AAVE price continues to surge, cementing its position as the biggest lending protocol in crypto with a market cap of $5.5 billion—more than all other top 10 lending protocols combined.

The token has risen an impressive 220% this year and 110% in just the last 30 days, driven by strong bullish momentum and increasing market interest. Technical indicators such as the RSI and CMF highlight ongoing positive trends, though some signs of cooling momentum suggest potential consolidation ahead.

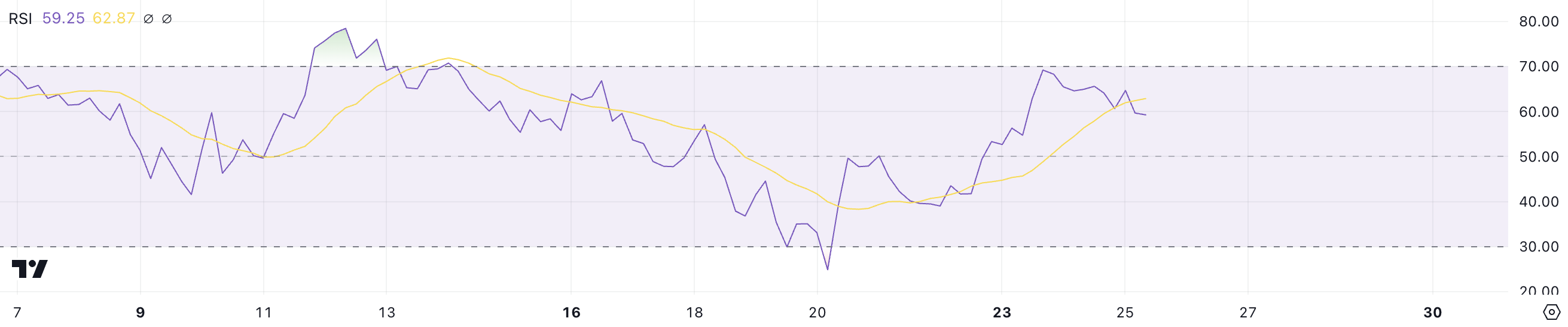

AAVE RSI Is Neutral After Almost Reaching the Overbought Zone

AAVE Relative Strength Index (RSI) is currently at 59.2, down from 69.19 on December 23, when its price peaked at $382. This decline in RSI suggests that AAVE price has moved away from overbought territory, where heightened buying pressure typically precedes a price correction.

While the current RSI still reflects relatively strong momentum, the pullback indicates that the market may be stabilizing after a period of intense buying activity.

AAVE RSI. Source: TradingView

AAVE RSI. Source: TradingView

RSI is a momentum indicator that measures the speed and magnitude of price movements on a scale from 0 to 100. Values above 70 indicate overbought conditions, signaling the potential for a correction, while values below 30 suggest oversold conditions, often preceding a rebound.

With AAVE RSI at 59.2, the coin remains in a neutral-to-bullish range, signaling that the uptrend could continue in the short term if buying momentum rebuilds. However, the decline from overbought levels also suggests that AAVE price may consolidate, allowing the market to absorb recent gains before deciding its next direction.

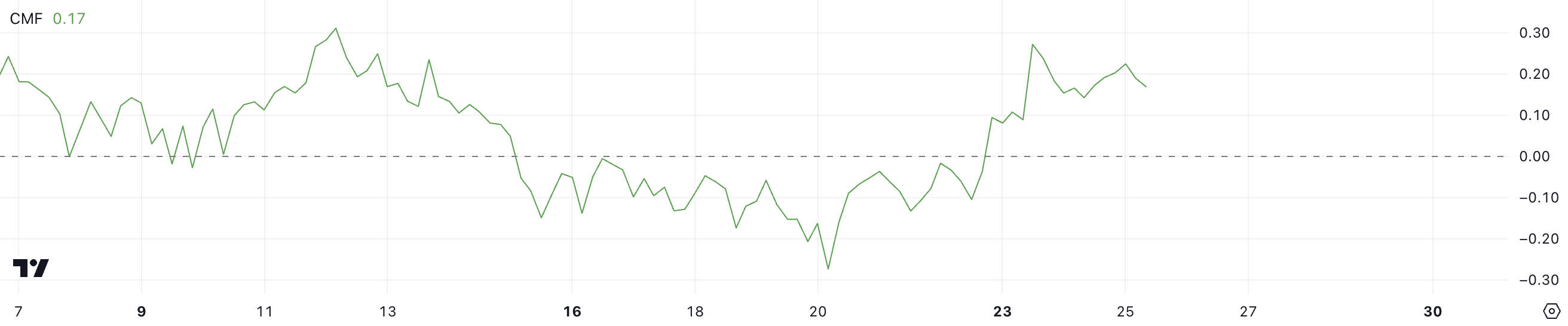

AAVE CMF Is Still Very Positive, But Down From The Recent Peak

AAVE’s Chaikin Money Flow (CMF) is currently at 0.17, maintaining a positive trend since December 23, when it reached a peak of 0.27. This indicates that AAVE has been experiencing consistent capital inflows, reflecting strong buying pressure in the market.

While the CMF has declined from its recent peak, the positive value suggests that buyers are still in control, albeit with slightly reduced intensity.

AAVE CMF. Source: TradingView

AAVE CMF. Source: TradingView

CMF is a volume-weighted indicator that measures the accumulation or distribution of an asset over a specific period, ranging from -1 to +1. Positive CMF values indicate accumulation and buying pressure, while negative values signify distribution and selling pressure.

With AAVE CMF at 0.17, the ongoing positive inflow suggests that the token may sustain its current price levels or even see further gains in the short term if buying activity persists. However, the decline from the December 23 peak indicates that momentum may be cooling, potentially leading to a period of consolidation before any decisive move.

AAVE Price Prediction: Can AAVE Rise to 3-Year Highs?

If the current positive momentum continues, AAVE price could test $400, a significant level that would mark its highest price since 2021. The token needs to rise just 7.5% to reach this milestone, supported by the golden cross formation on December 23 and EMA lines that indicate the uptrend could persist.

This alignment of technical indicators suggests that bullish sentiment remains strong, with buyers likely to push prices higher if the trend holds steady.

AAVE Price Analysis. Source: TradingView

AAVE Price Analysis. Source: TradingView

However, as highlighted by the CMF, the strength of the uptrend has waned compared to a few days ago, signaling the potential for a trend reversal. If AAVE price uptrend loses steam, the price could drop to test the $355 support level.

Should this support fail, AAVE might see further declines, with potential targets at $297 or even $271, reflecting a significant correction.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.