Australian Dollar receives support from easing RBA rate cut bets.

Australia’s Westpac Consumer Confidence fell 3.1% to 95.4 in September from 98.5 in August.

The US Dollar continues to lose ground amid rising Fed rate cut odds.

The Australian Dollar (AUD) gains ground against the US Dollar (USD) on Tuesday for the third successive session. The AUD/USD pair appreciates following Westpac Consumer Confidence, which declined 3.1% to 95.4 in September from 98.5 in August. The drop reflected renewed concern about the economic outlook. Focus shifts toward the US Nonfarm Payrolls Benchmark Revision due later in the day.

Mathew Hassan, Head of Australian Macro-Forecasting, noted that consumer recovery since mid-2024 has been sluggish, suggesting that additional policy easing may be required by the Reserve Bank of Australia (RBA). Hassan expects the central bank to lower rates by 25 basis points (bps) in November, followed by two further cuts in 2026.

The AUD, however, received support after last week’s solid July Trade Surplus and Q2 GDP figures, along with hotter July inflation, dampening expectations of additional Reserve Bank of Australia rate cuts. Swaps are now assigning nearly an 84% probability that the RBA will keep policy unchanged in September, while the likelihood of a 25-basis-point rate cut in November has eased to 80% from 100%.

Australian Dollar advances as US Dollar struggles amid rising odds of Fed rate cuts

The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is facing challenges and trading around 97.40 at the time of writing. The Greenback struggles as traders ramp up their bets on an extra rate reduction by the US Federal Reserve (Fed) as the labor market continues to weaken.

The CME FedWatch tool indicates a pricing in nearly 90% of a 25-basis-point (bps) rate cut by the Fed at the September policy meeting, up from 86% a week ago, with bets rising on a potential 50 bps reduction this month.

Federal Reserve (Fed) Bank of Chicago President Austan Goolsbee said in an interview on Bloomberg TV on Friday that he is still unsure whether September is the right time for an interest rate cut, following weaker jobs data. He added that high inflation data is still cause for concern, and key Fed officials may not be fully sold on a September rate cut.

The US Bureau of Labor Statistics (BLS) reported on Friday that the US Nonfarm Payrolls (NFP) rose by 22,000 in August, falling short of the market expectations of 75,000. This figure followed the 79,000 increase (revised from 73,000) recorded in July. Meanwhile, the Unemployment Rate increased to 4.3% in August, as expected, against the 4.2% prior. Average Hourly Earnings increased 0.3% MoM in August, in line with expectations.

China’s Trade Balance rose to CNY 732.7 billion in August, up from CNY 705.18 billion previously. Exports rose 4.8% YoY in August vs. 8% in July. The country’s imports advanced 1.7% YoY in the same period vs. 4.8% recorded previously.

Australia’s Trade Balance increased to 7,310 million month-over-month in July, from 5,366 million the prior month. The trade surplus widened against the expected decline to 4,920 million. Gross Domestic Product (GDP) rose by 0.6% quarter-over-quarter in Q2, following the 0.3% growth in Q1 and surpassing the expectations of 0.5% expansion. Meanwhile, the annual Q2 GDP grew by 1.8%, compared with the 1.4% growth in Q1, and was above the consensus of a 1.6% increase.

Australia’s Monthly Consumer Price Index rose 2.8% year-over-year in July, beating both the previous 1.9% increase and the 2.3% forecast.

Australian Dollar rises to near 0.6600, ascending channel’s upper boundary

The AUD/USD pair is trading around 0.6590 on Tuesday. The technical analysis of the daily chart shows the pair moves upwards within the ascending channel pattern, suggesting the strengthening of a bullish bias. Additionally, the pair is positioned above the nine-day Exponential Moving Average (EMA), indicating short-term price momentum is stronger.

On the upside, the AUD/USD pair may target the upper boundary of the ascending channel at around 0.6620, followed by the 10-month high of 0.6625, which was recorded on July 24. A break above this crucial resistance zone would strengthen the bullish bias and support the pair to approach the 11-month high of 0.6687, recorded in November 2024.

The initial support lies at the nine-day EMA of 0.6551, aligned with the ascending channel’s lower boundary around 0.6540. A break below the channel would weaken the bullish bias and prompt the AUD/USD pair to test the 50-day EMA at 0.6511. Further declines would dampen the medium-term price momentum and open the doors for the pair to navigate the region around the three-month low of 0.6414, recorded on August 21.

AUD/USD: Daily Chart

Australian Dollar Price Today

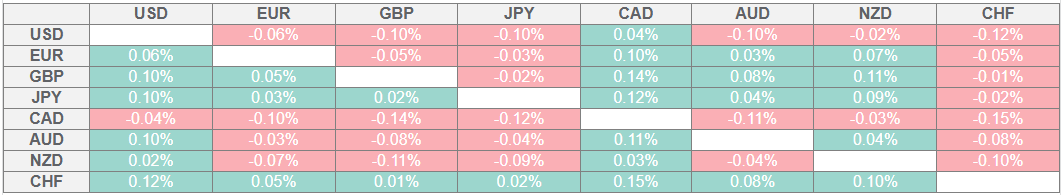

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Canadian Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.