Monero Price Forecast: Bearish bets rise as XMR extends correction below $400

- Monero records a loss of over 9% so far on Wednesday, dropping below $370.

- Derivatives data indicate a surge in bearish bets as futures Open Interest declines.

- The technical outlook remains to the downside as XMR risks breaking the neckline of a double top pattern.

Monero (XMR) falls by over 9% at press time on Wednesday, erasing the gains from the recovery seen late in the previous week. The intraday drop stokes fear among traders, prompting a surge of bearish bets in the derivatives market. Monero risks a further correction as technical indicators flash a sell signal amid resurgent bearish momentum.

Monero suffers from reduced market demand

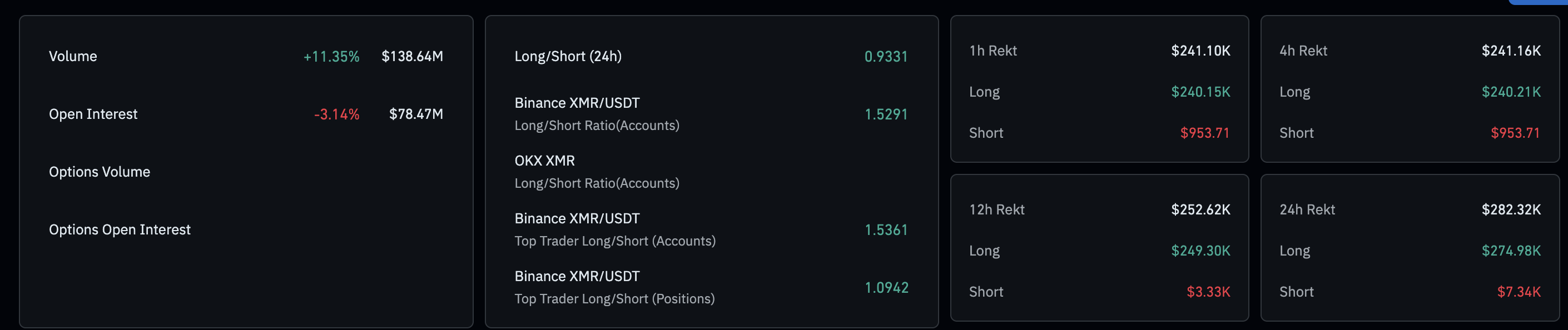

Monero is losing demand among retail traders. CoinGlass data shows that XMR futures Open Interest (OI) dropped 3.14% to $78.47 million over the last 24 hours, suggesting that traders are withdrawing capital amid a short-term correction that is tainting hopes of a future recovery.

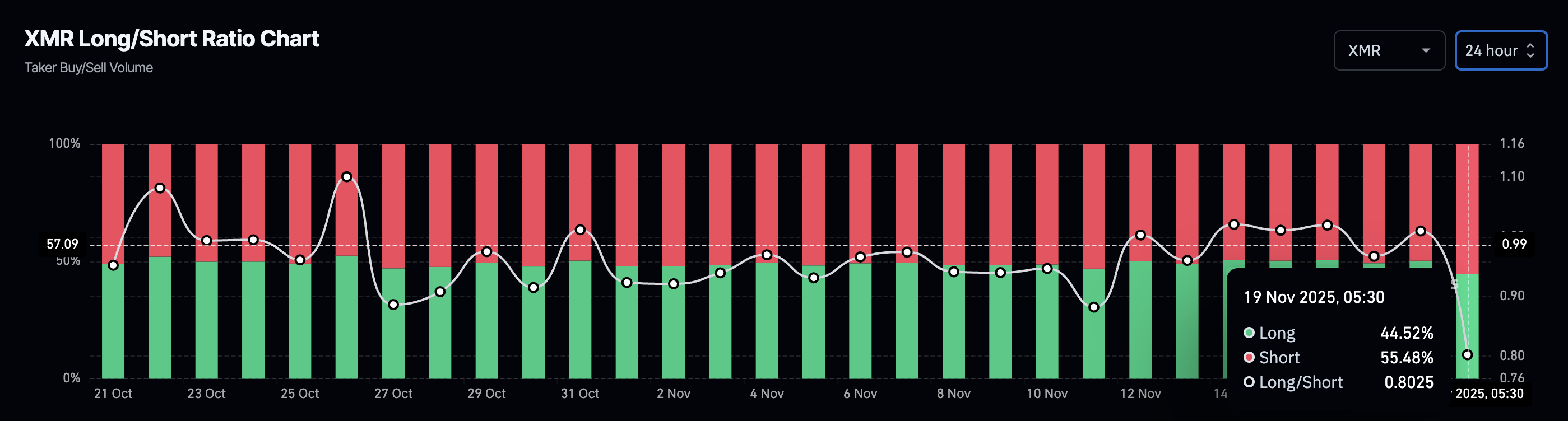

In line with rising fear, the XMR long-to-short ratio chart shows that short positions account for 55.48% of all trades in the last 24 hours, dropping the ratio to 0.8025. Monero could experience further selling as bearish bets increase and the futures market declines.

Monero could test its crucial EMAs

Monero’s intraday drop marks the fourth straight day of selling, which has erased the prevailing demand. The Relative Strength Index (RSI) is down to 48 on the daily chart, slipping below the midline, indicating a wipeout of buying pressure and a dominant shift to selling.

Adding points to XMR bears, the Moving Average Convergence Divergence (MACD) flashes a sell signal as the blue line crosses below the red signal line, indicating renewed bearish momentum.

The immediate support for Monero is the 50-day Exponential Moving Average (EMA) at $348, followed by the 100-day and 200-day EMAs at $326 and $304, respectively. Technically, if XMR ends the day below $358, which aligns with the July 14 high, it would confirm the breakout of a double-top pattern, as previously reported by FXStreet.

On the flipside, if Monero rebounds, the key resistance remains at the June 3 high of $372.