How Will the Trump-Musk Feud Affect Tesla? Short-Term Pain, Long-Term Still Gains?

TradingKey - The recent public feud between U.S. President Donald Trump and Tesla CEO Elon Musk triggered a historic sell-off in Tesla shares, erasing more market value than ever before in a single day. Although the so-called “Trump-Musk alliance” has largely collapsed, Wall Street analysts believe the fallout will mainly hurt Tesla’s electric vehicle sales in the short term. In the long run, however, Tesla still holds many strong, non-political cards that can sustain its growth narrative.

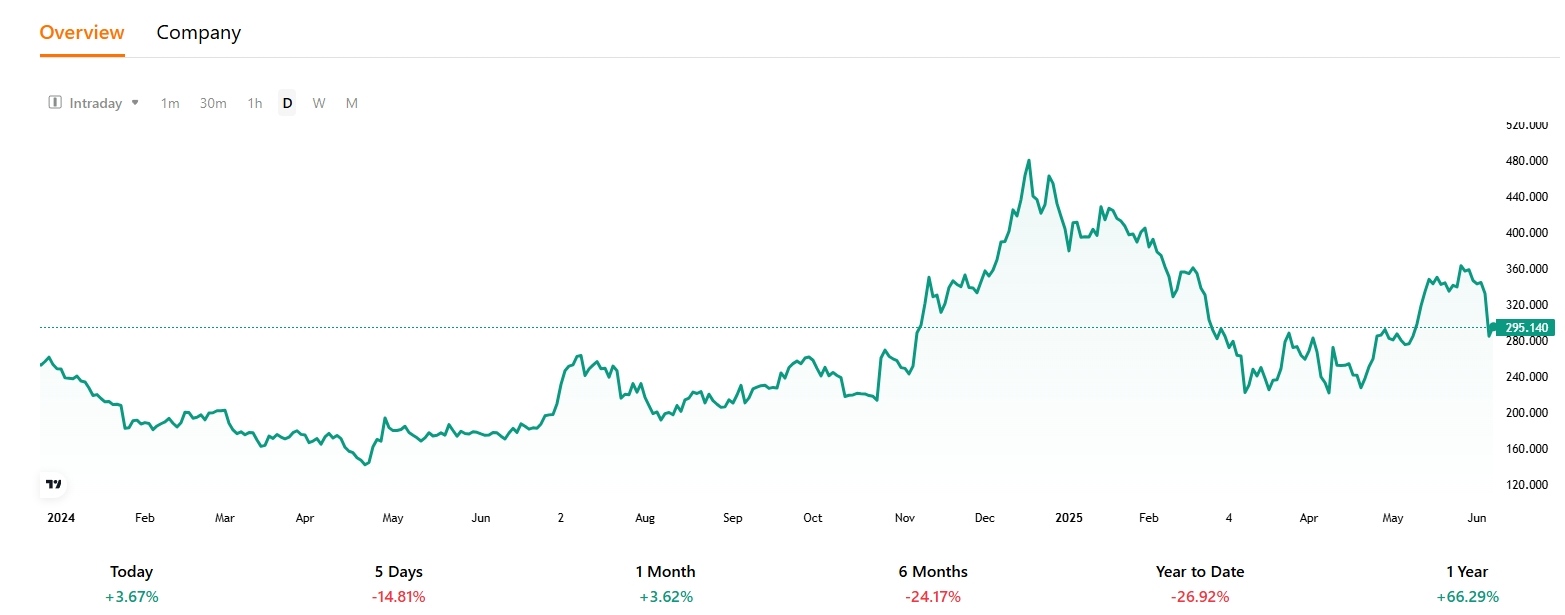

On June 5, 2025, a heated online argument between President Trump and Elon Musk sparked investor concerns about Tesla’s future, sending the stock plunging over 14%. Just one day later, Tesla shares rebounded as much as 7%, closing up 3.67% at $295.14.

Tesla Stock Performance, Source: TradingKey

Despite the dramatic nature of the online clash — which even raised concerns about threats to U.S. space security — Wall Street analysts have generally downplayed the event's long-term impact.

The End of EV-Related "Government Favors"

The most immediate consequence of the Trump-Musk rift is on Tesla’s electric vehicle business. Trump’s proposed tax cut legislation includes plans to eliminate or reduce EV subsidies and tax credits. Gene Munster, Managing Partner at Deepwater Asset Management, estimates that the removal of such measures could reduce Tesla’s 2025 delivery volume by up to 15%.

Musk himself has acknowledged the potential impact of subsidy cuts. He once argued that while such changes would be devastating for Tesla’s competitors, they would have limited negative effect on Tesla itself — and in the long run, might even help solidify its leadership position in the industry.

Last Thursday, Goldman Sachs lowered its price target for Tesla, citing declining delivery expectations for 2025 — including a slowdown in U.S. deliveries this quarter, a 50% drop in Europe in April followed by further declines in May, and a roughly 20% year-over-year decline in China over the past two months.

Moreover, worsening relations with the federal government may also cost Tesla some of the long-standing benefits it has enjoyed. Over the past two decades, Musk and his companies have received at least $38 billion in government contracts, loans, subsidies, and tax credits. In 2024 alone, Musk secured over $6.3 billion in commitments from state and local governments — a record high.

In Q1 2025, Tesla earned $595 million from regulatory credit sales — surpassing its net profit of $409 million during the same period. Jesse Jenkins, an assistant professor studying the EV industry at Princeton University, noted that these credits are often the difference between profitability and loss for Tesla.

Tesla Still Holds Many Non-Political Cards

Seth Goldstein, an analyst at Morningstar, said while the Trump-Musk relationship could influence Tesla’s stock and investor sentiment, he never viewed Trump’s presidency as inherently bullish or bearish for Tesla.

Tesla is set to unveil its Robotaxi service on June 12, launching a trial fleet of 10–20 autonomous taxis in Austin and planning to expand to San Francisco and Los Angeles. This initiative is seen as a major new growth engine. Musk claims it could unlock trillions of dollars in market value.

Unlike its automotive business, Wall Street believes that Trump’s administration may not target Tesla’s development in autonomous driving technology and AI.

Gene Munster of Deepwater argues that the White House has little to gain in standing in front of autonomy, given autonomy is central to physical AI, and for the US to be a leader globally in AI, it also needs to be a leader in physical AI.

Munster expects cooler heads to prevail and the Federal Government will continue to support the growth of these services.

Morgan Stanley analysts also stated that the deterioration in Musk-Trump relations won’t affect the long-term fundamentals that drive Tesla’s valuation. Tesla continues to hold valuable, politically neutral assets, including AI leadership, autonomy/robotics, manufacturing, supply chain re-architecture, renewable power and critical infrastructure.

Cox Automotive analysts added that Tesla’s overall valuation increasingly depends on its vision for autonomous driving and AI. If Musk distances himself from right-wing politics, Tesla could actually benefit significantly.