1 Undervalued Growth Stock Down 44% to Buy Before 2026

Key Points

Airbnb is a steady growth stock with a lot of potential to keep growing.

The company has underrated margin expansion potential.

Shares of the stock are not overly expensive at current prices.

- 10 stocks we like better than Airbnb ›

Airbnb (NASDAQ: ABNB) is a battleground stock. Either you love or hate the disruptive home-sharing platform, which went public through an initial public offering (IPO) back in late 2020. Share prices are down 44% from all-time highs as of this writing on Nov. 12, disappointing investors during a time when the broad market is soaring.

However, if you look at the actual business performance, Airbnb is doing just fine. Profit margins are expanding, and revenue is up 255% cumulatively in the last five years. Shares of the beaten-down stock now look cheap, making it the perfect choice to add to your portfolio before 2026. Here's why.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

Airbnb is making geographical inroads, showing steady growth

The brand is known globally as a premier Silicon Valley company of the 2010s, but Airbnb's home-sharing platform is still only dominated by a select few English-speaking markets, as well as France. The majority of its bookings come from the United States, United Kingdom, France, Canada, and Australia. To truly become a global brand, Airbnb is working to expand its platform across new markets in Europe, Latin America, and Asia.

For example, last quarter had first-time bookers in Japan jump 20% year over year, with India growing an impressive 50%. It wants people to become more familiar and comfortable with the home-sharing platform, so it is localizing marketing and services for different nations. Bookings in Latin America jumped more than 20% year over year last quarter, while Asia Pacific grew in the mid-teens.

Overall bookings were up 12% year over year in constant currency last quarter. This type of year-over-year growth should continue due to steady growth in core markets (North America bookings grew by single digits year over year) and strong growth in these new geographical areas. Bookings are a direct indicator of future revenue growth, making it the key performance indicator investors should follow for Airbnb.

Airbnb has long-term margin expansion potential

Airbnb management spends a lot of time talking up its effort to develop new segments outside of the core home-sharing marketplace. It is diving back into what it calls Experiences and Services, which are add-ons that tourists can buy using the Airbnb application. These include extras like tour guides, private chefs in your home, or at-home massages. While there is potential to steadily grow this part of the platform, it will be years before it can match the $23 billion in Q3 gross booking value that comes from home sharing.

What will truly move the needle financially for Airbnb is continued margin expansion as it scales up around the world. Its home-sharing platform comes with extremely strong unit economics. It does not own any of the real estate used for hosting, it simply takes a fee on all transactions made through the marketplace, which come with high incremental profit margins.

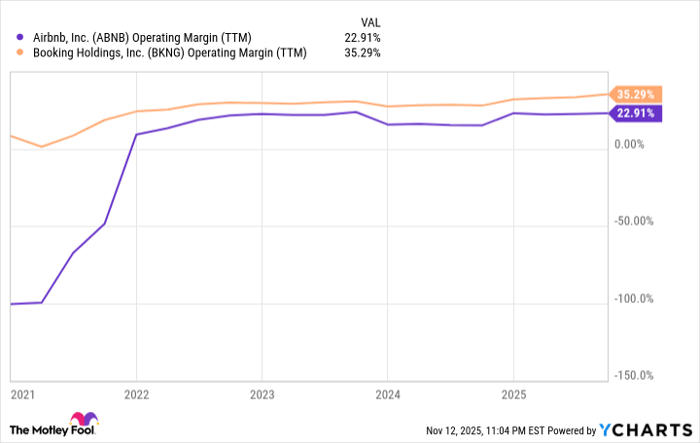

Today, Airbnb has an operating margin of 23%. Its competitor Booking Holdings has an operating margin above 35%. With similar business models, there is no reason that Airbnb cannot achieve the same profit level as Booking Holdings. In fact, one could argue that it will have higher profit margins because it is not as reliant on sponsored search results compared to Booking Holdings, with more bookings beginning within the search engine of the Airbnb application instead of Google.

Data by YCharts.

Why Airbnb stock is a buy before 2026

When looking at its trailing financials, Airbnb stock does not look overly cheap. It has a price-to-earnings ratio (P/E) of 29, which is well above the long-term market average of 15-20. However, due to its potential for steady growth and margin expansion, this P/E ratio may come down rather quickly. In the future, Airbnb looks well on its way to taking its $12 billion in revenue up to $20 billion. Applying a 35% profit margin on this $20 billion in revenue equates to $7 billion in bottom-line earnings power.

Today, Airbnb has a market cap of $74 billion, which would give the stock a P/E ratio of just above 10 based on these forward earnings estimates. Plus, Airbnb management is starting to aggressively repurchase shares, buying back close to $1 billion each quarter. This can juice forward returns for a stock that looks mighty cheap if you have a time horizon longer than just one year.

Buy Airbnb stock before 2026, sit tight, and watch the gains roll in.

Should you invest $1,000 in Airbnb right now?

Before you buy stock in Airbnb, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Airbnb wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,784!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Brett Schafer has positions in Airbnb. The Motley Fool has positions in and recommends Airbnb, Alphabet, and Booking Holdings. The Motley Fool has a disclosure policy.