Crypto Today: Bitcoin, Ethereum, XRP take a breather from two-day rally

- Bitcoin steps back to $120,000, signaling profit-taking ahead of the weekend.

- Ethereum’s uptrend stalls around $4,500 resistance despite steady ETF inflows.

- XRP holds above the $3.00 support after breaking a key descending trendline support.

Bitcoin (BTC) is trading near $120,000 on Friday after reaching a seven-week high of $120,960 the previous day. Altcoins, including Ethereum (ETH) and Ripple (XRP), are holding near their respective weekly highs, reflecting steady demand from both institutions and retail investors.

The rest of the cryptocurrency market has taken a breather, following two connectivity days of gains, supported by positive sentiment around the “Uptober” narrative. Typically, market participants expect better performance in October, as sentiment suggests September is often a bearish month for crypto.

Data spotlight: Bitcoin shows upside potential as ETF inflows surge

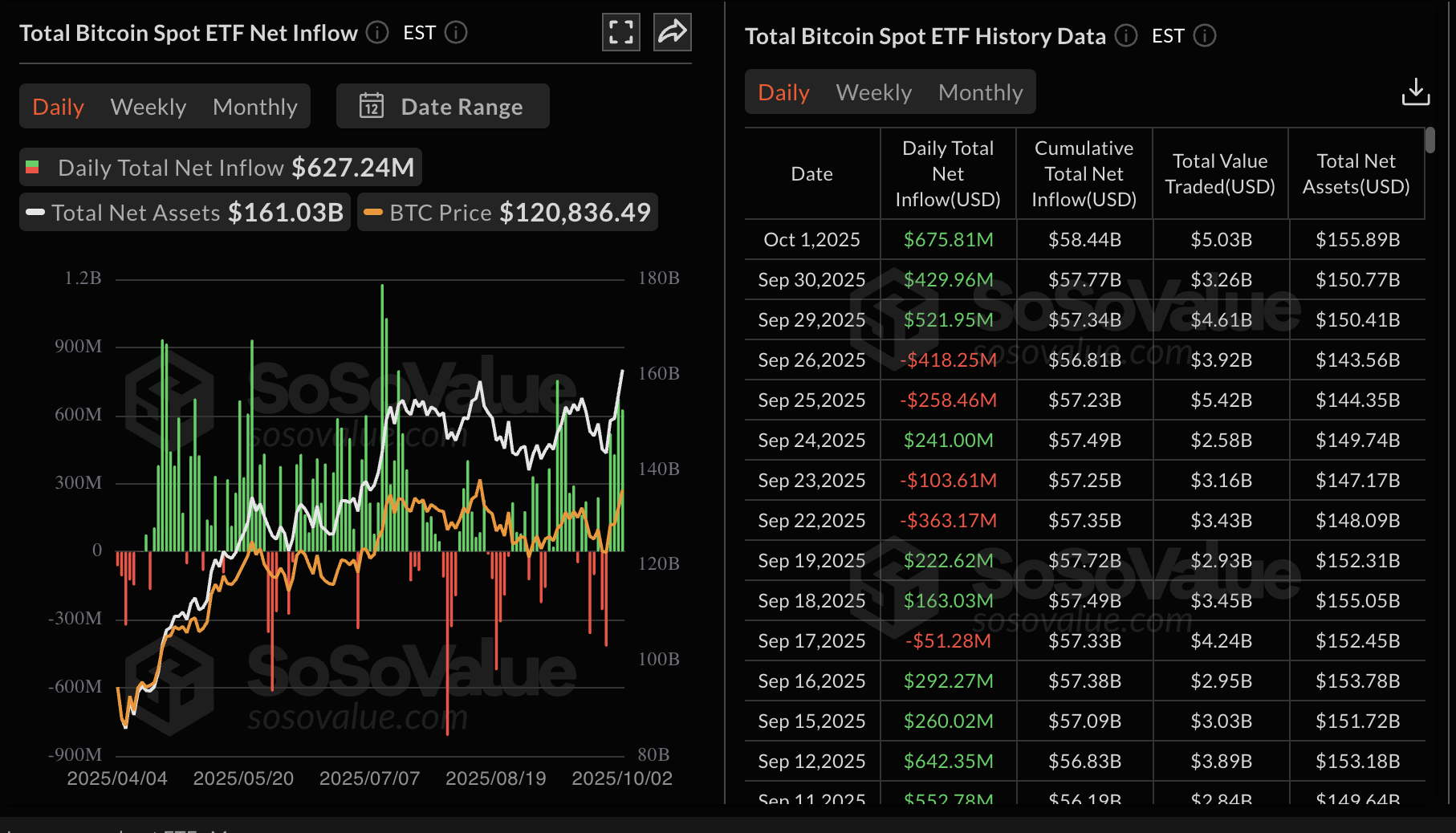

Interest in Bitcoin spot Exchange Products (ETF) has significantly improved from early in the week, mirrored by steady inflows. SoSoValue data shows that US ETFs experienced a total of $627 million in inflows on Thursday, $676 million on Wednesday, $430 million on Tuesday and $522 million on Monday.

BlackRock’s IBIT ETF saw $466 million in inflows on Wednesday, followed by Fidelity’s FBTC with $87 million and Ark Invest’s ARKB with $45 million. None of the 12 ETF products saw outflows, underscoring the increase in demand.

