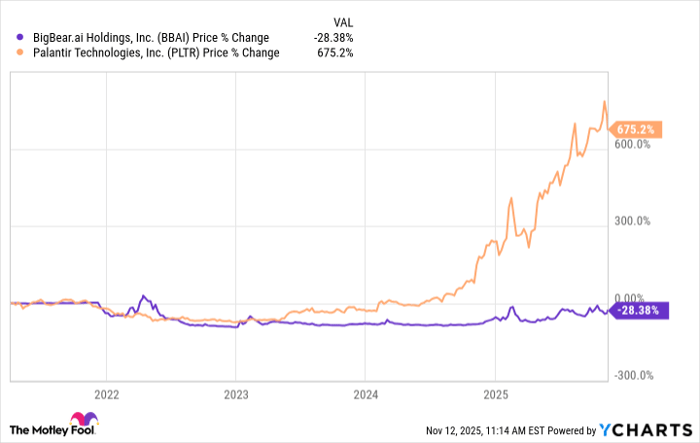

While BigBear.ai's stock has gone up over the last year, it started from a low base, having hit a 52-week low of $1.65 last November. Looking at its share price performance over time tells a different story.

Data by YCharts.

As the chart reveals, since BigBear.ai went public in 2021, its stock has performed poorly compared to Palantir.

A light at the end of BigBear.ai's tunnel?

While 2025 has been a rough year, BigBear.ai may soon turn a corner. On Nov. 10, the company announced the acquisition of Ask Sage, a generative AI platform built specifically for defense and national security agencies as well as other highly regulated industries. It serves 160,000 government teams.

Ask Sage is forecasted to generate $25 million in annual recurring revenue this year. The sum represents a sixfold increase compared to 2024. If Ask Sage can continue to ramp up revenue, it will be a significant boost to BigBear.ai's sales, which are expected to reach between $125 million and $140 million in 2025, a decline from 2024's $158.2 million.

Next, the company needs to begin moving toward profitability by reducing operating costs. In the meantime, BigBear.ai's current performance suggests it won't mirror the lofty gains achieved by Palantir stock, but if its sales growth accelerates and profitability is achieved, perhaps in time, it can get there.

Should you invest $1,000 in BigBear.ai right now?

Before you buy stock in BigBear.ai, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and BigBear.ai wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,784!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Robert Izquierdo has positions in Palantir Technologies. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.