BNB Price Forecast: BNB down 5% from peak as Windtree Therapeutics plans $520 million treasury

- BNB slips from its record peak amid overheated market conditions and risk-off sentiment in the broader crypto market.

- Windtree Therapeutics plans to raise $520 million via a common stock purchase agreement to establish a BNB treasury.

- BNB could extend its decline as the RSI continues to retreat from the overbought region, and if the MACD confirms a sell signal.

BNB (BNB) price is down slightly to trade at $771 on Friday, after correcting from its new record high of $809, reached on Wednesday. The Binance exchange native token is up nearly 20% in July, amid relatively overheated market conditions and institutional adoption.

The next few days could be crucial in providing insight into the direction BNB will likely take, particularly with risk-off sentiment spreading across the cryptocurrency market, hinting at profit-taking activity in the wake of the bullish wave that has dominated the past three weeks.

Windtree Therapeutics to establish BNB treasury

Windtree Therapeutics announced on Thursday that it has entered into a Common Stock Purchase Agreement, which will see it raise up to $500 million to set up an equity line of credit ("ELOC), as part of its corporate plan to boost its BNB crypto treasury strategy.

According to a press release published by Globe Newswire, the biotechnology company has also entered into an additional $20 million stock purchase agreement with Build and Build Corp. Windtree Therapeutics now awaits stockholder approval, according to the company's CEO, Jed Latkin.

"We are excited to incorporate these new facilities to enable our future BNB acquisitions as part of our BNB treasury strategy," Latkin said.

The treasury announcement came a day after BNB hit a new record high, which could help bolster sentiment around the token to keep prices elevated heading into the weekend.

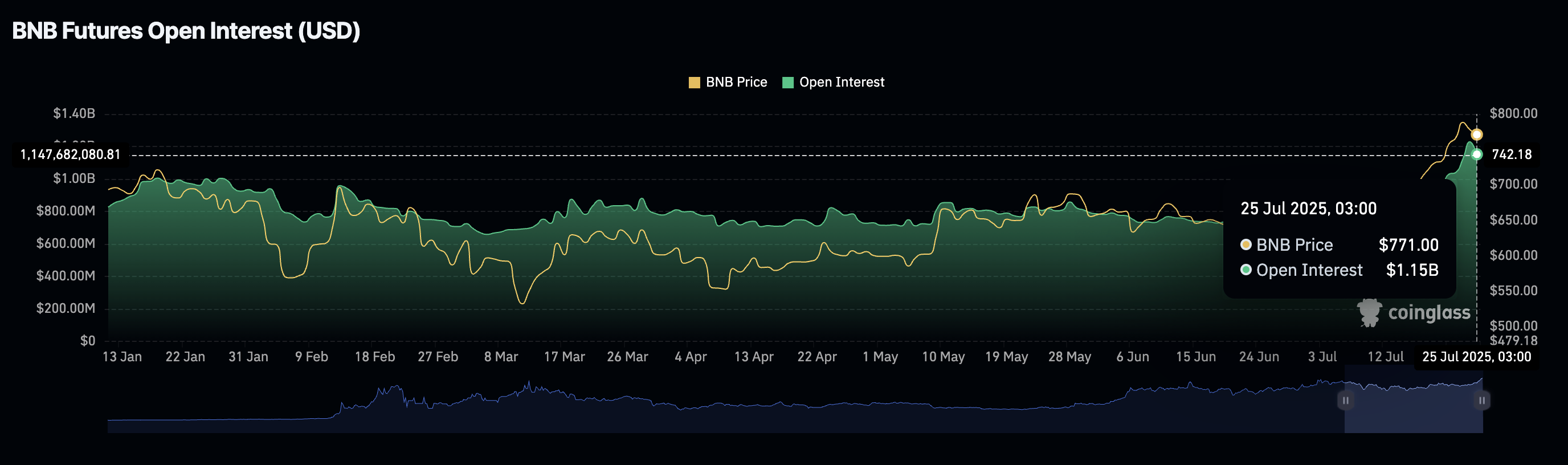

Interest in BNB remains relatively high despite a slight correction in the futures contracts Open Interest (OI). Coinglass data shows the OI, which highlights the notional value of outstanding futures or options contracts, averaging $1.15 billion after peaking at $1.23 billion on Thursday.

BNB Futures Open Interest | Source: CoinGlass

Technical outlook: BNB upholds bullish outlook

BNB price holds near record highs as bulls anticipate the resumption of the uptrend. The Relative Strength Index (RSI), which is currently overbought, shows signs of extending the upswing after stabilising at 76.

A recovery toward the maximum 100 level would suggest that bullish momentum is building, but also signal overheated market conditions likely to result in a price pullback.

BNB/USD daily chart

The Moving Average Convergence Divergence (MACD) indicator upholds a buy signal triggered on June 28 when the blue MACD line crossed above the red signal line.

Still, with the RSI showing overheated market conditions, traders should temper bullish expectations. Should the blue MACD line cross below the red signal line while the RSI extends the decline below 70, the path of least resistance could stay downward. This could result in a longer-than-expected trend reversal toward support at $689, provided by the 50-day Exponential Moving Average (EMA).

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.