Forex Today: US Dollar rally pauses ahead of consumer confidence data

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

Here is what you need to know on Friday, October 10:

The US Dollar (USD) takes a step back following a four-day rally as markets await the University of Michigan's (UoM) preliminary Consumer Sentiment Index data for October. In the second half of the day, Statistics Canada will publish the employment data for September.

US Dollar Price This week

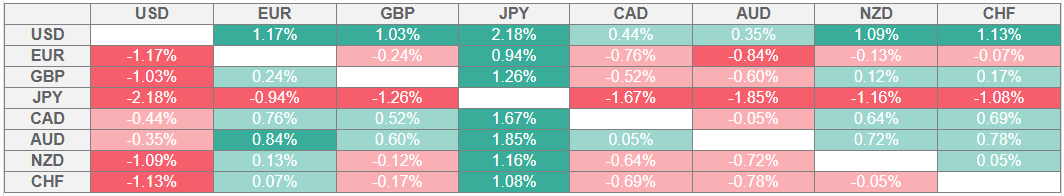

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Democrats and Republicans failed to make any progress in reopening the government after the funding bill, once again, was rejected with a 54-45 vote. The Senate will return on Tuesday and there won't be any other votes on the bill until then. Meanwhile, the New York Times reported earlier in the day that the US Bureau of Labor Statistics (BLS) is calling back a limited number of staff from furlough to complete the September Consumer Price Index (CPI) report. Nevertheless, it's unclear whether the inflation data will be released on October 15, as originally scheduled. After rising more than 0.5% on Thursday, the USD Index stays below 99.50 in the European morning on Friday, while US stock index futures trade marginally higher.

The Unemployment Rate in Canada is forecast to edge higher to 7.2% in September from 7.1% in August. USD/CAD holds steady at around 1.4000 in the European morning on Friday after having touched its highest level since April above 1.4030 earlier in the day.

USD/JPY holds steady at around 153.00 early Friday and it's up more than 3.5% since the beginning of the week. Growing concerns over a political crisis in Japan doesn't allow the Japanese Yen to stage a decisive rebound. Komeito party leader Tetsuo Saito said on Friday that they cannot agree with the Japan’s ruling Liberal Democratic Party (LDP) on issues involving money, politics, adding that they want to reset LDP-Komeito ruling coalition for the time being.

EUR/USD lost more than 0.5% on Thursday and closed the fourth consecutive day in negative territory. The pair corrects higher early Friday but remains below 1.1600.

GBP/USD stabilizes near 1.3300 in the European session on Friday after falling about 0.75% on Thursday.

Easing geopolitical tensions in the Middle East triggered a deep correction in Gold on Thursday. After losing 1.6% and closing below $4,000, XAU/USD struggles to gather recovery momentum and fluctuates in a tight range above $3,980.

Reserve Bank of Australia (RBA) Governor Bullock said on Friday that services inflation remains "a little sticky" and added that the labor market is close to coming to balance despite being a little tight. Following Thursday's 0.5% loss, AUD/USD clings to small daily gains above 0.6560 in the European morning on Friday.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.