Bitcoin ETF stats | Source: SoSoValue

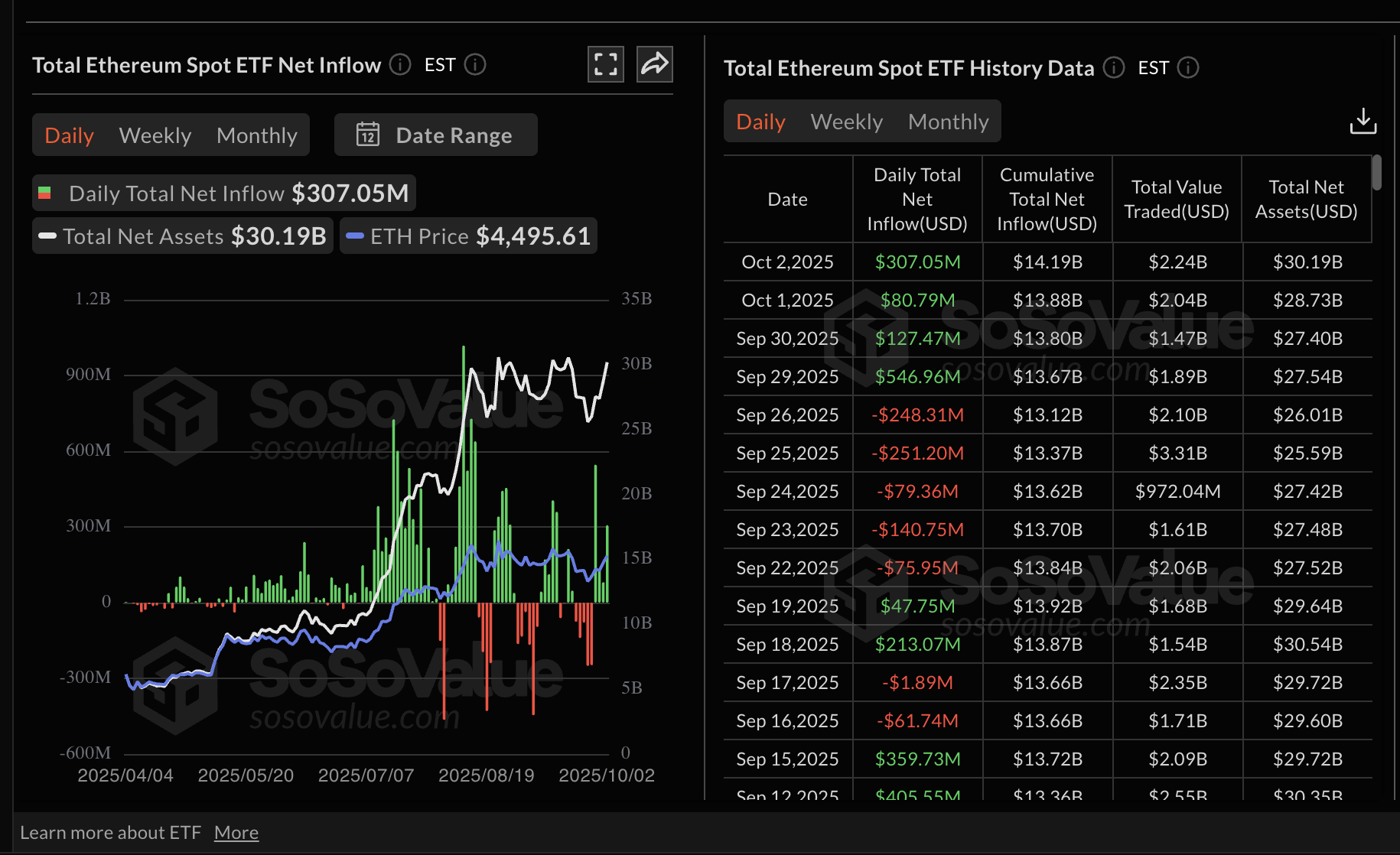

Demand for Ethereum spot ETFs has also increased steadily this week, but it is significantly lagging behind that for Bitcoin. Inflows on Thursday totalled $307 million, marking four consecutive days of inflows.

BlackRock’s ETHA saw $177 million in inflows on Thursday, with Fidelity’s FBTC leading at $61 million and Grayscale’s ETH at $46 million. None of the nine ETF products saw outflows, underpinning the increase in demand.

