Whales and Retail Back Cardano (ADA) Price Rebound Despite Bearish Signals

At present, Cardano (ADA) is down nearly 20% over the past 24 hours, extending its 30-day losses to 26.2%. The crash took ADA to its lowest point in weeks, but the token has since rebounded close to the $0.65 mark.

What’s driving this recovery attempt are two key groups — whales and retail traders — both adding exposure as prices slide. But can they overpower weak technical signals and spark a real rebound?

Whales and Retail Build Conviction Together

While most of the market panicked, Cardano whales were quietly adding. Santiment data shows that wallets holding 10 million to 100 million ADA increased their holdings from 13.06 billion on October 10 to 13.20 billion today — a gain of 0.14 billion ADA, worth about $89.6 million at the current price of $0.64.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Cardano Whales: Santiment

Cardano Whales: Santiment

This buildup started just before the crash and hasn’t slowed since (they didn’t sell into the crash). That consistency during a market-wide selloff suggests these large holders are expecting stability or an eventual rebound.

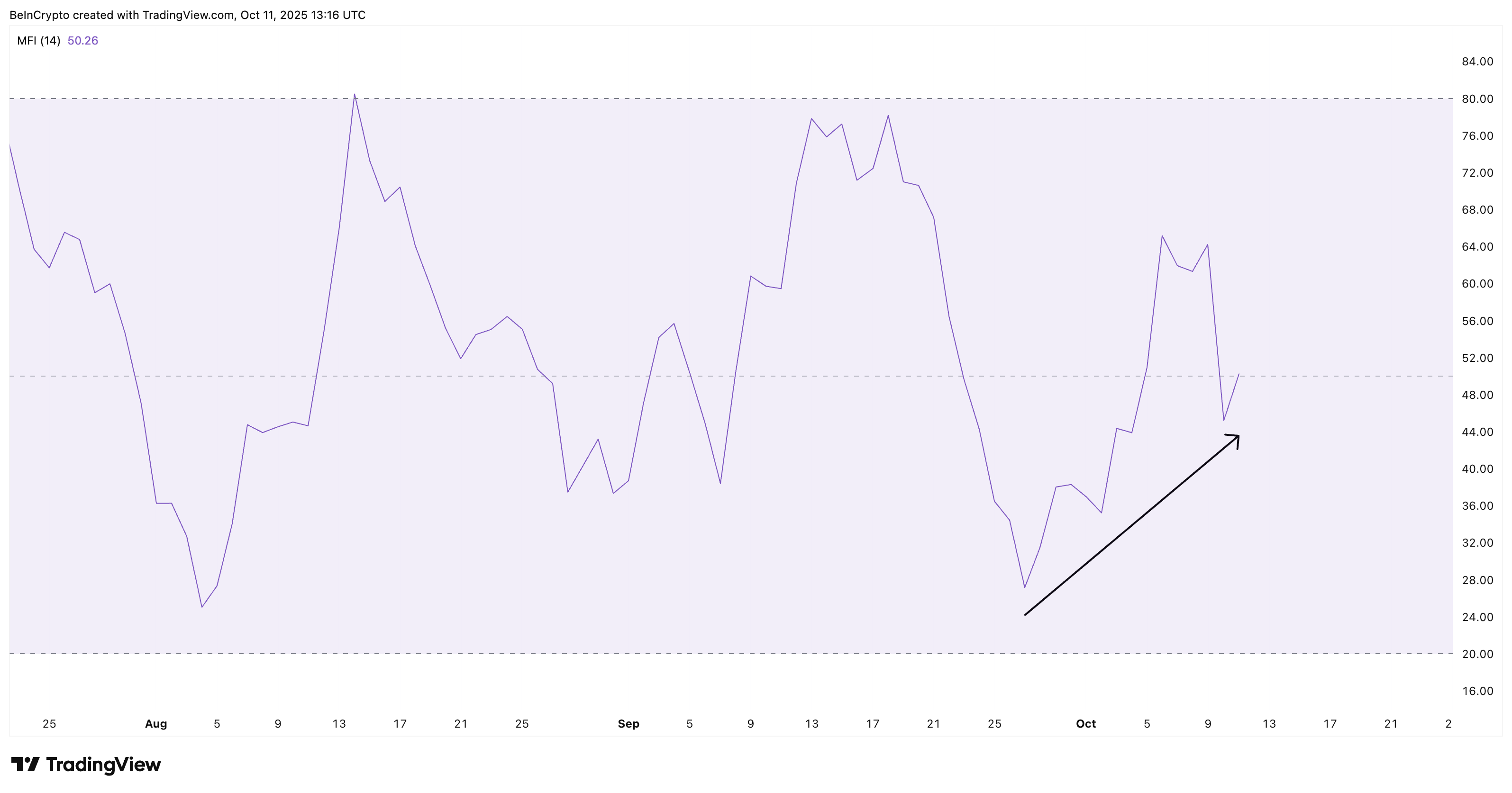

The Money Flow Index (MFI) — which tracks how much money flows in and out of an asset based on price and volume — supports that narrative. MFI has formed a higher low, showing capital inflows even as the price fell.

Cardano Retail Joining The Action: TradingView

Cardano Retail Joining The Action: TradingView

This shows retail traders seem to be stepping in alongside whales, adding to the buying strength that could serve as a base for a gradual Cardano price recovery.

