Ethereum Foundation Converts 1,000 ETH to Stablecoins – Here’s Why

The Ethereum Foundation has announced plans to sell 1,000 ETH, worth roughly $4.5 million, as ETH’s price climbs above $4,500 for the first time since mid-September.

The sale, disclosed on October 4, will be executed using CowSwap’s Time-Weighted Average Price (TWAP) feature. This automated tool spreads large transactions over time to prevent sudden market disruptions.

Ethereum Foundation’s 17th ETH Sale This Year Renews Market Debate

By using TWAP, the Foundation aims to reduce price volatility, minimize slippage, and secure more balanced execution prices.

Institutional investors and crypto treasuries often rely on similar strategies to offload large holdings without triggering sharp price swings.

As a result, the proceeds will be converted into stablecoins to fund ongoing operations such as ecosystem research, developer grants, and community donations.

According to the Foundation, this sale aligns with its broader strategy of managing its treasury more efficiently while leveraging DeFi tools.

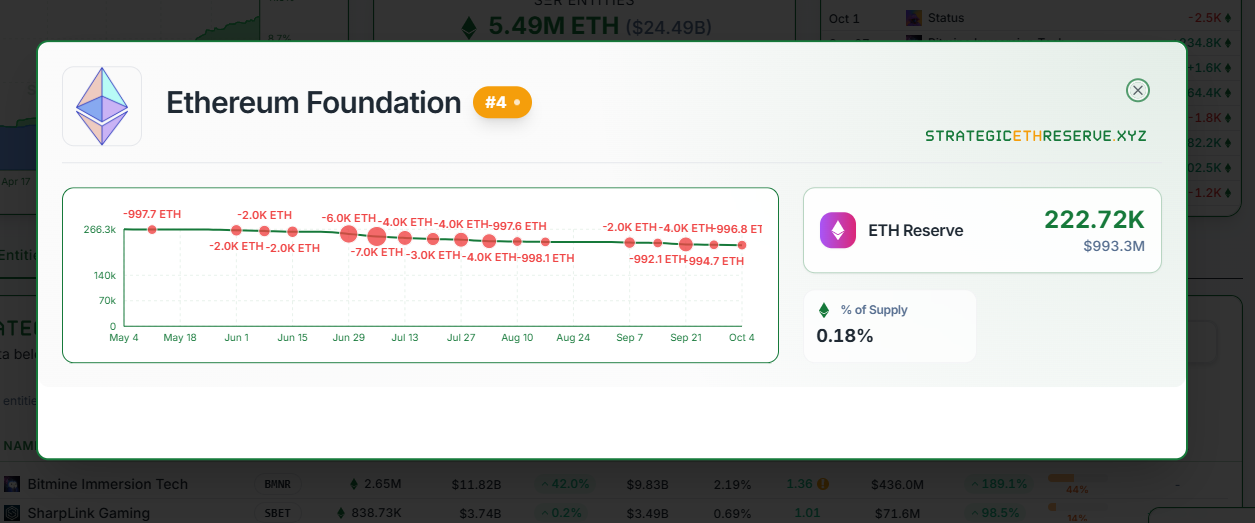

Meanwhile, according to data from the Strategic ETH Reserve, this marks the Foundation’s 17th ETH sale in 2025. Its remaining balance now stands near 222,720 ETH—worth approximately $1 billion at current prices.

Ethereum Foundation ETH Holdings. Source: Strategic ETH Reserve

Ethereum Foundation ETH Holdings. Source: Strategic ETH Reserve

The frequent sales have raised concerns among community members, who argue that such activity can create bearish sentiment and weaken investor confidence.

While some critics have questioned the optics of repeated sales during bullish momentum, others view the move as a necessary step toward responsible treasury management.

Crypto researcher Naly suggested that the Foundation could “highlight the power of DeFi” by using decentralized tools to generate liquidity rather than selling tokens outright.

Naly proposed an alternative: “Supply ETH on Aave, earn interest, borrow stablecoins, and fund operations using DeFi-generated capital.”

Advocates say this method would allow the Foundation to maintain exposure to ETH’s potential upside while still accessing liquidity for expenses.

Still, not all feedback has been negative.

Several community members have praised the Foundation’s transparency for announcing its sales publicly. According to them, this practice is uncommon among large crypto organizations.

As of press time, Ethereum trades around $4,500, up 12% from last week’s low near $4,000, according to BeInCrypto data.