Cardano Price Forecast: Bulls reclaim control with ADA eyeing higher levels

- Cardano price extends its gains on Monday after rebounding from its key support level the previous week.

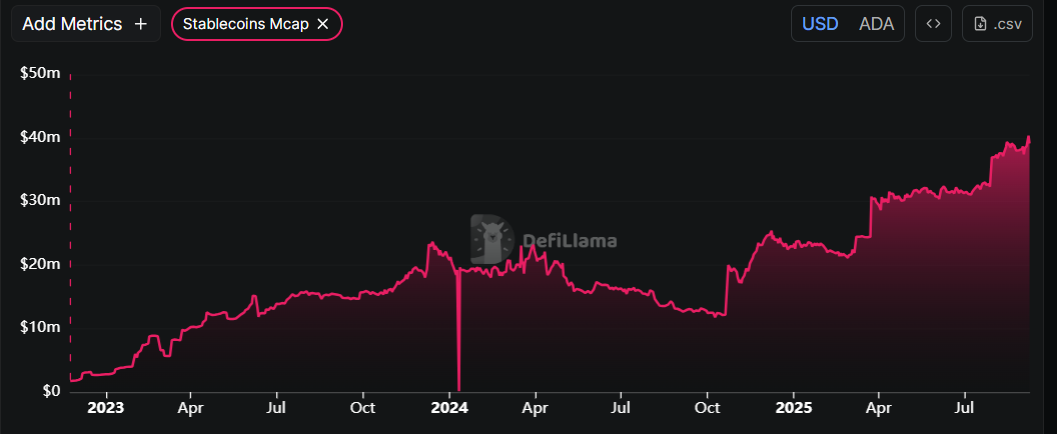

- Derivatives and on-chain data support a bullish view as funding rates are positive and stablecoin market capitalization continues to grow.

- Technical outlook on the 4-hour chart confirms a bullish pattern breakout, signaling potential for further upside.

Cardano (ADA) is extending its gains, trading above $0.84 at the time of writing on Monday after rebounding from a key support level last week. Positive funding rates and stablecoin market growth back the bullish sentiment, while technical analysis on the 4-hour chart confirms a bullish pattern breakout, suggesting ADA is headed toward further gains.

Cardano’s derivatives show improving bullish sentiment

Coinglass’s OI-Weighted Funding Rate data shows that the number of traders betting that the price of Cardano will slide further is lower than those anticipating a price increase.

The metric has flipped to a positive rate on September 2. It continued to show a positive value of 0.0079% on Monday, indicating that longs are paying shorts, which suggests a bullish sentiment among Cardano traders.

Cardano funding rate chart. Source: Coinglass

DefiLlama data shows that the ADA stablecoin market capitalization reached a record high of $40.37 million on Sunday. Rising stablecoin activity and value increase on ADA is positive, as they increase network usage and can attract more users to the ecosystem.

Cardano stablecoin market capitalization chart. Source: DefiLlama

Cardano Price Forecast: Confirms a bullish pattern breakout

Cardano price on the 4-hour chart shows that it broke above the falling wedge pattern on Sunday and rose slightly. This pattern is formed by connecting multiple high and low levels with a trendline from August 14, and a breakout favours the bulls. At the time of writing on Monday, it trades at around $0.84.

If ADA continues its upward momentum, it could extend the rally toward its 61.8% Fibonacci retracement at $0.92.

The Relative Strength Index (RSI) on the 4-hour chart reads 58, which is above its neutral level of 50, indicating bullish momentum. The MACD indicator also displayed a bullish crossover on the 4-hour chart, further reinforcing the bullish outlook.

ADA/USDT daily chart

On the daily chart, Cardano's price retested and found support around its 100-day Exponential Moving Average (EMA) at $0.77 on September 1, and recovered 4.19% by Sunday. At the time of writing on Monday, it hovers at around $0.83.

If the ADA closes above the daily resistance at $0.84 on a daily basis, it could extend the rally toward its August 14 high of $1.02.

The RSI on the daily chart is hovering around its neutral level of 50, indicating indecision among traders. For the recovery rally to be sustained, the RSI must move above its neutral level. Moreover, the MACD is also showing a falling red histogram bar below its neutral level, suggesting fading bearish momentum.

ADA/USDT daily chart

However, if ADA faces a correction, it could extend the decline toward its 100-day EMA at $0.77.