Three Technical Risks Still Haunt The Cardano Price Action

Despite the encouraging accumulation, three technical risks remain.

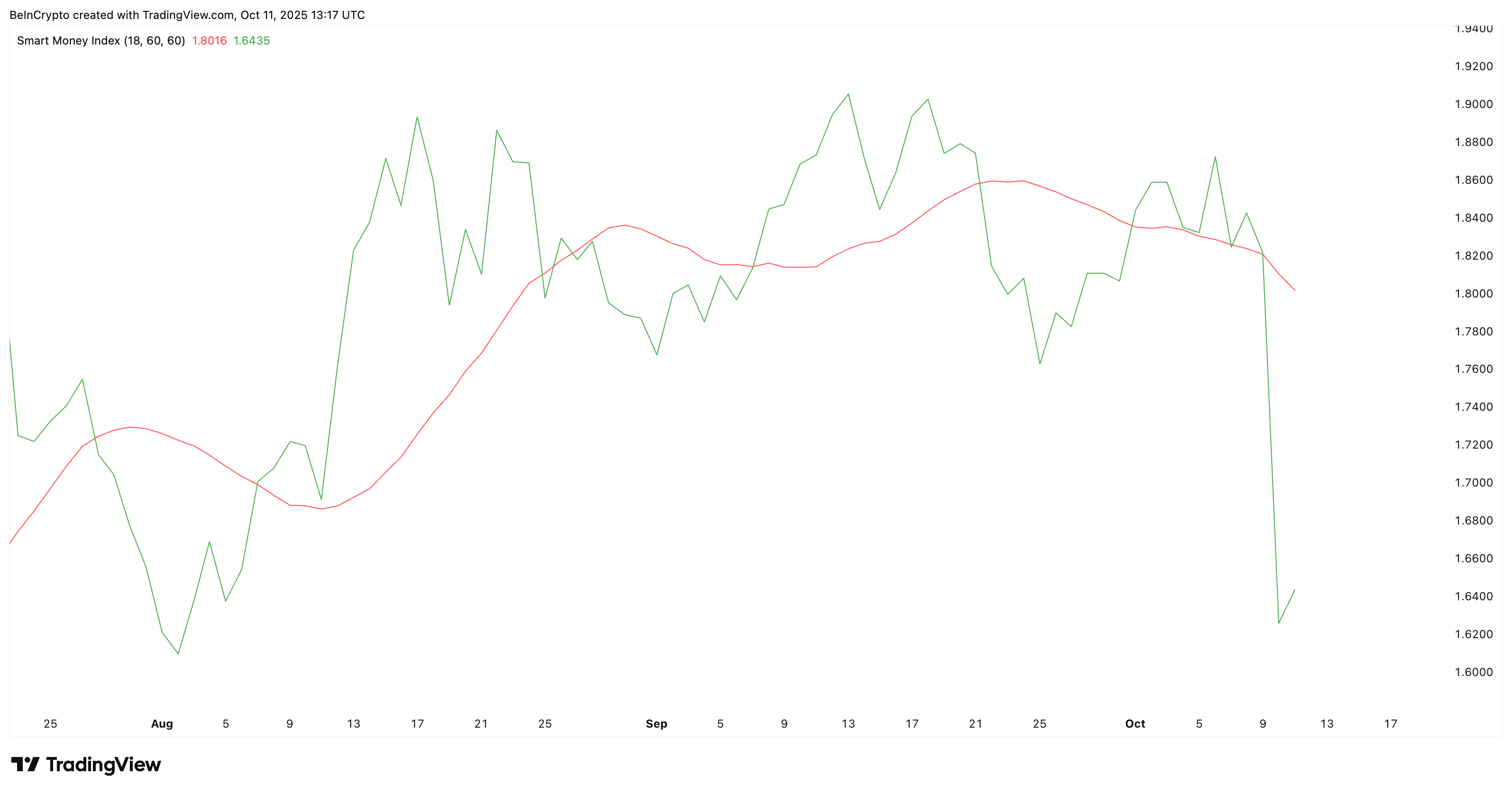

The Smart Money Index (SMI) — which measures professional trader-specific positioning — has dropped sharply and is yet to recover. Though it has slightly curled up, the move remains too weak to confirm a sustained comeback or rebound-hopeful traders.

Smart Money Not Expecting A Cardano Rebound TradingView

Smart Money Not Expecting A Cardano Rebound TradingView

Similarly, RSI, which measures the strength of buying or selling momentum, shows no bullish divergence. While ADA’s price made a lower low during the crash, RSI followed with another lower low — meaning momentum hasn’t reversed yet.

Cardano Price Analysis: TradingView

Cardano Price Analysis: TradingView

At 30, RSI does show ADA is oversold, but without divergence, the rebound could be slower than other top altcoins.

Adding to this caution, ADA’s descending trendline continues to form a bearish triangle pattern on the daily chart. Without a bullish RSI divergence to counter it, the structure suggests that downside risk still exists — making this a potentially fragile rebound unless buyers sustain higher closes.

Currently, the Cardano price trades near $0.64. A daily close above $0.68 could prime the ADA price for a short-term recovery toward $0.76 and $0.89, while a break below $0.61 may drag it further down to $0.55.