Ethereum ETF stats | Source: SoSoValue

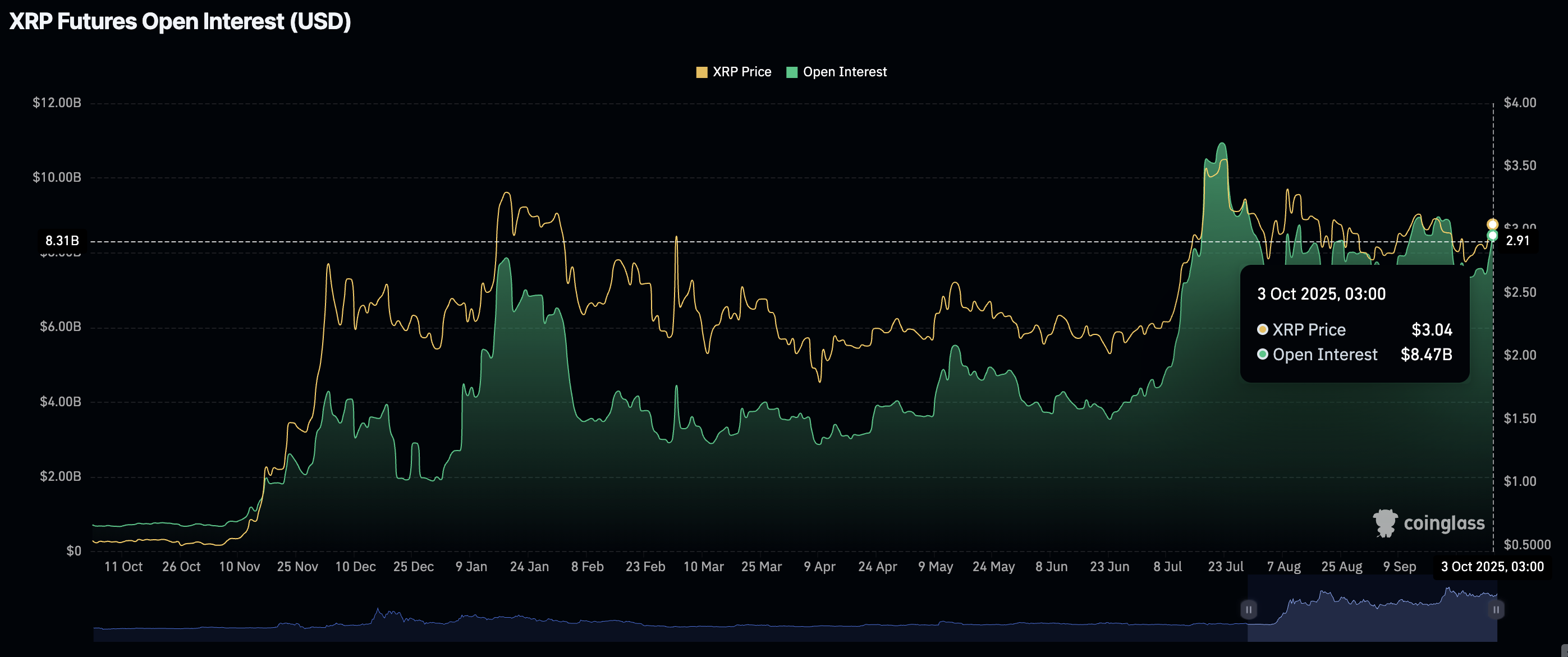

Meanwhile, retail interest in XRP derivatives is growing, with futures Open Interest (OI) reaching a monthly low of $7.35 billion and averaging approximately $8.47 billion at the time of writing, per CoinGlass data. A steady OI also implies increased engagement and conviction in XRP’s ability to sustain the uptrend in the short term.

XRP Open Interest | Source: CoinGlass

Chart of the day: Can Bitcoin sustain recovery?

Bitcoin hovers around $120,000 at the time of writing on Friday, down from the seven-week high of $120,960 as pressure from potential profit-taking builds. Despite the minor correction, the current technical picture remains relatively bullish, supported by a buy signal from the Moving Average Convergence Divergence (MACD) indicator on the daily chart, which has been maintained since Wednesday.

A daily close above the $120,000 would affirm the bullish grip, increasing the odds of the rally extending toward BTC’s all-time high of $124,474, reached on August 14.

Still, the Relative Strength Index (RSI), which has stabilized at 65 after rising from the bearish region, indicates that bullish pressure is easing. If investors focus on taking profits, the down leg below the $120,000 could stretch toward the 50-day Exponential Moving Average (EMA) at $114,094.

BTC/USDT daily chart

Altcoins update: Ethereum, XRP bulls hold steady

Ethereum trades relatively above the 50-day EMA, a key support level at $4,236, following a rejection from the short-term resistance around $4,500, which reinforces positive market sentiment.

A sustained break above the short-term resistance range from $4,400 to $4,500 would validate the bullish picture. If the pullback persists, the RSI at 56 on the daily chart may decline toward the midline, indicating that bullish momentum is fading.

Since the MACD indicator exhibits a buy signal on the same chart, encouraging traders to increase risk exposure, a break above the general descending trendline in place since the Ethereum price hit a record high of $4,956 in late August, would reinforce the bullish grip.

ETH/USDT daily chart

As for XRP, bulls are largely in control, supported by a descending trendline on the daily chart and key moving averages. The 50-day EMA, positioned at $2.93, provides immediate support, with the 100-day EMA in line at $2.84 and the 200-day EMA at $2.62.

A gradually uptrending RSI, currently at 57, underpins the bullish outlook alongside a buy signal from the MACD indicator triggered on Wednesday.

XRP/USDT daily chart

Traders should watch out for a potential break above the next hurdle at $3.18, which was previously tested in mid-September. Such a move could mark a bullish turning point for XRP, potentially rallying toward its current record high of $3.66.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.