BNB Price Forecast: BNB trades near record high as Binance's YZi Labs unveils $1 billion builder fund

- BNB holds below $1,300 after reaching a new record high of $1,350 on Tuesday.

- Binance's YZi Labs announces a $1 billion builder fund to support project founders within the BNB ecosystem.

- YZi Labs encourages founders to focus on long-term BNB-based innovations, including trading, AI, and DeFi.

Binance Coin (BNB) trades slightly below $1,300 on Wednesday, underpinning steady interest in the centralized exchange (CEX) native token.

The majority of assets in the broader cryptocurrency market appear stable at the time of writing, after facing sharp declines the previous day, mirroring Bitcoin's (BTC) pullback from its all-time high of around $126,199.

Binance's YZi Lab launches $1 billion builder fund

YZi Labs, Binance's venture capital arm, has announced a $1 billion builder fund, seeking to deepen its commitment to project founders in the BNB ecosystem. The announcement on Wednesday stated that the fund will primarily support innovations ranging from trading, real-world assets (RWAs), Artificial Intelligence (AI), Decentralised Finance (DeFi), payments and wallets on the BNB Chain.

"YZi Labs is committed to leveraging the BNB Ecosystem as the backbone for humanity's new scaling laws: Web3 for democratized access and ownership, AI to enhance human potential, and biotech to improve quality of life," YZi Labs stated on X.

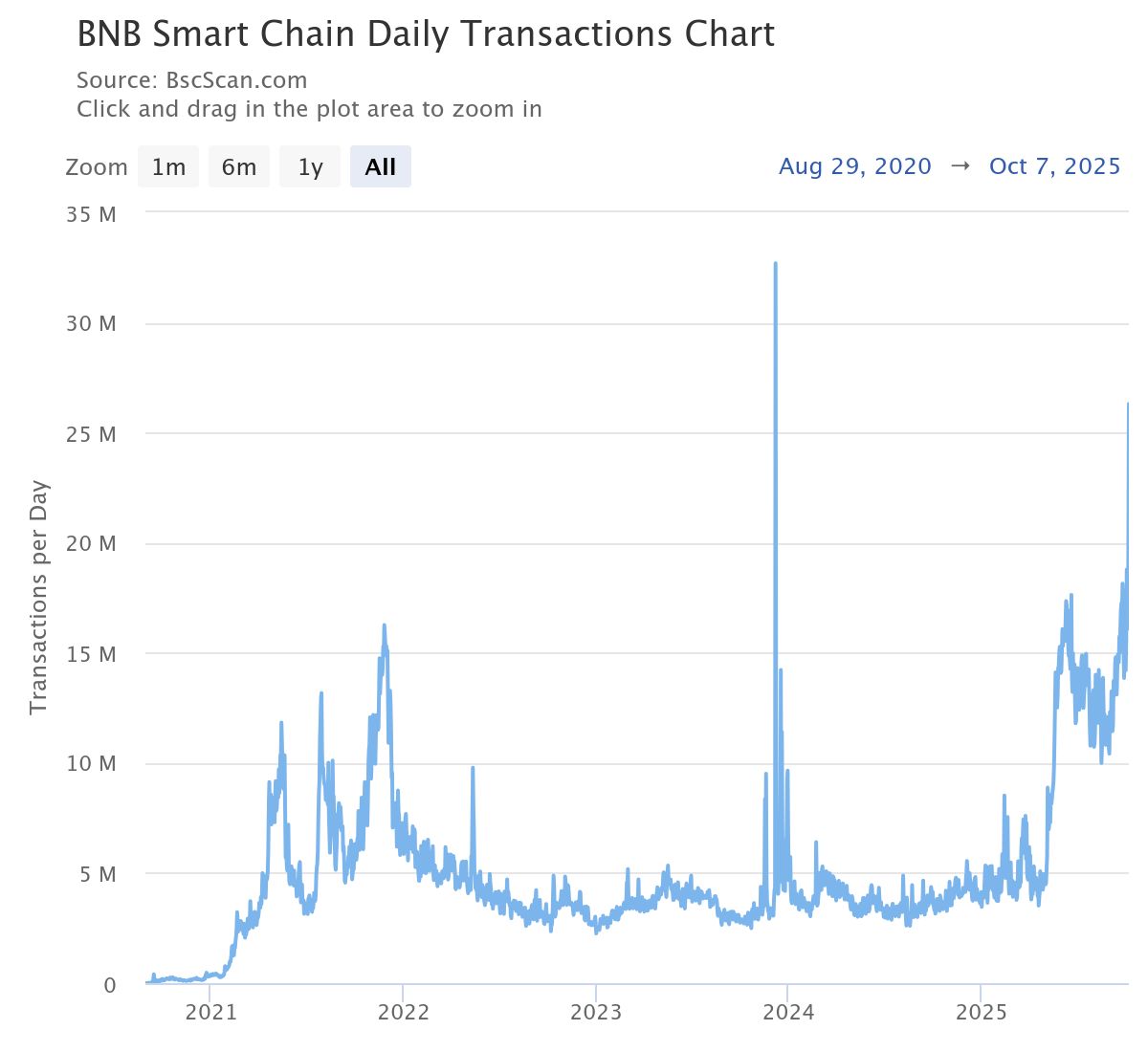

The unveiling of the builder fund comes at a time when the BNB Chain is experiencing a surge in key on-chain metrics, including 26 million daily transactions, ranking as the leading protocol in decentralized exchange (DEX) trading volume and daily active users.

BNB Smart Chain daily transactions | Source: Bsc Scan

The performance of the BNB price over the last few weeks, reaching a new record high of $1,350 on Tuesday, reflects the surge in on-chain activity. BNB has also surpassed Ripple (XRP) to become the third-largest digital asset, with a market capitalization of $183 billion, according to CoinGecko.

"BNB's climb into the top three by market cap reflects both the maturity and fragility of the current crypto cycle, signaling a shift toward ecosystem-driven growth while also flashing signs of overheating," Jamie Elkaleh, CMO at Bitget Wallet, told FXStreet in a written statement.

Technical outlook: BNB bulls eye higher support

BNB trades slightly below $1,300 on Tuesday after correcting from its record high. The Relative Strength Index (RSI) at 76 indicates slightly overheated market conditions, which could see BNB extend the pullback. Hence, traders should be cautiously optimistic and watch out for the RSI's potential retreat into the bullish region below 70.

Key areas of interest include $1,237, which was tested as resistance on Monday, and $1,137, which was tested as support on Sunday.

BNB/USDT daily chart

Still, a buy signal from the Moving Average Convergence Divergence (MACD) indicator has been sustained since October 2, reinforcing the short-term bullish outlook. If traders increase risk exposure, a recovery above $1,300 cannot be ruled out, which could also increase the chances of the up leg extending above $1,350.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.