Crypto Liquidations Hit $1.2 Billion As Bitcoin, Ethereum Plummet

Data shows the plunge in Bitcoin and the altcoins has sent a shockwave through the derivatives market, resulting in massive long liquidations.

Bitcoin Has Just Witnessed A Crash To $104,000

Last Friday was a shock for the cryptocurrency market and it seems this Friday is continuing the trend as Bitcoin and company have just seen another leg down. The below chart shows how BTC’s recent price action has looked.

From the graph, it’s visible that shortly after the earlier crash, Bitcoin saw a rebound back to $116,000, giving investors hope for a market recovery. This surge, however, has now turned out to be just a dead-cat bounce.

With a plunge of over 6% in the last 24 hours, BTC has returned to the $104,200 level. The altcoins have faced even heavier losses, with Ethereum being down almost 9% to $3,700. Just like how last week’s crash caught out derivatives traders, the same has happened this time around as well.

Crypto Derivatives Market Has Seen Liquidations Of Nearly $1.2 Billion

According to data from CoinGlass, a large number of liquidations have occurred in the cryptocurrency derivatives sector during the past day. A “liquidation” takes place when an open contract amasses losses of a certain percentage and is forcibly shut down by its platform.

Here’s a table that shows the numbers related to the liquidations that have occurred on cryptocurrency exchanges during the last 24 hours:

As displayed above, the sector as a whole has seen a total of $1.18 billion in liquidations during the past day. Since most of the liquidity in this period has been toward the downside, it’s no surprise that long investors took the brunt of the squeeze. More specifically, $917 million or 77% of the liquidations involved bullish bets.

In terms of the individual assets, Bitcoin-related contracts contributed the most toward the event, with over $431 million in liquidations.

Ethereum came second with $267 million in contracts and Solana third with $89 million. Interestingly, XRP, which has a notably larger market cap than SOL, saw only $27 million in liquidations, despite a similar degree of volatility in this window. This suggests speculative interest around the asset hasn’t been as strong recently.

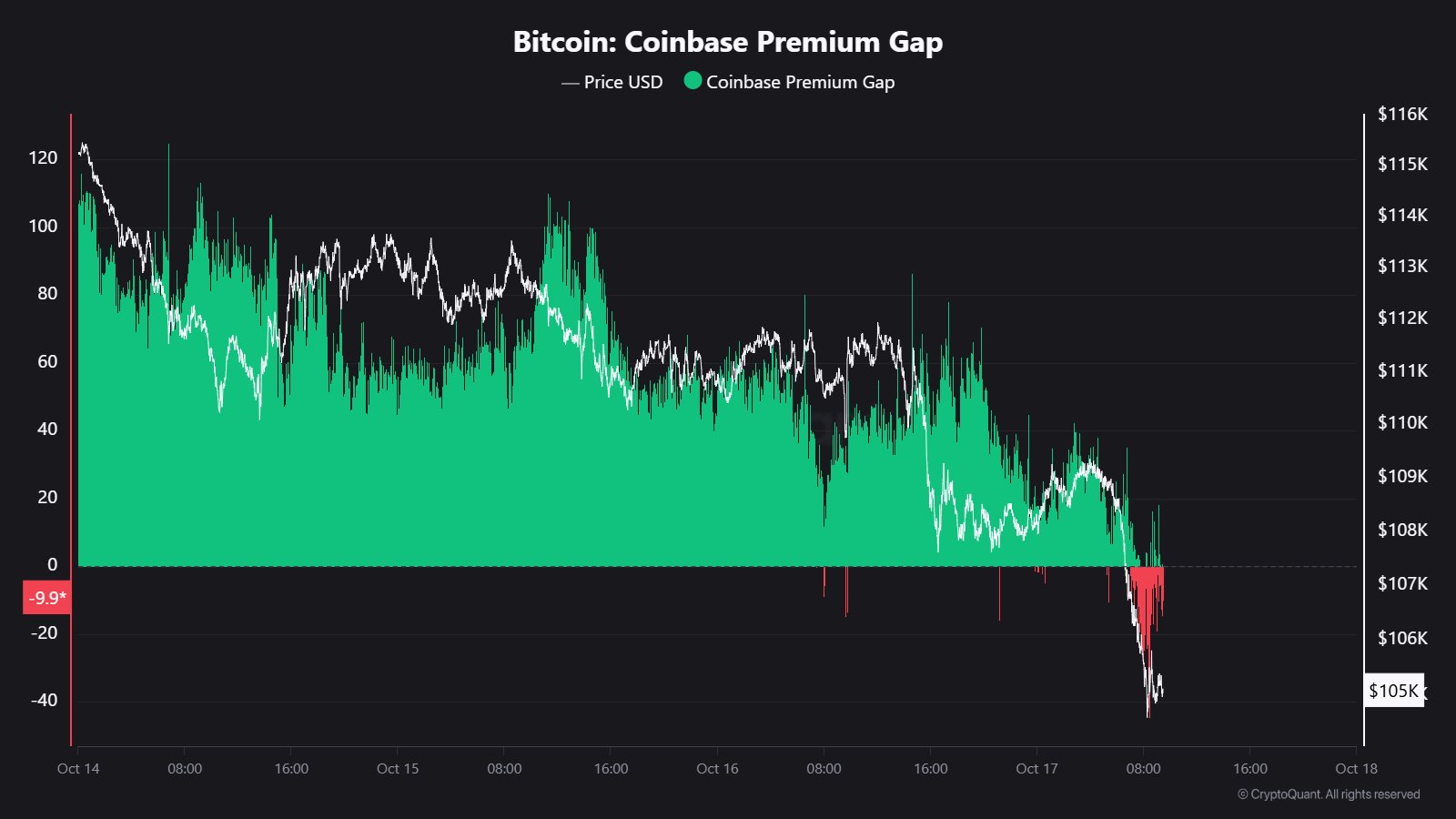

In some other news, the Bitcoin crash appears to have come alongside a shift to red values on the Coinbase Premium Gap, as CryptoQuant community analyst Maartunn has pointed out in an X post.

The Coinbase Premium Gap tracks the difference between the Bitcoin price listed on Coinbase (USD pair) and that on Binance (USDT pair). A negative value on the indicator suggests users of the former are applying a higher selling pressure than traders on the latter. Thus, given the latest shift, it would appear possible that institutional entities using Coinbase could, in part, be behind the bearish action.